TrueUSD’s (TUSD) circulating supply has more than doubled in the last two weeks, reaching over 2 billion tokens on March 13.

TUSD’s total supply is 2.073 billion as of press time, according to CryptoSlate’s data.

During the period, the little-known stablecoin has also grown to become the second-largest stablecoin by circulating supply and transfer volume on the Tron blockchain.

TUSD’s rise coincides with rival troubles

TUSD’s rise has coincided with recent troubles affecting stablecoin rivals and their banking partners.

Binance USD (BUSD) troubles began in February when regulators ordered its issuer Paxos to stop other mints. At the time, Binance CEO Changpeng ‘CZ’ Zhao said the exchange would support other stablecoins in the ecosystem following BUSD’s decline.

True to his word, the exchange minted nearly 50 million TUSD tokens and added new trading pairs for the stablecoin.

Blockchain analytical firm Santiment noted that TUSD’s adoption reached a new high as its supply on exchanges reached 73% for the first time since June 2021.

Meanwhile, the collapse of crypto-friendly banks like Silicon Valley Bank alongside Silvergate and Signature Bank affected confidence in USD Coin’s (USDC) reserve. Its issuer Circle said it held part of the stablecoin’s reserve at the failed SVB.

TUSD has exposure to Signature Bank

TrueCoin said it had paused TUSD minting and redemption for several of its Signature Bank users. The TUSD issuer said some of its fiat U.S. Dollar funds were held at the embattled Signature Bank.

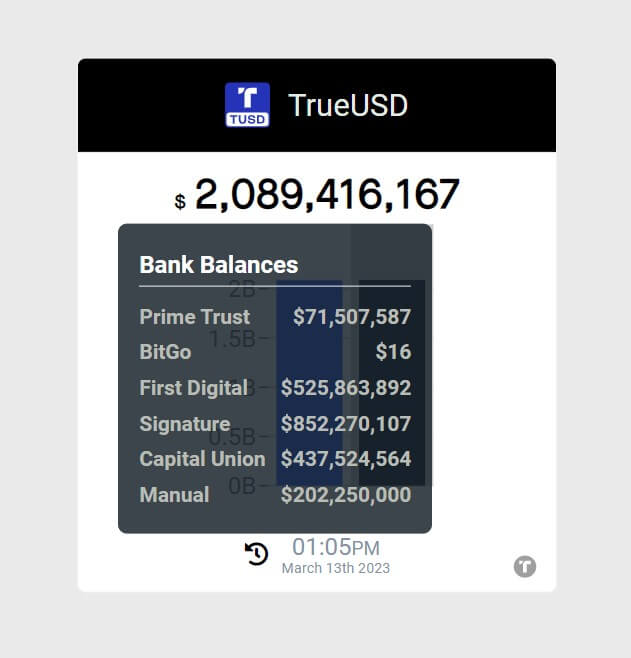

TUSD’s reserves showed that it held $852.27 million at Signature Bank. Other banks holding TUSD’s reserves include Prime Trust, First Digital, Capital Union, Manual, and BitGo.

U.S. regulators took control of the bank on March 12. The New York State Department of Financial Services appointed the FDIC as its receiver. FDIC has transferred all Signature’s deposits and assets to the new full-service bank it created, Signature Bridge Bank.

According to TUSD, it is in direct contact with affected users. The stablecoin firm added that its other banking networks were fully operational, assuring users that minting and redemptions continue.

The post TUSD’s supply crosses $2B amid banking woes for stablecoin rivals appeared first on CryptoSlate.