ConsenSys CEO Joseph Lubin recently suggested that US President Donald Trump’s family may “build one or more giant businesses” on Ethereum (ETH). Responding to an X thread about Trump’s recent ETH purchases, Lubin stated that the Trump Administration is exploring ways the US could support Ethereum.

Trump Family To Start Businesses On Ethereum?

After a relatively subdued price performance and limited public attention in 2024, ETH may be set for a resurgence in 2025. In a post on X, crypto expert DCinvestor highlighted that Trump-backed decentralized finance (DeFi) venture World Liberty Financial has significantly increased its ETH holdings.

Data from Etherscan reveals that World Liberty Financial’s wallet currently holds 55,719 ETH, valued at over $183 million at the time of writing. Lubin’s recent comments hint at a deeper involvement by the Trump family in the cryptocurrency industry. He said:

The Trump Administration will do what is good for the USA and that will involve ETH, considerations of how the USA can support Ethereum — the most capable and largest decentralized protocol ecosystem for the benefit of the USA, and perhaps eventually use Ethereum technology in government activities just as they currently use the internet and web protocols.

Lubin further noted that, in addition to Ethereum, the Trump family might engage with other blockchain ecosystems, such as Bitcoin and Solana. The recent launch of the official Trump meme token on Solana appears to validate this statement.

Besides ETH, the World Liberty Financial wallet holds other tokens such as Aave (AAVE) and Chainlink (LINK). The DeFi project is expected to become operational soon.

Analysts Eye ETH Rally Soon

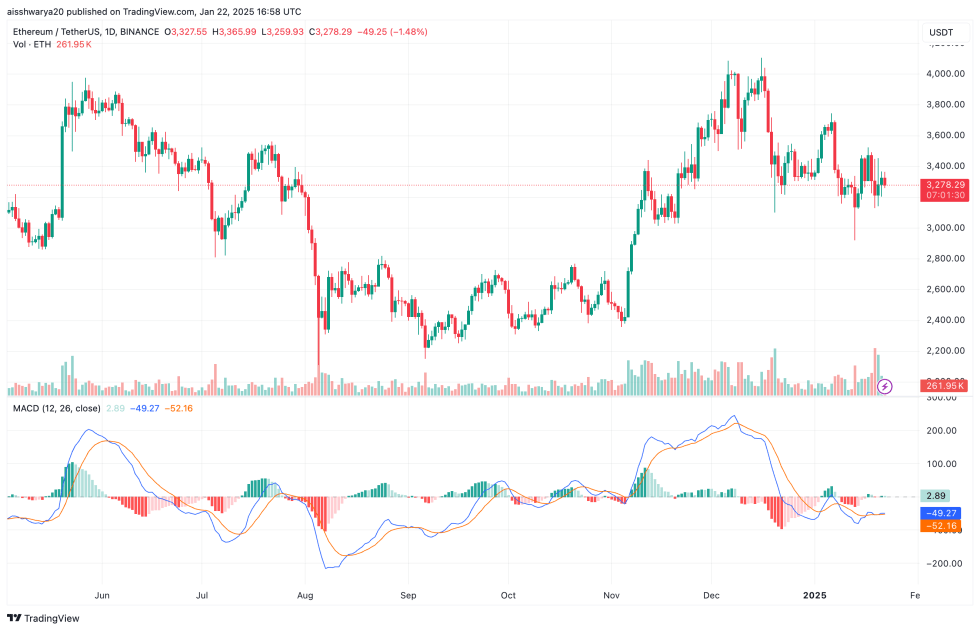

As Ethereum continues to trade in the low $3,000 range, crypto analysts are becoming increasingly confident of an imminent rally for the the second-largest digital asset by market cap.

Seasoned crypto trader Michael van de Poppe highlighted World Liberty Financial’s growing ETH exposure as a bullish signal for the cryptocurrency. Poppe added that 2025 could mark a turning point for Ethereum’s performance.

From a technical perspective, crypto analyst Jelle shared a weekly ETH chart illustrating a bullish inverse head-and-shoulders pattern in formation, along with a massive ascending triangle that Ethereum may soon break out of.

Similarly, crypto analyst TraderSZ shared the following ETH daily chart, showing a bullish descending triangle pattern. The analyst remains long-term bullish on ETH, projecting targets as high as $10,000.

However, Ethereum’s prolonged underperformance has begun to dent the confidence of some whales. At press time, ETH trades at $3,278, down 1% in the past 24 hours.