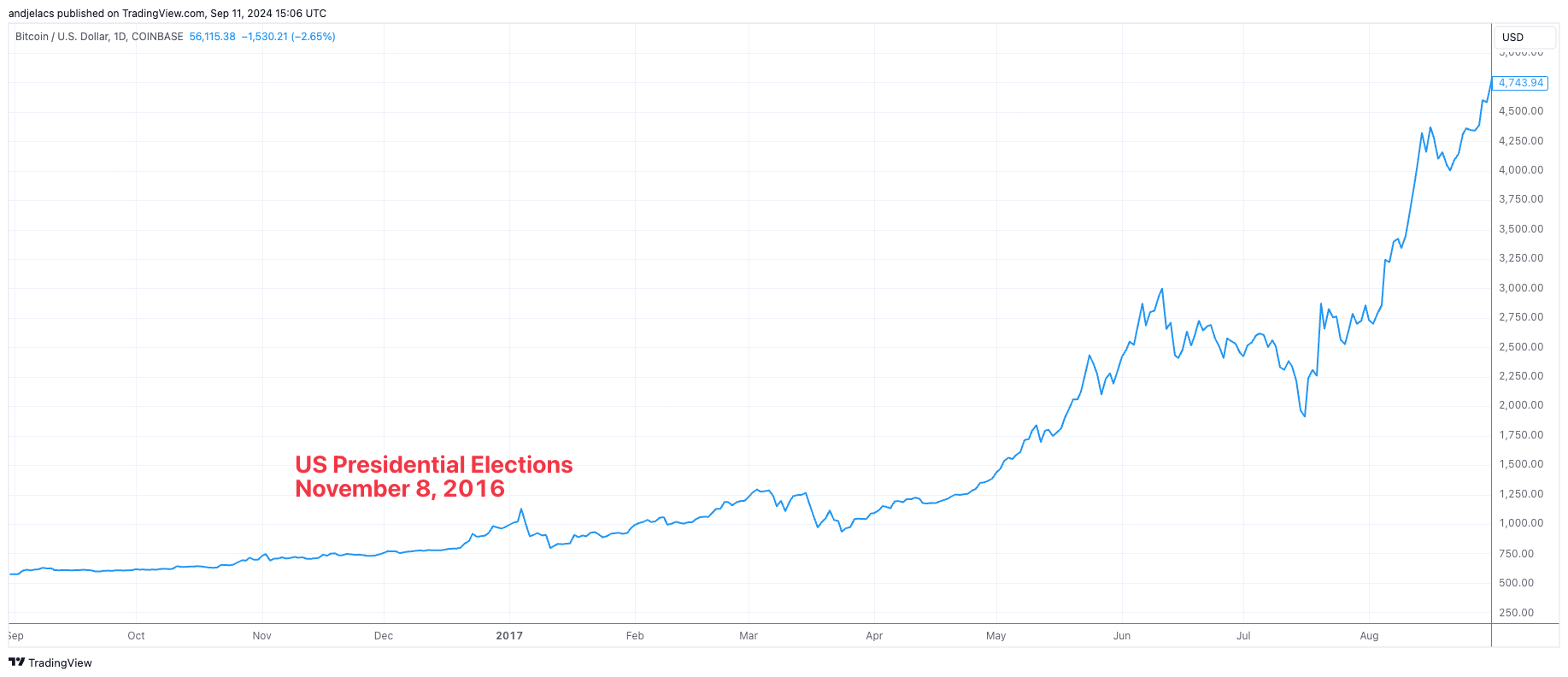

Bitcoin’s price has exhibited an interesting pattern following the last two US Presidential elections. After Republican candidate Donald Trump won the presidency in 2016, Bitcoin’s price climbed steadily throughout 2017, ultimately peaking near $20,000 in December.

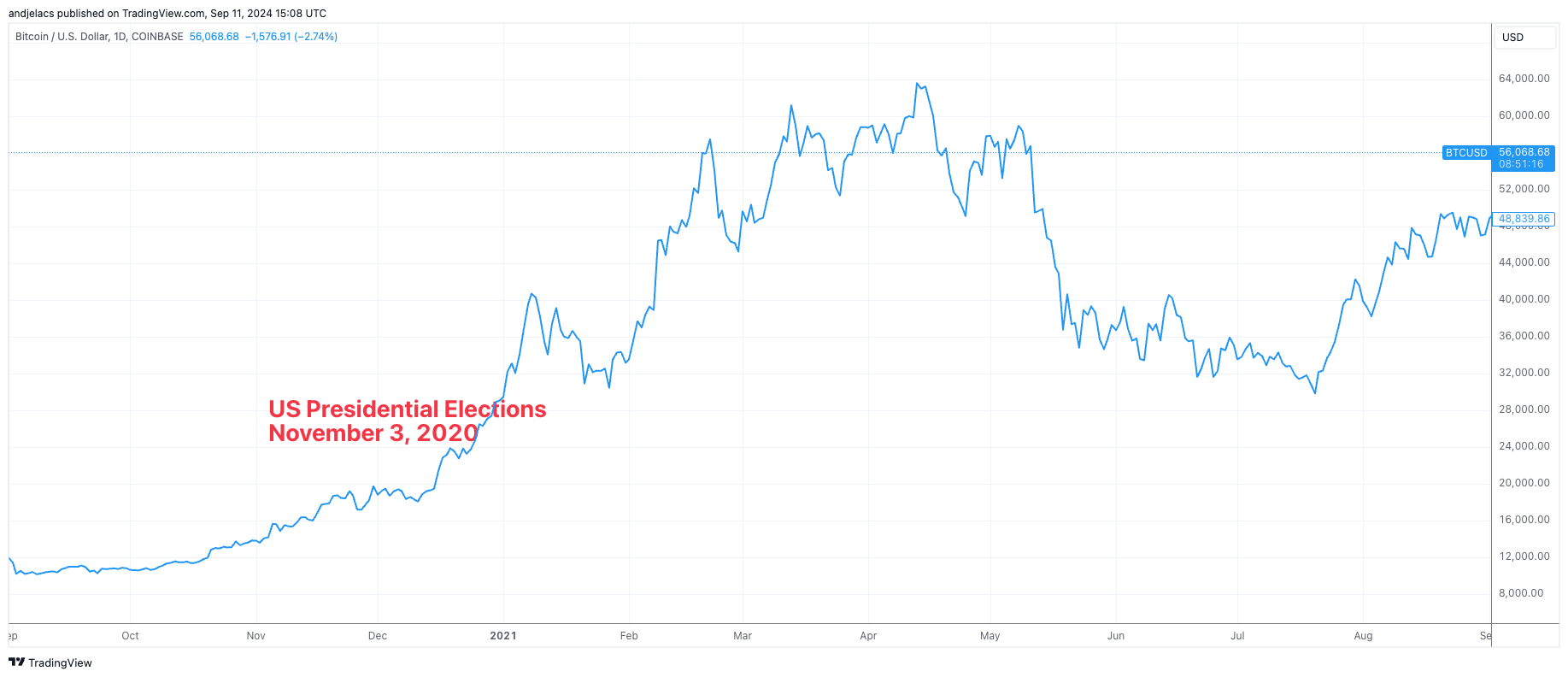

In the year following the 2020 election, which resulted in a Democratic victory for Joe Biden, Bitcoin experienced a bull rally that led to it reaching an all-time high of over $60,000 by April 2021.

These price movements have so far been independent of which political party claims victory, suggesting that the election event itself — rather than the winning party — is what influences BTC’s post-election performance.

The upcoming presidential elections in November could also trigger a rally similar to previous cycles, as major political events tend to create market uncertainty, which usually drives volatility in crypto markets.

However, it’s important to note that two election cycles aren’t enough data to predict the next one accurately. Given that the crypto market consisted solely of Bitcoin during the 2012 Presidential election and there was essentially no liquidity, it is hard to connect price movements between 2012 and 2013 to the presidential elections that took place during the period.

In 2024, Bitcoin has a market cap of $1.12 trillion, significantly higher than the $35 billion it had in 2020 and $3.6 billion in 2016. The size of Bitcoin-based assets, including derivatives and ETPs, has also ballooned since the last cycle, adding a significant layer of complexity and liquidity to the market.

The broader economic context will also play a role in this cycle — inflation, interest rates, and regulatory developments will all likely intersect with the election’s influence on Bitcoin’s price. Volatility is undoubtedly anticipated, but the scale of any price movements will depend on the market’s broader macroeconomic and liquidity conditions.

The post US elections led to Bitcoin rallies regardless of winning party appeared first on CryptoSlate.