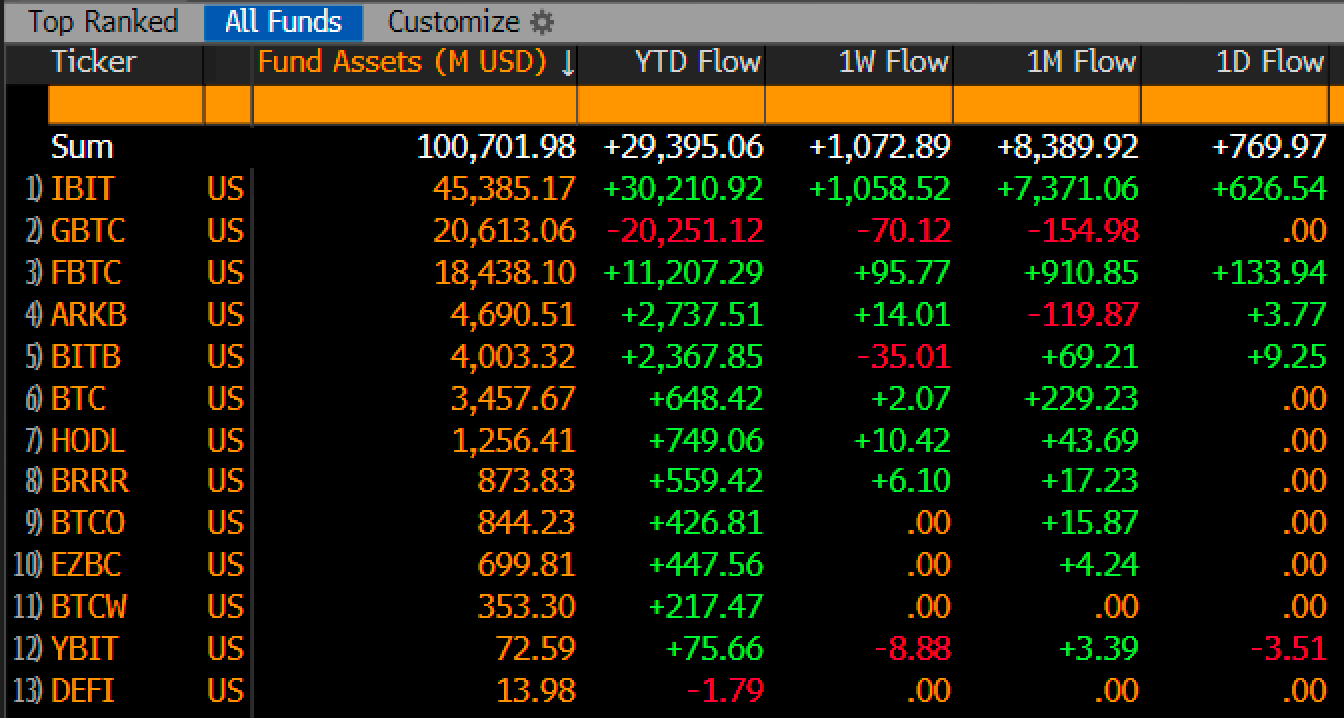

Spot Bitcoin exchange-traded funds (ETFs) have reached an impressive benchmark, crossing $100 billion in net assets. According to SoSoValue data, this achievement represents 5.4% of Bitcoin’s total market value.

The 12 Bitcoin ETFs, launched by prominent issuers such as BlackRock and Fidelity, have reached this milestone in just 10 months since their debut in January. Leading the pack is BlackRock’s iShares Bitcoin Trust (IBIT), which manages $45.4 billion in assets.

Grayscale’s GBTC takes the second spot with $20.6 billion, while Fidelity’s Wise Origin Bitcoin Fund (FBTC) follows in third with $18.4 billion. Other notable contributors include the Ark 21 Shares BTC ETF (ARKB) at $4.6 billion and Bitwise BITB at $4 billion.

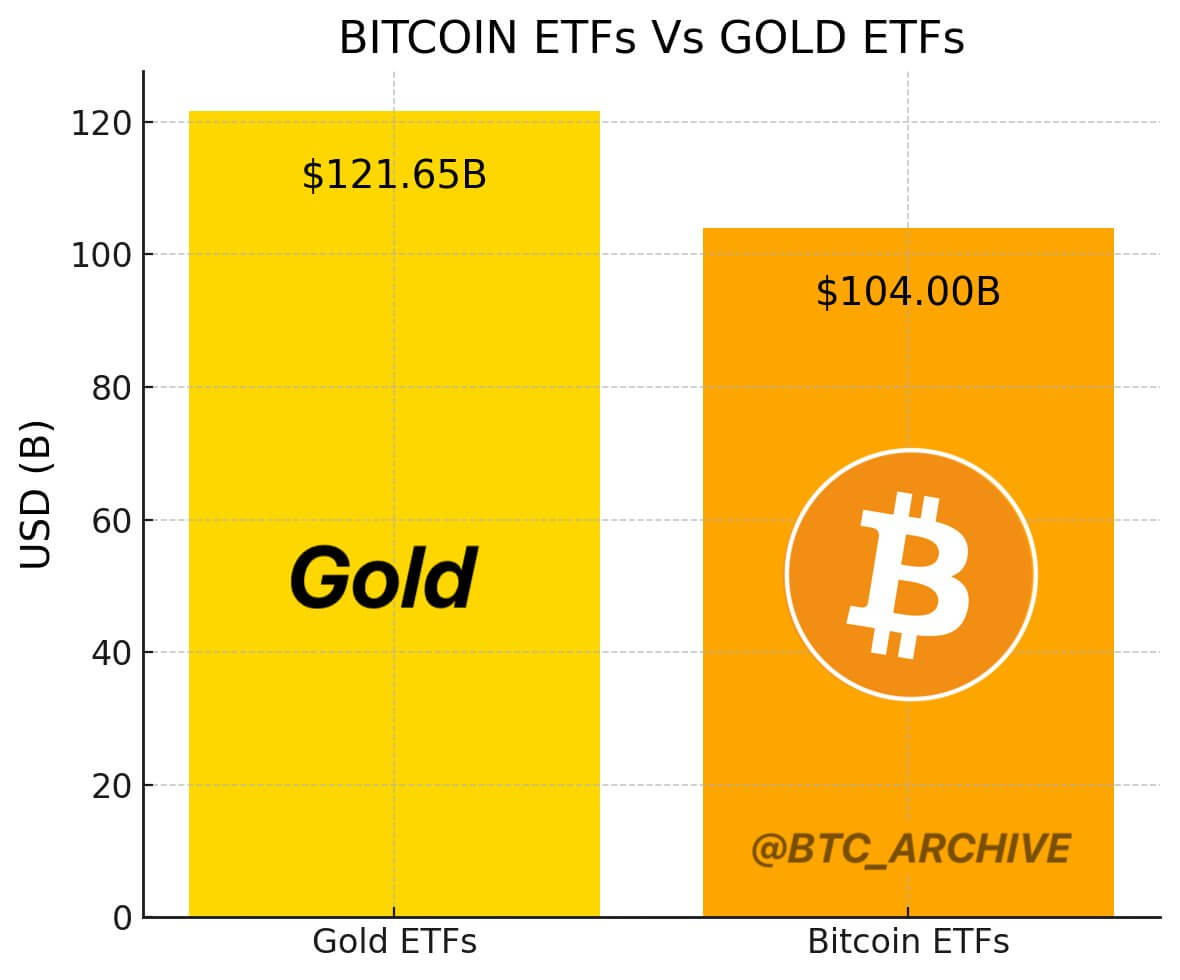

The rapid growth of spot Bitcoin ETFs makes them one of the most successful fund categories to date. Bloomberg ETF analyst Eric Balhcunas stated that the numbers show that the funds are close to overtaking Satoshi Nakamoto as the largest Bitcoin holder while advancing steadily toward surpassing gold ETFs in asset value.

The post US Bitcoin ETFs surpass $100 billion, pose challenge to largest Bitcoin holders appeared first on CryptoSlate.