Devin Walsh, Executive Director of the Uniswap Foundation, a non-profit organization supporting the growth and decentralization of the Uniswap decentralized exchange (DEX), believes that Uniswap is decentralizing. Walsh even compares the current state of the DEX to that of Ethereum. The executive also acknowledged that the DEX’s current level of success is due to the active participation and contribution of the developer community.

Uniswap Becoming More Decentralized?

The Executive Director responded to a thread on X where Antonio Juliano, the founder of dYxX, a layer-2 DEX on Ethereum, insinuated that Uniswap is now centralized. However, it started on a decentralized path.

With centralization, Juliano added, the protocol can iterate quickly, mainly to boost revenue. On the other hand, by being more decentralized, dapps allow users to enjoy the full advantages of decentralized finance (DeFi).

Decentralization of protocols launching on public ledgers, like Ethereum or Cardano, is crucial. Usually, the community will gauge how well a dapp is decentralized by looking at, among other factors, how decisions are made and which party spearheads development.

In the case of Ethereum, Walsh pointed out that the community has taken over from where Vitalik Buterin, the co-founder; and Consensys, a technology company developing solutions for Ethereum, left. Since then, multiple developers have been refining the network and ensuring it is secure and robust to anchor dapps.

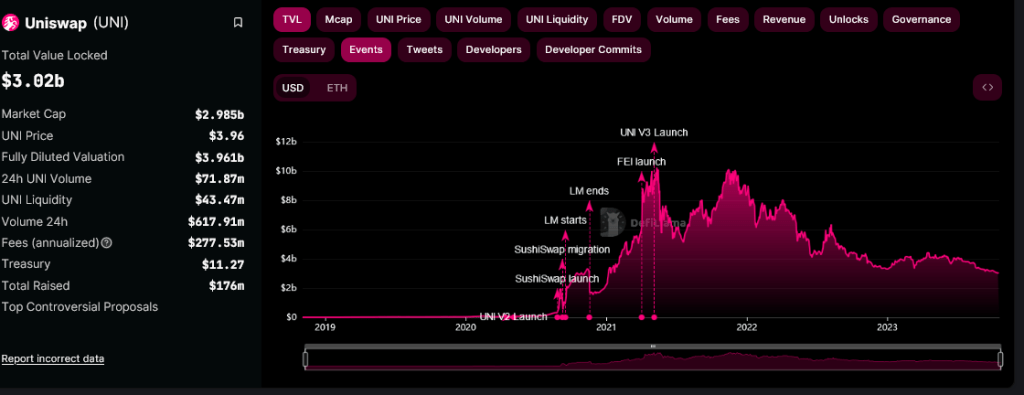

Uniswap is one of the most popular DEXes on Ethereum, looking at total value locked (TVL). DeFiLlama data shows that the exchange manages over $3 billion of assets and is primarily active on Ethereum. However, the exchange enables trustless swapping on layer-2 platforms like OP Mainnet, and public ledgers like the BNB Chain.

Preparing For Hooks And KYC?

Presently, Uniswap Labs leads the development of Uniswap. Nonetheless, Walsh said more developers are now building and contributing solutions. This, the Uniswap Foundation executive further observed, is especially considering the scheduled launch of Hooks in v4.

There is no specific timeline for when Uniswap will deploy the latest iteration, but the release of the Cancun upgrade on Ethereum will play a role. The protocol will be more customizable with Hooks since the feature acts more like a plugin.

Even so, there have been concerns that Hooks, though being developed by community developers, will be the basis for Uniswap to censor liquidity providers (LP) or traders who don’t verify by adhering to know-your-customer rules (KYC). UNI prices remain under pressure at spot rates and may break lower, registering new 2023 lows.