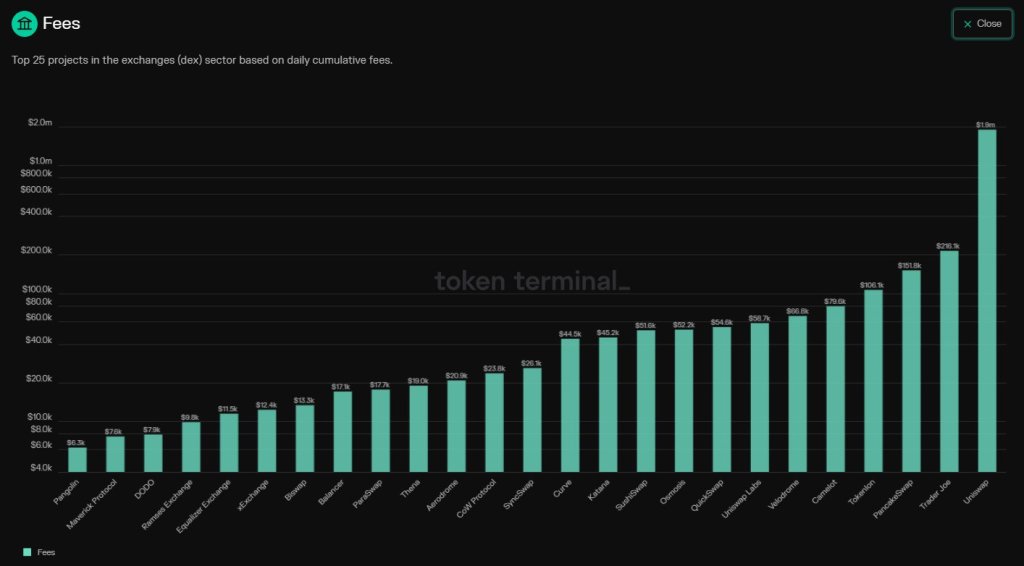

Trader Joe, the decentralized exchange (DEX) dominating Avalanche, has surpassed PancakeSwap. It is now the second-largest DEX by fees generated in the past 24 hours.

Trader Joe Is The Second Largest DEX After Uniswap

According to an Artemis Researcher citing Token Terminal data, the DEX processed over $142 million in trading volume on the last day, with 98% of fees from tokens based in Avalanche. This dominance points to how crucial the DEX is in the high-throughput blockchain, whose on-chain activity has been rising in recent months.

Trader Joe also confirmed that it facilitated over $100 million in trading volume through its Liquidity Book. Through this feature, traders can create tailored strategies while benefiting from low fees. The Liquidity Book is designed to significantly enhance efficiency and flexibility versus other traditional automated market maker (AMM) platforms like Uniswap.

In the past 24 hours, Trader Joe processed over $216,000 in fees, above $151,000 recorded by PancakeSwap–a DEX on the BNB Chain ecosystem. While impressive, their combined figure is less than half that recorded by Uniswap, a DEX that’s active on multiple platforms and blockchains, including BNB Chain.

During the same period, Uniswap generated over $1.9 million in trading fees, most of which came from Ethereum, where the DEX is actively used.

Whether Trader Joe’s will cement its position as the second most active DEX after Uniswap remains to be seen; however, in recent months, the Avalanche ecosystem has been trending following Solana and other low-fee but high-throughput environments, including Ethereum-layer-2s.

Will Avalanche’s Focus On Meme Coins Cement Trader Joe’s Position?

More meme coin projects appear keen to deploy on Avalanche’s sub-nets, benefiting from low fees and high scalability. To encourage participation and meme coin projects to launch on the platform, Avalanche Foundation announced a new initiative in late December 2023.

As part of a culture drive, the foundation revealed that it would consider buying meme coins, drawing inspiration from the impact of Bonk in Solana. Through their “Culture Catalyst,” the foundation will explore and acquire potent meme coins deploying on Avalanche.

Considering how viral meme coins can be, it is likely that Trader Joe, a famous DEX on Avalanche, will benefit from this drive. When writing, the foundation has not revealed whether it has bought any meme coin.

However, what’s clear is that Trader Joe has been growing, looking at its total value locked (TVL) in the past few trading weeks. According to DeFiLlama, Trader Joe’s TVL stands at over $172 million, of which more than $126 million are Avalanche-based assets.