Tron (TRX) gains massively as it continues on its bullish path after new developments hit the market. According to CoinGecko, the token is up 14% since last week. This trend may continue as major cryptocurrencies like Bitcoin and Ethereum pull altcoins upward as well.

With favorable market conditions, TRX has a chance to pull off something great this week. Supporting this probability is Mobilum’s recent tweet that placed the spotlight on Tron’s robust network as it supported transactions worldwide.

Tron Users Contribute Massively On Mobilum

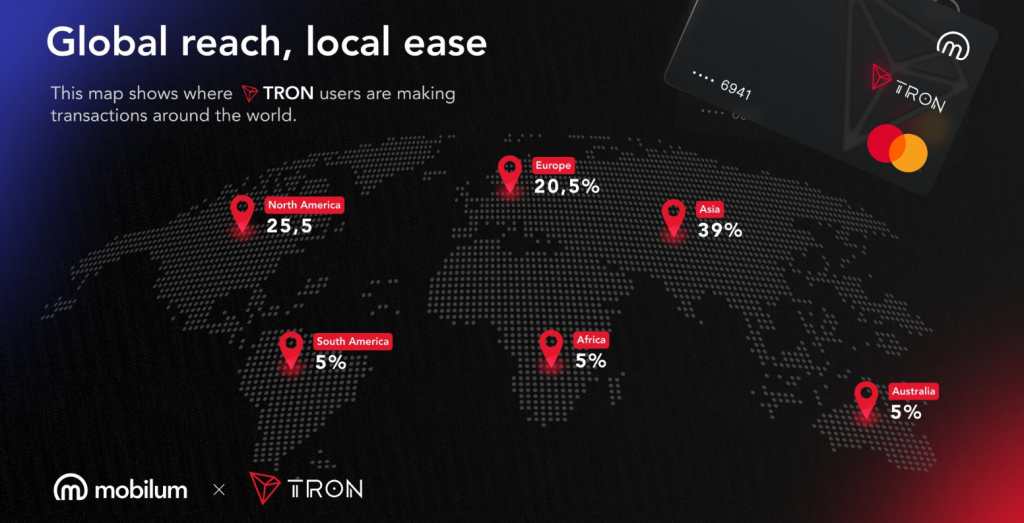

Crypto banking platform Mobilum released some statistics featuring Tron users using the platform for real world transactions. According to the X post, Tron users contributed massively to Mobilum’s operations worldwide.

Global reach, local ease with @trondao

In August 2024, #TRON users made transactions in the Mobilum ecosystem worldwide:

• Asia: 39%

• North America: 25.5%

• Europe: 20.5%

• South America: 5%

• Africa: 5%

• Australia: 5%Proud to power seamless crypto payments across… pic.twitter.com/IpyiScqmks

— Mobilum (@mobilumofficial) August 19, 2024

The biggest figure came from Asia with over 39% of transactions attributed to Tron users followed by the United States and Europe. This signals a huge turning point for Tron as it continues to find itself in real-world use cases.

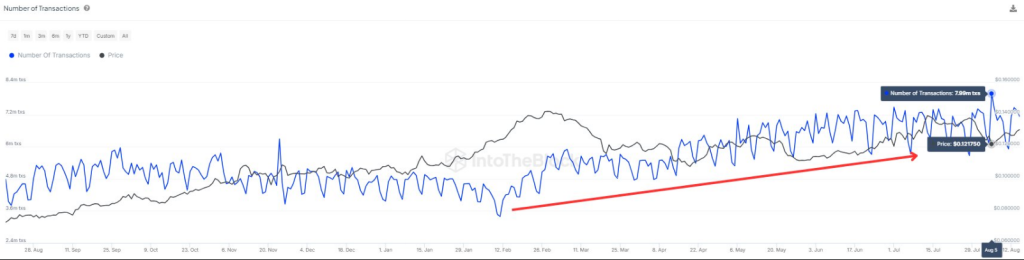

Tron Hits New Annual Transactions High

Tron’s network has also continued to flex its muscles as Into The Block recently posted how it hit almost 8 million transactions per day, with an average of 7 million transactions per day. This high throughput on the platform helped TRX’s growth in the long term.

With over 7 million daily transactions, the #TRON network is becoming a vital part of everyday life for millions around the world.

https://t.co/Br1DLllzae

— TRON DAO (@trondao) August 19, 2024

The platform’s focus on stablecoins is one of the factors that contribute to its growth. As of writing, there are four stablecoins used on Tron namely USDT, USDJ, TUSD, and USDC.

Ceiling Hit But Not Broken By TRX

The token’s current trajectory might be upward, but it seems the next couple of days might be tough for investors and traders. At its best, TRX might retract to more sustainable levels with a possible rebound right after.

As of writing, breaking through the current ceiling of $0.1472 is too big of a hurdle for TRX bulls in the short term. Given some time, however, we might see the token gain enough momentum to have a breakthrough on this level. TRX is overpriced after nearly a couple of days’ worth of bullish momentum pushing gains to investor portfolios.

With the relative strength index (RSI) being at its peak, this signals a possible loss in momentum will occur in the coming days, pushing the token back to $0.14. If this happens, $0.14 will give way to the bears, pushing the token to $0.13.

However, $0.13 is the lowest the token will go. TRX’s low correlation with Bitcoin will gradually pick up as the days go by, helping TRX retake lost ground once the friction of the bullrun wears out. For now, holding the token might be the best decision for investors and traders as they continue to monitor the broader market for swings in price.

Featured image from Mudrex, chart from TradingView