The US House of Representatives has voted for a resolution to overturn the Securities and Exchange Commission (SEC)’s 2022 bulletin on crypto custodian accounting.

US President Joe Biden released a statement opposing the resolution and revealing a possible veto if the bill passes the Senate.

Democrats And Republicans Join Forces Against The SEC

On May 8, 21 Democrat House Representatives joined 207 Republican Representatives to vote in favor of H.J.Res.109 to nullify the Staff Accounting Bulletin (SAB) 121. The bulletin requires all custodians of cryptocurrencies and other digital assets to recognize these assets as a liability in their accounting books.

As reported by Bitcoinist, the rule has prevented US banks from holding Bitcoin and other cryptocurrencies as it made their crypto business “non-viable.” Republican Congressman Mike Flood argued that “the SEC’s accounting standards for firms that custody crypto are unfair and hinder banks looking to provide such services.”

House votes to overturn the #SEC crypto custody guidance.

228 – 182.

According to PANews, the US House of Representatives has voted in favor of a resolution aimed at overturning the Securities and Exchange Commission's (SEC) cryptocurrency custody accounting standards. The…

— CryptoSmind (@SmindCrypto) May 9, 2024

Wednesday’s vote was passed with 228 representatives in favor and 182 opposing it. The bill now awaits the Senate’s vote to be passed to the President’s desk. If approved, the resolution would allow financial institutions to hold Bitcoin and other cryptocurrencies under viable requirements.

Fox Business Journalist Elizabeth Terret asserted that the bipartisan decision saw a “larger number of supporting House Democrats than expected.” However, the journalist considers that the bill “likely won’t pass the Senate or the President’s desk.”

SAB 121 has been greatly criticized by important figures like Patrick McHenry, the Chairman of the Financial Services Committee.

On Wednesday, the Committee’s Chair called the bulletin “one of the most glaring examples of the regulatory overreach that has defined Gary Gensler’s tenure at the SEC.” During his speech on the House floor, Chair McHenry remarked his support for the resolution, stating:

This bipartisan resolution is an essential effort to protect consumers and foster innovation in digital asset markets. It’s also critical to stop the SEC’s regulatory power grabs and efforts to circumvent the Administrative Procedure Act.

Senator Cynthia Lummis has also expressed disagreement with the “unnecessary” SAB 121 rule on different occasions. On May 1, the pro-crypto senator criticized the US government’s “overreach” on the industry, revealing her concerns over the Department of Justice (DOJ) “hyper-aggressive” arguments against the sector.

President Biden In Favor Of SEC’s Crypto Crackdown

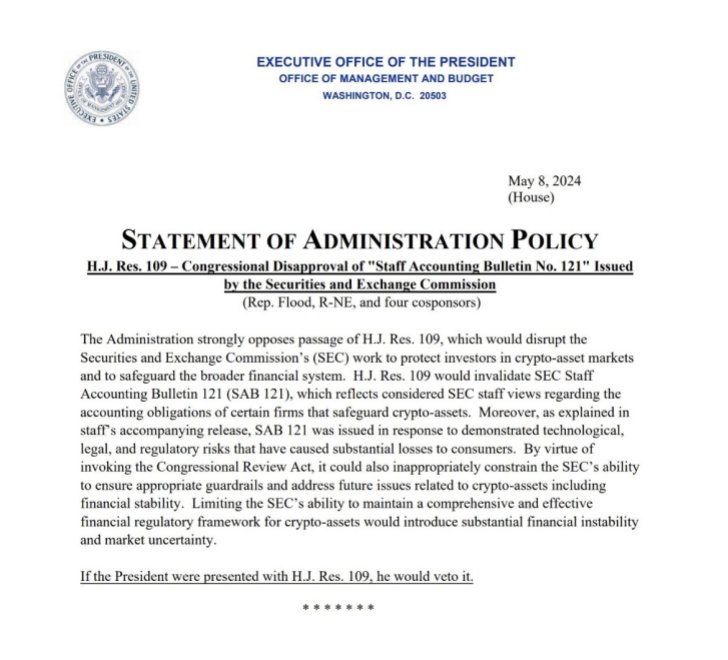

After the news of the favorable vote by the US House Representatives, the White House addressed the matter. According to the statement, Biden’s administration “strongly opposes” the resolution’s passage.

The president considers the bill “disruptive” against the SEC’s “work to protect investors in crypto-asset markets and to safeguard the broader financial system.”

Moreover, the statement claims that the SEC’s ability to ensure appropriate regulations in the future could be “constrained” by invoking the Congressional Review Act.

The White House considers that “limiting” the SEC’s ability to regulate digital assets “would introduce substantial financial instability and market uncertainty.” Ultimately, the statement affirms that President Biden would veto the resolution if passed by the Senate.