The post Trump Crypto Holdings: Analyzing the Impact of Meme Coins on His Portfolio appeared first on Coinpedia Fintech News

Data from Arkham Intelligence, a public data application that enables users to analyze blockchain and crypto activities, shows that Republican presidential candidate Donald Trump has earned nearly $6.1 million from his cryptocurrency holdings this year. Trump, who is considered as a pro-crypto candidate, will compete against Democratic leader Kamala Harris in the upcoming US presidential election, scheduled to take place on November 5, 2024. If you analyze the composition of Trump’s portfolio, you will see something unexpected: the dominance of Meme Coins. Curious to know more! Read on!

Meme Coins’ Dominance in Trump’s Portfolio: What You Should Know

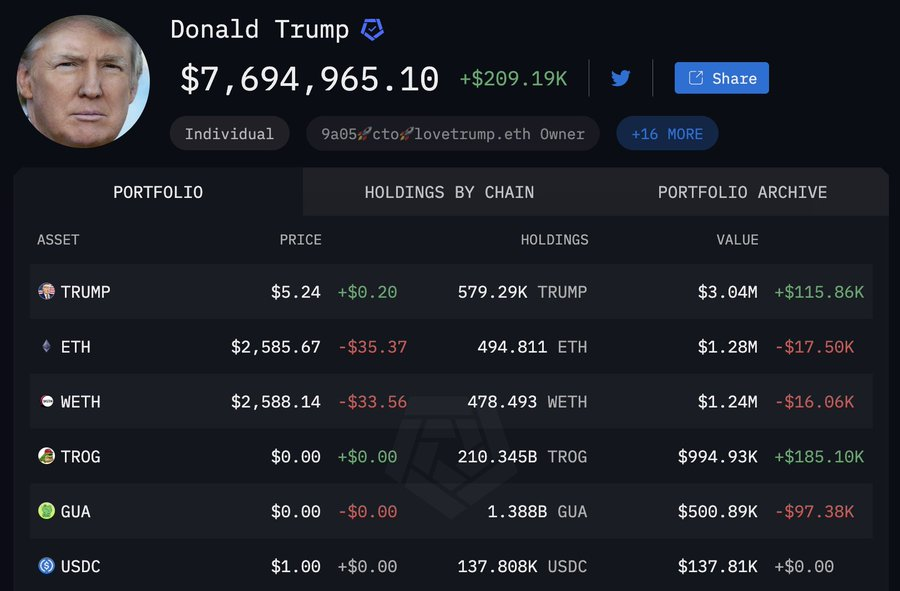

The Arkham Intelligence data shows that Meme Coins make up at least 65% of the total holdings of Donald Trump’s crypto portfolio. In the portfolio, there are nearly 579.29k TRUMP, 478.493 WETH, 210.345B TROG, 10.017M FIGHT, 10.005M MAAG, 950K BABYTRUMP, and many more.

Trump’s Crypto Portfolio: An Overview

The total value of Trump’s crypto portfolio is nearly $7,915,735.66. In the last 24 hours, it has seen a surge of +$283.72K (+3.58%). In terms of value, TRUMP, ETH, and WETH, are TROG the top four cryptos in Trump’s cryptocurrency portfolio. The current value of Trump’s total ETH holdings is $1.31M. Meanwhile, the values of TRUMP, WETH, and TROG are $3.14M, $1.23M, and $1.03M, respectively. The TRUMP coin has recorded an increase of +4.23% in the last 24 hours. Among the top four coins in the portfolio, TROG has reported the highest 24-hour increase of +23.54%.

Trump’s New Attitude Towards Crypto

Trump was once a crypto skeptic, who once dismissed the crypto concept as a scam. Lately, especially after he launched his campaign for the US presidential election, he changed his stance on cryptocurrency and presented himself to his followers as a passionate advocate of crypto. During his campaign, he promised to dismantle the strict regulatory environment, which he believes stifled the growth of the crypto sector.

In conclusion, Meme Coins are regarded as highly volatile coins. The high level of exposure of Trump’s crypto portfolio to Meme Coins indicates that the portfolio is heavily susceptible to even minor crypto market fluctuations.

Stay tuned to Coinpedia for more such interesting crypto news stories!