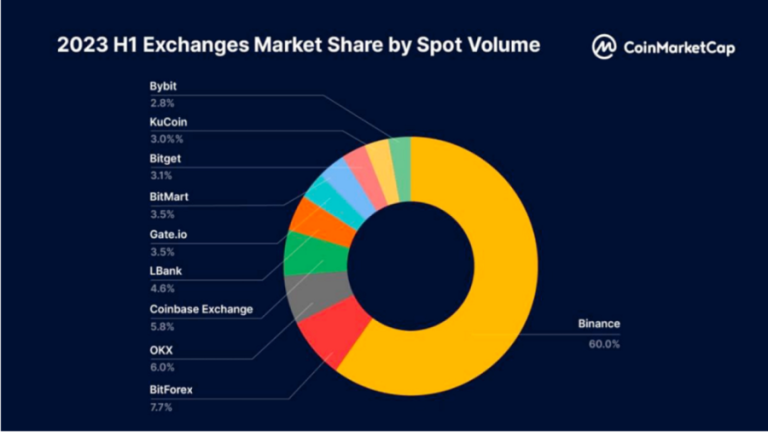

PRESS RELEASE. In the rapidly evolving crypto landscape, the LBank exchange platform is making waves. Their noteworthy achievement of being ranked among the top 5 global exchanges in CoinMarketCap’s (CMC) H1 report is reflective of their innovative strategies and an unyielding commitment to driving the industry forward.

Strategizing Success with MEME Coins

In the first half of the year, LBank, as per the CMC report, showcased an impressive performance with a market share of 4.6%, ranking 5th in spot trading volume. The catalyst for this growth was their strategic focus on MEME coins, an asset class often perceived as high risk due to its volatility. LBank’s effective MEME Listing strategy has played a crucial role in this achievement, aiding users in selecting quality MEME coins and creating a reputation for reliability.

Risk and Profitability: A Balancing Act

Profitability in the MEME coins market, given its inherently volatile nature, cannot be promised, a fact that LBank’s founder, Eric He, acknowledges upfront. However, he also stresses that LBank maintains a strong commitment to its users by implementing rigorous vetting and early listing of promising MEME coins.

This commitment is reflected in the platform’s robust selection process for listing new MEME coins. Each prospective coin undergoes a stringent review process where several factors, including contract quality, founder credibility, trading depth, and market popularity, are meticulously scrutinized. The aim is to ensure that only those assets meeting LBank’s high standards are listed, enhancing the likelihood of investors trading in quality assets.

But the commitment does not end with rigorous vetting; LBank further secures an advantage for its users by listing coins early. The platform ensures that promising coins are accessible to investors as soon as possible, potentially at lower price points. A testament to this approach was the listing of PEPE on April 18th, arguably the earliest among known centralized exchanges.

This proactive move by LBank provided a notable advantage to its users. After being listed on LBank, PEPE saw an impressive rise in value, with its maximum increase reaching a staggering 6387%. The case of PEPE thus underscores the potential benefits of LBank’s approach, which couples rigorous selection with early listing, enabling users to access promising MEME coins at potentially more favorable price points.

Supporting the MEME Coin Sector Beyond Listing

The support for MEME coins on LBank extends beyond simply listing. The platform demonstrates tangible commitment through several initiatives. The recently established $10 million MEME Fund by LBank Labs is designed to stimulate early-stage innovative MEME projects, nurture industry growth, and give back to the community. Furthermore, LBank has hosted the MEME Journey voting contest, sparking enthusiasm within the community. The first MemeKing voting event saw impressive participation, with QUACK securing victory with a staggering 500,000 votes, earning the coveted title of MemeKing. The second round saw similar enthusiasm, with 4CHAN triumphing with an impressive 150,000 votes. The event generated over 100 million impressions on Crypto Twitter, which further demonstrated the enthusiastic spirit of the global Memecoin community.

Embracing Innovation Beyond High-Risk Assets

When asked about LBank’s stance on supporting high-risk MEME coins, Eric He takes a broader view. He asserts that LBank’s commitment isn’t confined to MEME coins alone but extends to all innovative blockchain coins. In his view, the embrace of MEME coins represents the first step in LBank’s larger strategy to support innovation within the cryptocurrency landscape.

This commitment to supporting innovative coins positions LBank as a frontrunner in the market, ready to deepen its presence and partnership with innovative project teams in the industry.

He emphasizes that LBank will continue to be a pioneer in this market, working closely with innovative projects to continually cultivate and advance the market. This holistic approach highlights LBank’s commitment to driving innovation and growth in the broader blockchain and crypto industry, demonstrating its role as more than just an exchange platform.

As we look to the future, the latest CMC H1 report underscores LBank’s continued growth and commitment to top-tier Centralized Exchange (CEX) services. By prioritizing MEME coins, LBank has shown a willingness to embrace risk, supporting innovation and engaging their community in the ever-evolving crypto market. As the industry landscape continues to evolve, LBank stands ready to contribute to its growth and diversification.

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.