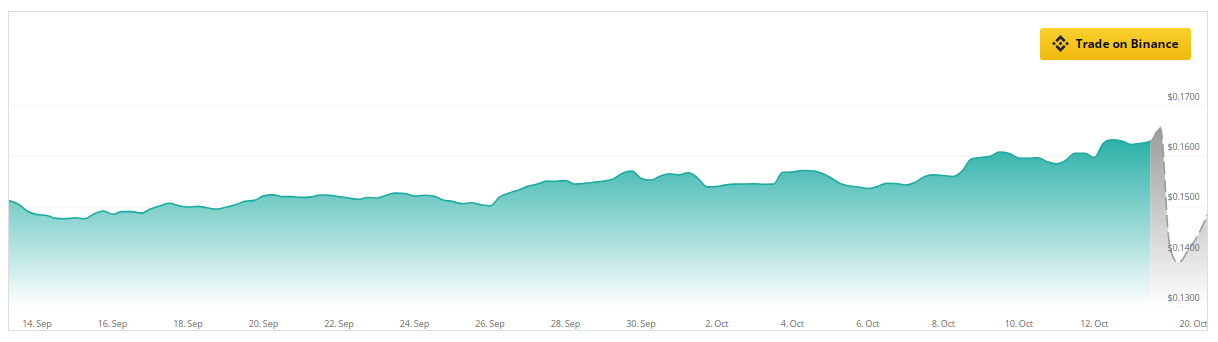

TRON (TRX) recently garnered attention by incinerating over 10 million tokens, demonstrating its dedication to a deflationary approach intended to enhance its value. Currently, TRX is trading at roughly $0.1605, indicating a small increase.

Analysts express optimism on TRON’s future, forecasting a 57% price increase during the next three months, and an even more remarkable 208% rise over six months, figures from CoinCheckup show. This optimistic perspective indicates that TRX may be poised for a substantial upward trajectory in the cryptocurrency market.

A Robust Technical Foundation

The technical indicators for TRX are converging towards a positive sentiment. The price chart demonstrates a modest upward trend, while the Relative Strength Index (RSI) is presently at 57.58. This statistic indicates that TRX is approaching overbought area, however there still potential for more gains.

The Stochastic indicator, currently at 66.63, reinforces this bullish perspective by demonstrating momentum without indicating imminent exhaustion. Collectively, these factors suggest that TRX may sustain its upward trend in the short future, rendering it an appealing opportunity for investors.

Increasing Enthusiasm For TRON

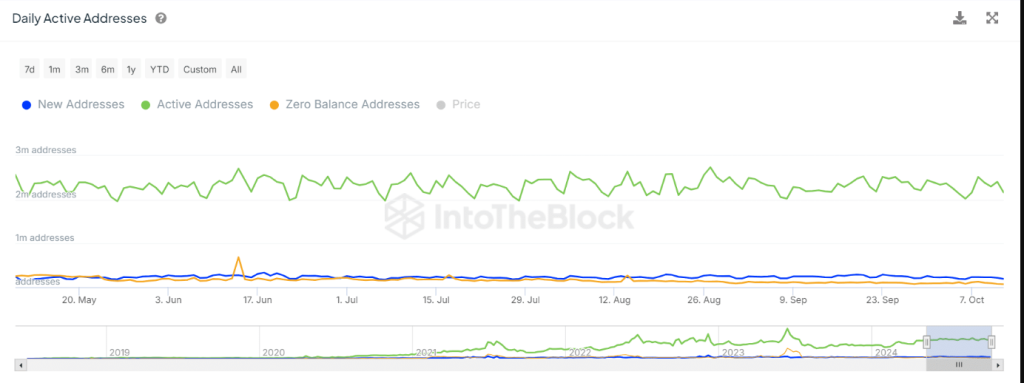

Alongside the token burn, TRON has had a decent increase in daily active addresses, indicating a growing investor interest, data from IntoTheBlock shows. Although the general trend seems constant, this minor uptick suggests that more people are entering the market.

This increasing participation may enhance the token’s upward trajectory, particularly when coupled with the current deflationary strategies. As TRON endeavors to diminish its circulating supply, these elements may establish a foundation for heightened prices.

Market Sentiment And Trading Conduct

Despite the positive statistics, traders remain extremely cautious. The Long/Short Ratio shows shorts slightly outstrip longs with 54% shorts and 46% of longs. This is a ‘wait-and-see’ attitude by traders while awaiting a possible volatility in the price movement of TRX.

The TRX OI-Weighted Funding Rate is at approximately 0. That means that the balance of longs to shorts is neutral, and hence it may also reflect positively on market sentiment pending short-term variability for TRX’s price.

Recent burning of tokens by TRON and the steady increase in active addresses can boost the momentum TRX needs to post solid growth rates for the next couple of months.

Technical indicators depict a positive trend and solid price projections, which shows TRX will gain substantially in the short term.

Featured image from Pixabay, chart from TradingView