The memecoin frenzy has reached the Tron Network after the launch of Pump.fun’s rival, SunPum. The new memecoin deployer has been making the headlines after surpassing its Solana-based counterpart on key metrics this week.

The platform’s remarkable performance in the past two weeks has propelled the network, TRX, and the SUN ecosystem. As a result, SUN, the native token of the DeFi protocol behind SunPump, has surged over 190% in the last seven days.

SunPump Takes The Market By Storm

Nearly two weeks ago, DeFi protocol SUN.io introduced SunPump, a Tron-based memecoin launcher to rival Solana’s Pump.fun. The project, which has been heavily promoted by Tron’s founder Justin Sun, became the first memecoin deployer in the blockchain.

Presented as a “convenient and cost-effective token issuance solution,” the deployer has gained significant popularity in the past week. The crypto community was first skeptical about the project, claiming it likely marked “the end of the memecoin era.”

However, its recent performance has brought new life to the Tron network, significantly boosting activity. Dune Analytics data shows that SunPump has deployed over 33,330 memecoins since its creation, generating over 13.1 million TRX, worth around $2 million, in revenue.

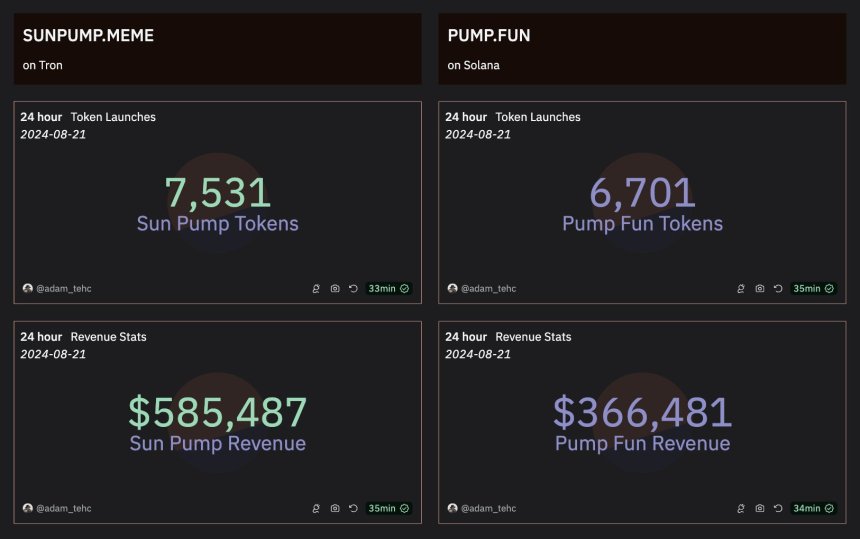

On Wednesday, the platform reached an all-time high (ATH) on key metrics, surpassing its Solana counterpart in issued tokens and daily fees. SunPump made $585,000 in revenue on that day from creating 7,531 tokens, while Pump.fun launched 6,701 and generated $366,000 in fees.

Tron-Based Tokens See Massive Surge

Some investors have capitalized on the new memecoin frenzy with some of the most popular tokens launched in the blockchain. A week ago, two animal-themed tokens saw increases of over 50,000% and 25,000% after launching.

At the time, SUNDOG reached a market capitalization of $60 million, which granted it to be listed on crypto exchanges Poloniex and HTX. Since then, the dog-themed token has reached a market cap of $322 million, currently at $190 million.

As of this writing, SUNDOG is trading at $0.1918, a 260% price increase in the last seven days. Similarly, SUN, the native token of SUN.io, is among the largest winners of the week, with a 197% surge propelled by the network’s momentum.

SUN was originally launched in 2021 and reached an ATH of $66 before crashing due to supply hyperinflation. Since then, the token has been redenominated as a multifunctional governance token on the SUN platform.

Last week, SunPump revealed that 100% of the protocol’s revenue would be used to buy back and burn SUN tokens to “support the sustainable development of the SUN ecosystem.”

Moreover, Binance Futures announced on Thursday the launch of the SUNUSDT Perpetual Contract with up to 75x leverage. This week, the bullish push has made SUN’s price break out of a multi-year consolidation range.

After moving sideways within the $0.003-$0.01 price range for the past four years, SUN broke above the $0.15 resistance level on Tuesday. Since then, the token has continued its bullish rally with a 30.4% increase in the last 24 hours. As of this writing, SUN is trading at $0.031 with a market capitalization of $301 million.