The post Trump-Linked DeFi Giant WLFI Shakes Crypto Market appeared first on Coinpedia Fintech News

The DeFi project supported by President elect Donald Trump, World Liberty Finance or WLFI is in the news again. The project made huge moves in the crypto world by buying millions of dollars worth of Ethereum, Chainlink and AAVE. These purchases not only got the ecosystem interested but also helped the prices to soar. Let’s dive into the details to see what they are doing.

Ethereum’s Big Day

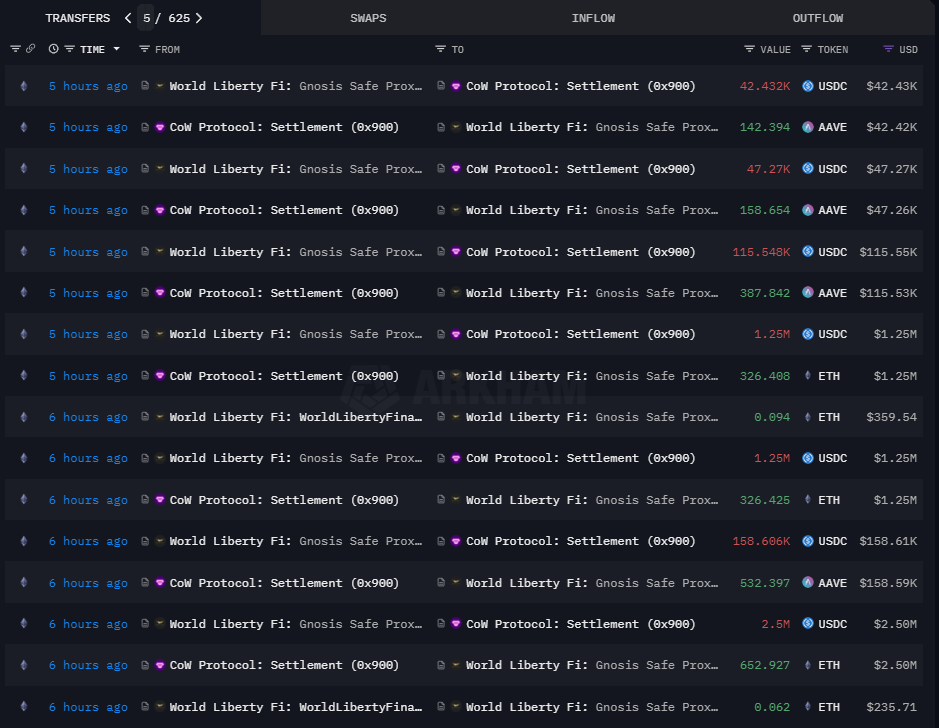

WLFI spent a whopping $10 million in USD Coin (USDC) to buy 2,631 Ether (ETH). At the time, Ether was priced at an average of $3,801 per token. This massive purchase caused the price to have a sudden spike of 2.36%. By the end of the day, ETH had already jumped by 6.86%. This gives a clear idea of how just one big transaction can send ripples throughout the market.

But that wasn’t all. WLFI’s move boosted investor confidence, proving how much influence this DeFi project has on the crypto scene.

Chainlink and AAVE Get Their Moment

It wasn’t just Ethereum feeling the love. WLFI dropped another $1 million USDC to snag 41,335 Chainlink (LINK) tokens at $24.2 each. This caused LINK’s price to shoot up by 20.56%, reaching $26.72 in just 24 hours. That’s a serious surge, even for a volatile market.

AAVE didn’t miss out either. WLFI spent $1 million on 3,357 AAVE tokens at $297 each. While the market impact wasn’t as dramatic as with LINK, it still cemented WLFI’s role as a heavy hitter in the DeFi space.

Justin Sun’s Big Bet

Adding to the excitement, Justin Sun, founder of Tron, announced a $30 million investment in WLFI. This makes him the project’s largest investor. He’s also taken on an advisory role, bringing his years of blockchain experience to the table.

Sun’s endorsement underscores WLFI’s growing credibility. In his own words, the U.S. is on its way to becoming a blockchain hub, and Trump’s involvement is a game-changer.

What’s Next?

WLFI isn’t slowing down. With a wallet packed with $74.36 million in cryptocurrencies, including 14,570 Ether and nearly 103 wrapped Bitcoin, this project is clearly in it for the long haul. Investors will be watching closely, especially with Justin Sun now onboard.

Will WLFI continue to dominate the DeFi space? The signs point to yes, but in crypto, anything can happen. One thing’s

Exciting Announcement!

Exciting Announcement!