The top two holders of Trump positions on Polymarket have conducted over 1,600 trades supporting Donald Trump in the 2024 US Presidential Election market, totaling more than $4 million in the past 24 hours.

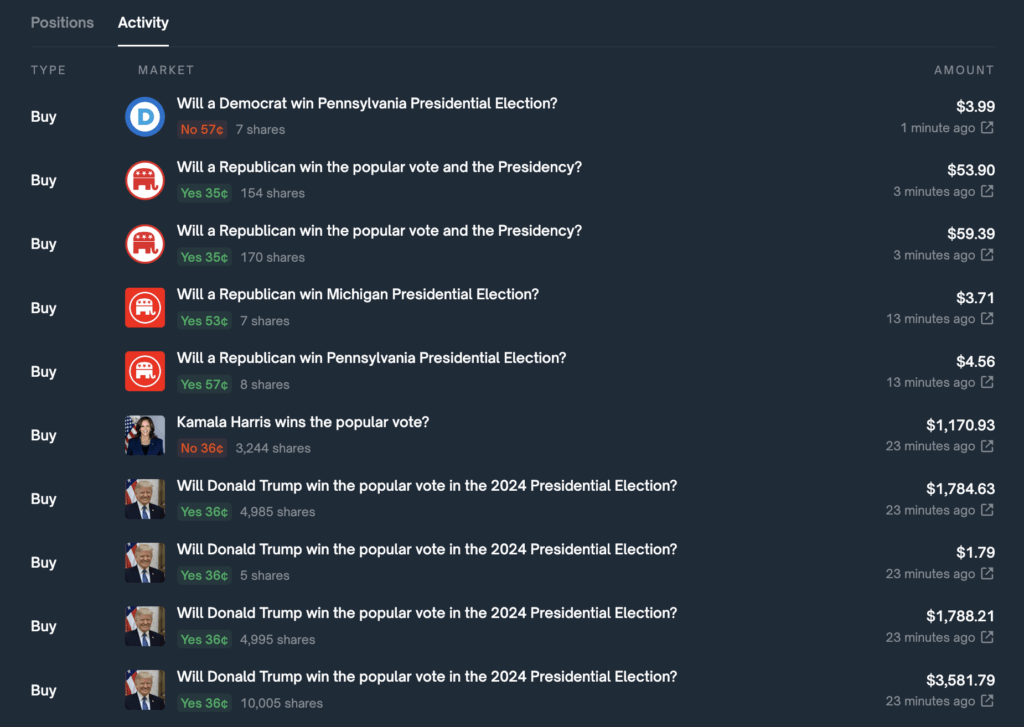

The first holder, “Fredi9999” (wallet address 0x1f2d), joined in June and has positions valued at $13,077,341.48 with a profit of $1,324,409.58. They have traded $67,668,524.47 across 45 markets, holding 15,657,595 shares in the Trump victory market at an average cost of 52 cents per share, now valued at 59 cents, yielding a gain of $1,067,080.74.

The second holder, “PrincessCaro” (wallet address 0x8119), joined in September with positions valued at $6,165,728.20 and a profit of $661,798.04. They have traded $21,850,960.05 across 14 markets, holding 6,091,006 shares at an average cost of 53 cents per share, now also valued at 59 cents, resulting in a gain of $380,371.14.

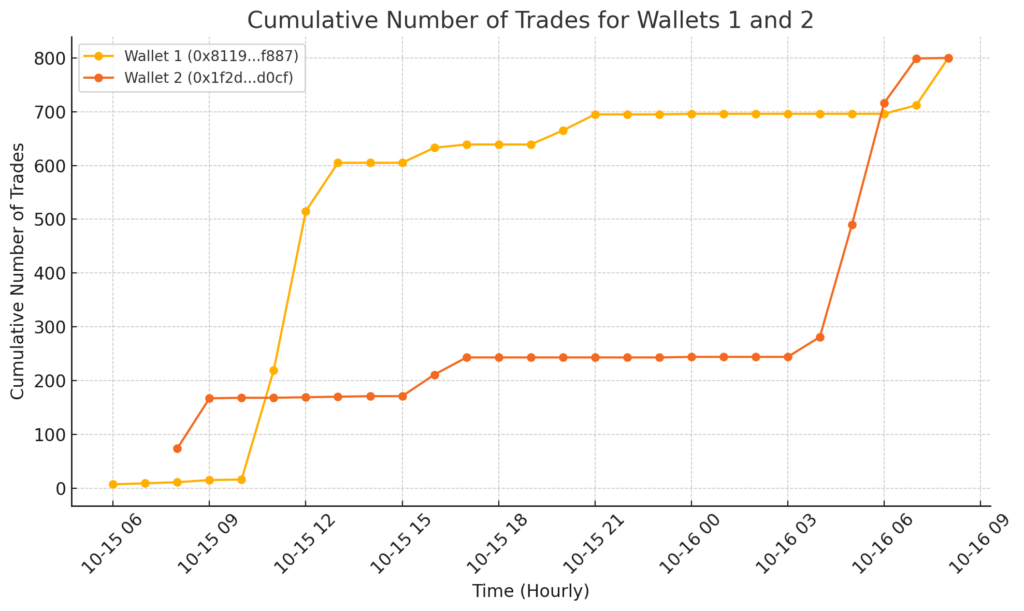

Analysis of their wallet histories reveals significant trading activity on the Polymarket exchange using USD Coin (USDC). “PrincessCaro” shows frequent small transactions ranging from $0.30 to $187, suggesting active participation without large individual trades. In contrast, “Fredi9999” has executed larger transactions, including a $4,302.82 trade alongside smaller ones. Combined, the two wallets have made over 1,600 trades in Trump or Republican-favored markets over the past 24 hours. Many of the bets appear to have been placed within seconds or minutes of each other.

The number of trades made in support of Trump may be influenced by the order book matching large orders to multiple smaller orders to fill traders’ requests. However, the persistent purchases are still worthy of note, showing an intense increase in buy pressure for the former President.

Trump’s chances of victory on the platform have soared by 9% over the past few days, alongside the increase in consistent high-frequency trading from these two accounts. In contrast, bets for Kamala Harris have seen a much lower velocity.

The post Two Polymarket whales bet $4 million for Trump across 1,600 trades in 24 hours as odds hits 59% appeared first on CryptoSlate.