In a week marked by consolidation across the cryptocurrency market, the native token of Uniswap, UNI, has defied the trend, surging over 15%, and surpassing the $10 mark. This bullish run comes amid positive developments within the Ethereum ecosystem and Uniswap’s ongoing legal battle with the US Securities and Exchange Commission (SEC).

Riding The Ethereum Wave

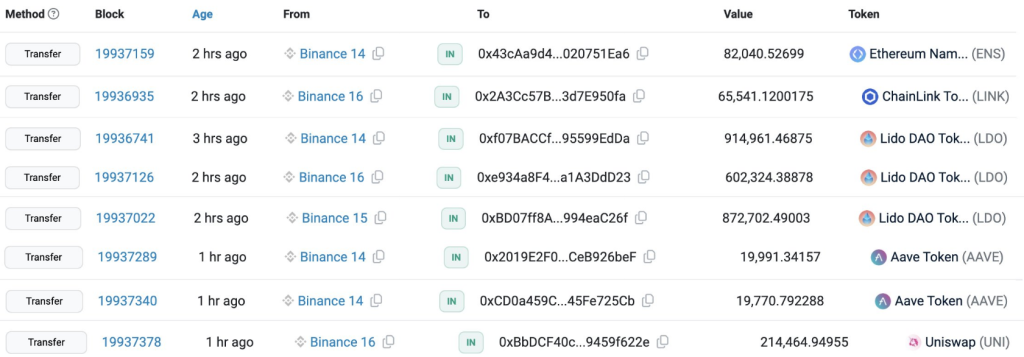

Beyond the legal battle, the current momentum within the Ethereum ecosystem is also propelling UNI’s price upwards. On-chain data reveals significant whale withdrawals from crypto exchanges following news of a potential spot Ethereum ETF.

Another fresh wallet withdrew 213,166 UNI($1.96M) from #Binance just now.https://t.co/u15CE864hm pic.twitter.com/kyOBv0TB5G

— Lookonchain (@lookonchain) May 24, 2024

This flight to safety, coupled with the overall bullish sentiment surrounding Ethereum, is creating a ripple effect that benefits UNI, a key player within the Ethereum DeFi landscape.

From a technical standpoint, UNI’s breakout from a monthly consolidation phase paints a promising picture. Both technical indicators and on-chain data suggest a potential 25% price increase for UNI.

The token’s recent surge indicates a potential bull run, with analysts eyeing a price target of $12.80 if the current momentum continues.

Adding fuel to the fire is Santiment’s Age Consumed index, which measures the movement of dormant tokens. Spikes in this index often precede price rallies, and the latest uptick by the latter part of April seems to have foreshadowed UNI’s current uptrend.

This on-chain metric reinforces the bullish outlook for UNI, suggesting that investors are awakening to its potential.

Short Sellers Get Burned As Bulls Take Charge

The recent price rally has also been accompanied by a significant rise in trading activity. Data from Coinalyze reveals over $1 million in Uniswap liquidations in the last day.

The majority of these liquidations (over $750,000) were short positions, indicating that traders betting against UNI are feeling the heat. This surge in open interest, with more traders going long on UNI, further strengthens the bullish control over the token’s price.

Uniswap Takes A Stand Against The SEC

This display of defiance has instilled confidence among investors, who view it as a positive sign for Uniswap’s future. The popular decentralized exchange (DEX) recently received a Wells notice from the regulatory body, alleging that UNI is a security. However, Uniswap has vowed to challenge this claim, asserting that the SEC’s case is weak.

The SEC case against Uniswap remains unresolved, and a negative outcome could dampen investor sentiment. A broader market correction could still impact UNI’s price.

Featured image from Wallpapers, chart from TradingView