The crypto market has recorded its highest weekly inflow this year, reaching an impressive $2.2 billion.

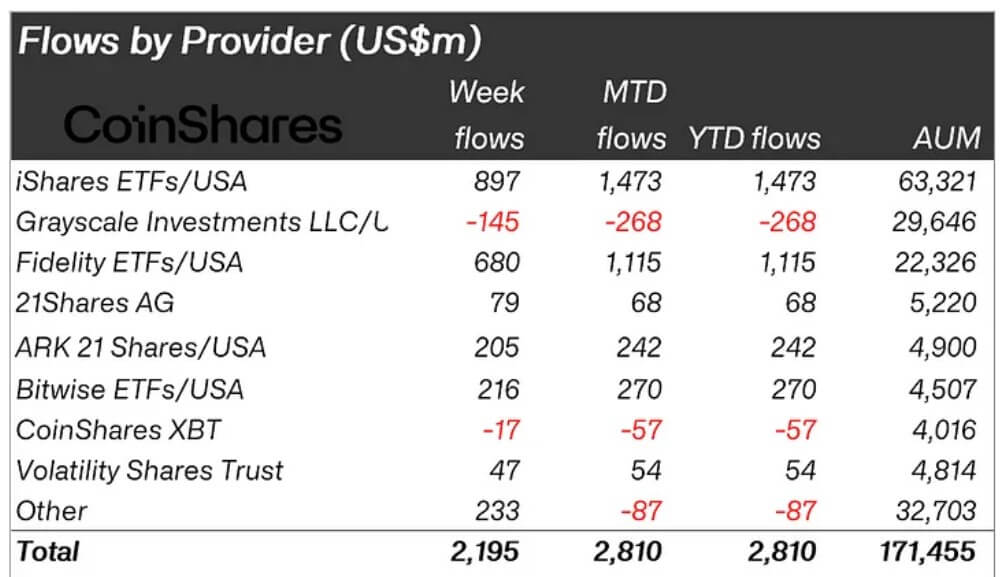

According to the latest CoinShares report, this influx of capital was fueled by growing excitement around Donald Trump’s Jan. 20 inauguration. The firm noted that the surge pushed total year-to-date inflows to $2.8 billion.

This influx has also pushed assets under management (AUM) to a record high of $171 billion. The surge coincided with Bitcoin’s impressive performance, with the flagship crypto climbing nearly 20% over the past week to hit an all-time high near the $110,000 mark.

Meanwhile, the market also experienced a corresponding spike in exchange-traded product (ETP) trading volumes, which reached $21 billion last week.

James Butterfill, CoinShares head of research, pointed out that this number accounted for 34% of Bitcoin’s trading activity on leading exchanges. This robust number highlights growing institutional interest and the increasing mainstream adoption of crypto.

Bitcoin and XRP shine

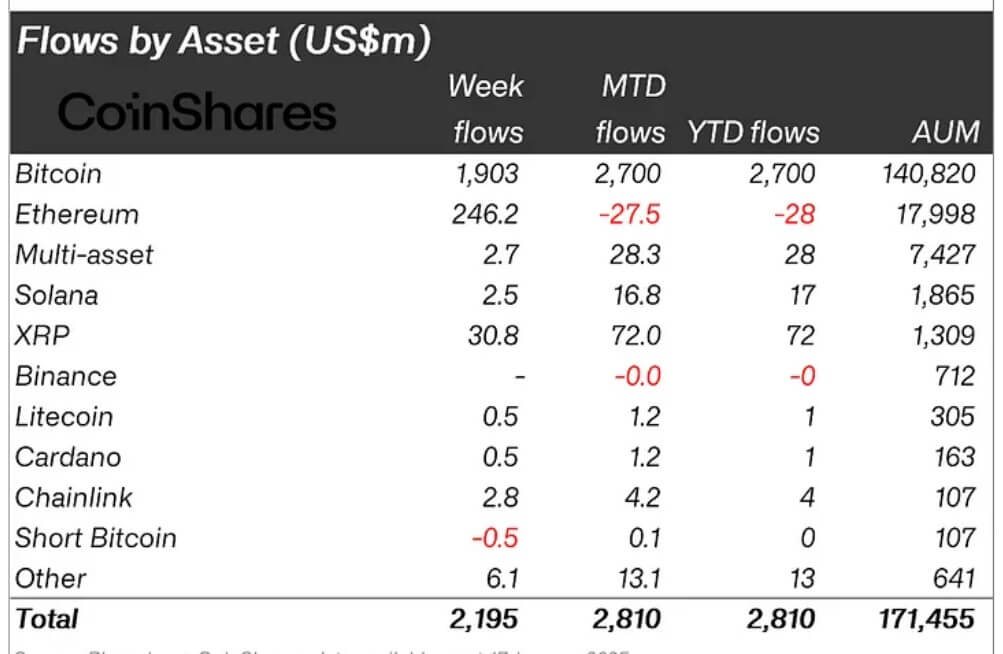

Bitcoin continued its dominance, securing $1.9 billion in inflows last week and bringing its total for the year to $2.7 billion.

The report highlighted that spot Bitcoin ETFs, offered by key players like BlackRock, Fidelity, Ark Invest, and Bitwise, collectively attracted over $2.1 billion in inflows. The inflows are seen as a positive response to market optimism about supportive regulatory policies expected under the incoming administration.

Interestingly, short-Bitcoin products registered modest inflows of $500,000, a surprising deviation from typical bearish behavior during bullish trends.

Meanwhile, Ethereum drew $246 million in inflows, marking a reversal of its previous outflows this year. However, the second-largest crypto continues to underperform in comparison to its peers.

Butterfill noted that Ethereum remains the weakest performer this year from an inflow perspective despite significantly outpacing Solana, which brought in $2.5 million last week.

On the other hand, XRP has proven to be a standout performer, attracting $31 million in inflows last week. Since mid-November 2024, XRP’s total inflows have reached an impressive $484 million, underscoring its growing appeal to investors.

Stellar followed with smaller inflows of $2.1 million, while other altcoins showed little activity during the period.

The post Trump buzz drives $2.2B inflow, setting new records for Bitcoin and AUM appeared first on CryptoSlate.