The post Top Economic Events to Watch Next Week: US Interest Rate Decision, FOMC Meeting to Decide Crypto Trends appeared first on Coinpedia Fintech News

The cryptocurrency market saw a big increase and a lot of buying activity after Donald Trump returned to the White House. With Trump signing several executive orders that support the cryptocurrency market, more people are interested in trading. The next week is important for the market because the Federal Open Market Committee (FOMC) meeting and decisions about interest rates, along with other major economic news, will likely influence future trends in the market.

Markets Stay Steady and Bullish Under Trump’s New Policies

This week, everyone’s been focusing on US President Trump’s policies after he took office, and it looks like the markets are handling it pretty well so far. Instead of causing worry, his announcements are actually making people more bullish. He’s talked about big investments in artificial intelligence (AI), making significant changes in crypto policy, keeping interest rates low, and controlling inflation by reducing oil prices. This has encouraged investors to take more risks, leading to the S&P 500 reaching a new record high.

Also read: Bitcoin Price Prediction 2025: Will BTC Break $109K and Hit a New All-Time High?

As we head into a new week, several important events could shape the future trends of the cryptocurrency market.

US 4Q earnings season

Next week, big tech companies like Microsoft, Meta Platforms, Tesla, and Apple are set to report their earnings. Analysts predict that these major players, along with three other large companies, will see their earnings grow by more than 17% over the next year, which is almost double the 9% growth expected from the other 493 companies.

Because these companies are valued so highly, investors will probably look for more than just the usual profit and revenue numbers.

US FOMC Meeting

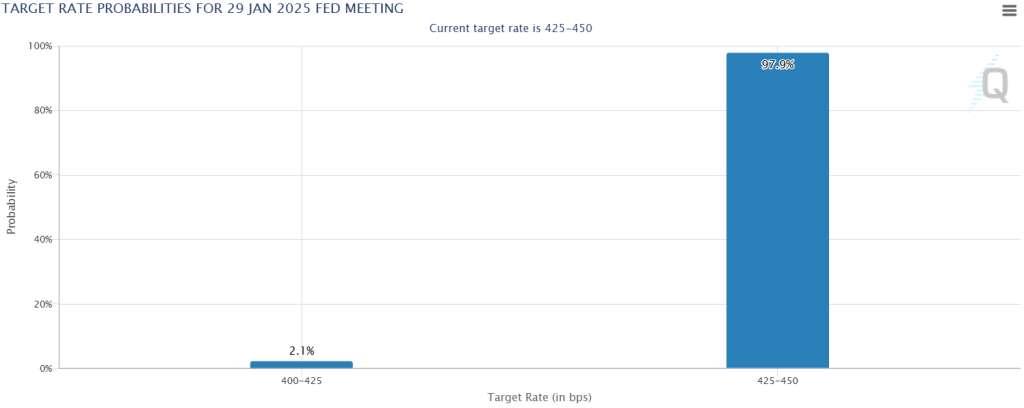

It’s widely expected that the Federal Reserve will keep its main interest rate unchanged this Wednesday while they wait for more information showing that inflation is decreasing.

At the World Economic Forum in Davos, Switzerland, Trump said he would insist on immediate cuts to interest rates globally, revisiting his frequent but ineffective pressure on the Fed during his first term. Early in his second term, Trump has already tightened immigration and announced plans to raise import taxes starting February 1.

This creates uncertainty for the Fed, making it tough for them to plan monetary policy. The Fed is meeting soon and is expected to maintain the current interest rate between 4.25% and 4.50%, as recent data supports a gradual approach to reaching their 2% inflation target.

Fed Chair Jerome Powell and his team face the challenge of balancing current monetary policy with uncertainties about the future and deciding how much to reveal about the Fed’s outlook.

US Core Personal Consumption Expenditures (PCE) Price Index

In November, the overall PCE prices in the US went up by 2.4% compared to last year, which is an increase from the three-year low of 2.1% seen in September. The core PCE price index, which the Fed uses to gauge underlying inflation, only rose by 0.1%—the smallest increase in six months. This kept the annual core PCE rate steady at 2.8% in December, which was below the expected 2.9%.

Looking forward, the overall PCE is expected to rise to 2.6% year-over-year, which will be announced on Friday. The core PCE inflation rate is also expected to stay stable at 2.8%.

European Central Bank (ECB) interest rate decision

The ECB is expected to cut interest rates by 0.25% at its next meeting on 30 January, bringing the rate down to 2.75%. This would be the fifth rate cut since June 2024, aimed at supporting economic growth.

Conclusion

With the Fed likely on pause, the ECB poised to cut rates, and Trump’s pro-crypto signals still fresh, the crypto market appears positioned for a generally bullish week ahead. However, traders should be prepared for volatility around the FOMC announcement and key corporate earnings releases.