The post Tron (TRX) on the Verge of All-Time High? Daily Chart Insights appeared first on Coinpedia Fintech News

Amid the ongoing price correction across the cryptocurrency market, Tron (TRX) has formed a bullish price action pattern on its daily chart. On October 22, 2024, while major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) are struggling to gain momentum and are forming a bearish pattern on the daily chart, TRX is poised for its all-time high.

Tron (TRX) Technical Analysis and Upcoming Levels

According to the expert technical analysis, TRX has formed a bullish morning star candlestick pattern at a crucial support level of $0.156. The formation of this candlestick pattern has sifted the asset sentiment from a downtrend to an uptrend.

Based on the recent price action and historical momentum, there is a strong possibility that TRX could soar by 7% to reach the $0.17 level in the coming days. However, TRX’s Relative Strength Index (RSI) and the 200-day Exponential Moving Average (EMA) suggest a potential upside rally and an uptrend for the asset.

Bullish On-Chain Metrics

TRX’s positive outlook is further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, TRX’s long/short ratio currently stands at 1.02, indicating a bullish sentiment among traders. Additionally, its open interest has jumped by 4.2% in the past 24 hours, indicating growing interest from traders, likely due to the bullish price action pattern.

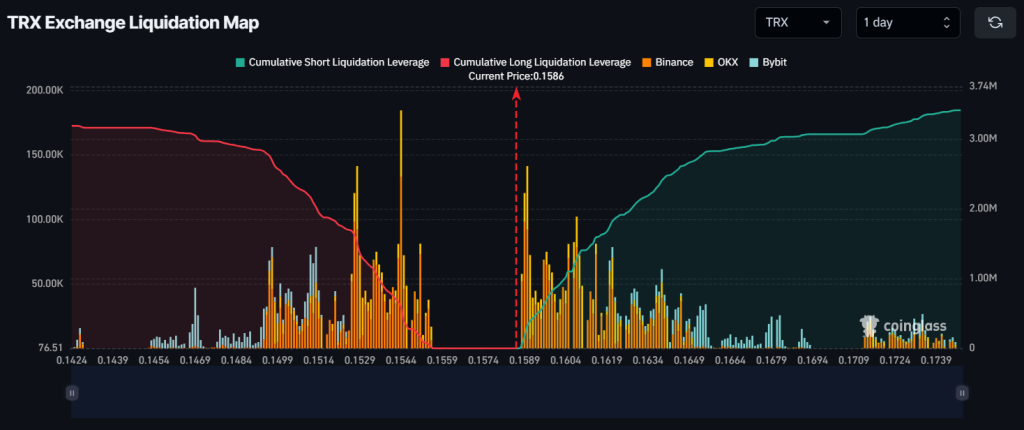

As of now, the major liquidation levels are at $0.154 on the lower side and $0.159 on the upper side, with traders over-leveraged at these levels, according to Coinglass data.

If the sentiment remains unchanged and the price rises to the $0.159 level, nearly $319,510 worth of short positions will be liquidated. Conversely, if the sentiment shifts and the price drops to the $0.154 level, approximately half a million dollars worth of long positions will be liquidated.

Current Price Momentum

At press time, TRX is trading near $0.158 and has experienced a modest price surge of over 1.25% in the past 24 hours. During the same period, its trading volume jumped by 70%, indicating higher participation from traders and investors amid TRX’s bullish price action.