Uniswap (UNI) has emerged as a formidable force within the cryptocurrency space, showcasing an impressive growth of 22% in recent weeks.

As one of the leading decentralized exchanges (DEX) built on the Ethereum blockchain, Uniswap has gained widespread recognition for its innovative approach to facilitating peer-to-peer token swaps.

With its unique automated market maker (AMM) model and emphasis on user empowerment, Uniswap has become a go-to platform for traders and liquidity providers alike.

The significant surge in UNI’s value begs the question: does it have enough fuel to climb higher?

Uniswap Optimism Incentives Contributes To UNI Rally

A recent UNI report has highlighted that Uniswap’s incentives on the Optimism network (OP) have generated diverse outcomes when it comes to liquidity and the decentralized finance (DeFi) sector.

While the effectiveness of these incentives may have varied, the price of UNI has demonstrated a strong bullish trend on the charts.

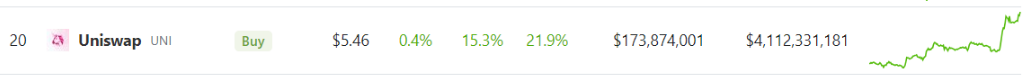

Over the past 24 hours, UNI has experienced a significant rally, with its price reaching $5.46 on CoinGecko, marking an impressive 15.3% increase.

Additionally, in the span of the last seven days, UNI has likewise demonstrated remarkable growth, surging by nearly 22%. These substantial price gains indicate a positive market sentiment surrounding UNI and suggest the potential for further upward movement.

Impact Of Decreased UNI Supply On Exchanges

On-chain data analysis has unveiled a significant drop in Uniswap’s supply on exchanges during early June, followed by a period of sideways movement from mid-June onwards. This data suggests that the selling pressure on UNI has eased in the short term, as the amount of UNI being moved to centralized exchanges (CEX) for offloading has decreased.

The decrease in UNI supply on exchanges implies that holders are becoming less inclined to sell their tokens in the immediate term. This reduction in selling pressure could have positive implications for the price of UNI, as a lower supply available for trading may create a more favorable supply-demand dynamic.

Additionally, the sideways movement of UNI on exchanges indicates a potential shift in market sentiment. Investors and traders may be adopting a more long-term approach to holding UNI, considering the potential for further price appreciation or the desire to participate in the governance and staking mechanisms provided by Uniswap.

#UNI is one of my small wallet, investing about $5,000. but who knows, this can give 10x or 50x one day. What attracted me to this coin is its max supply of 1B, check coingecko info, and it’s a utility. Hence it satisfies investment criteria. #uniswap pic.twitter.com/FX6PZzAi50

— Prof. Smalltimer (@RJinvestcoin) June 25, 2023

This shift in UNI supply and trading behavior highlights the evolving dynamics within the Uniswap ecosystem. With reduced short-term selling pressure and a potential increase in long-term holding, UNI’s price stability and upward potential may be bolstered.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Alamy