Bitcoin experienced significant volatility in the days leading up to President Donald Trump’s inauguration on Jan. 20. The market saw sharp price swings the week before, with heightened activity from US traders during the weekend. Political uncertainty surrounding the inauguration and the launch of $TRUMP and $MELANIA memecoins added to the turbulence, pushing Bitcoin’s price to a new ATH of $109,460 before retracting.

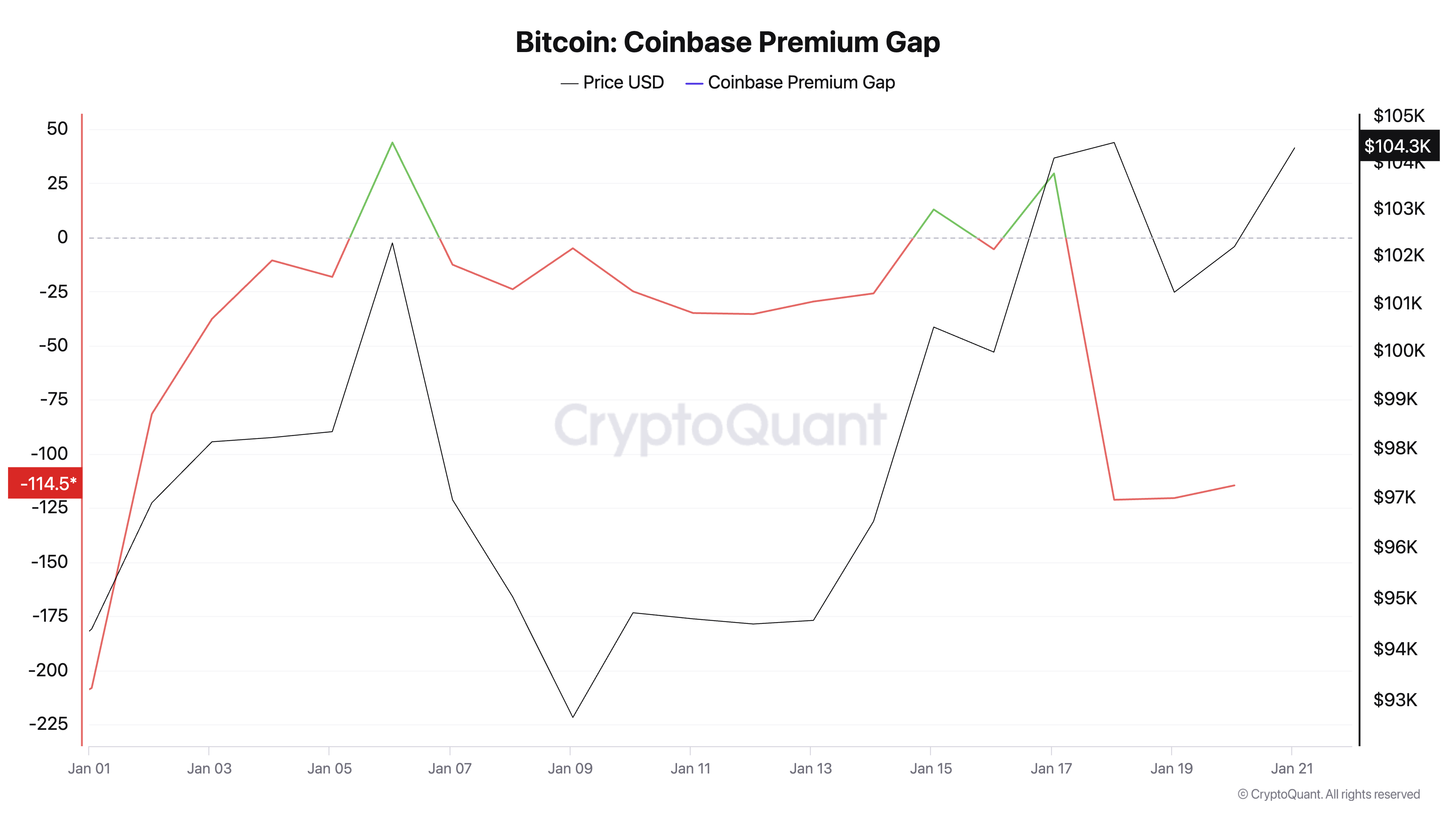

Data from CryptoQuant suggests that the US market was the main driver of this volatility. The Coinbase premium, which measures the price difference between Bitcoin on Coinbase and Binance, dropped noticeably in the days leading up to the inauguration.

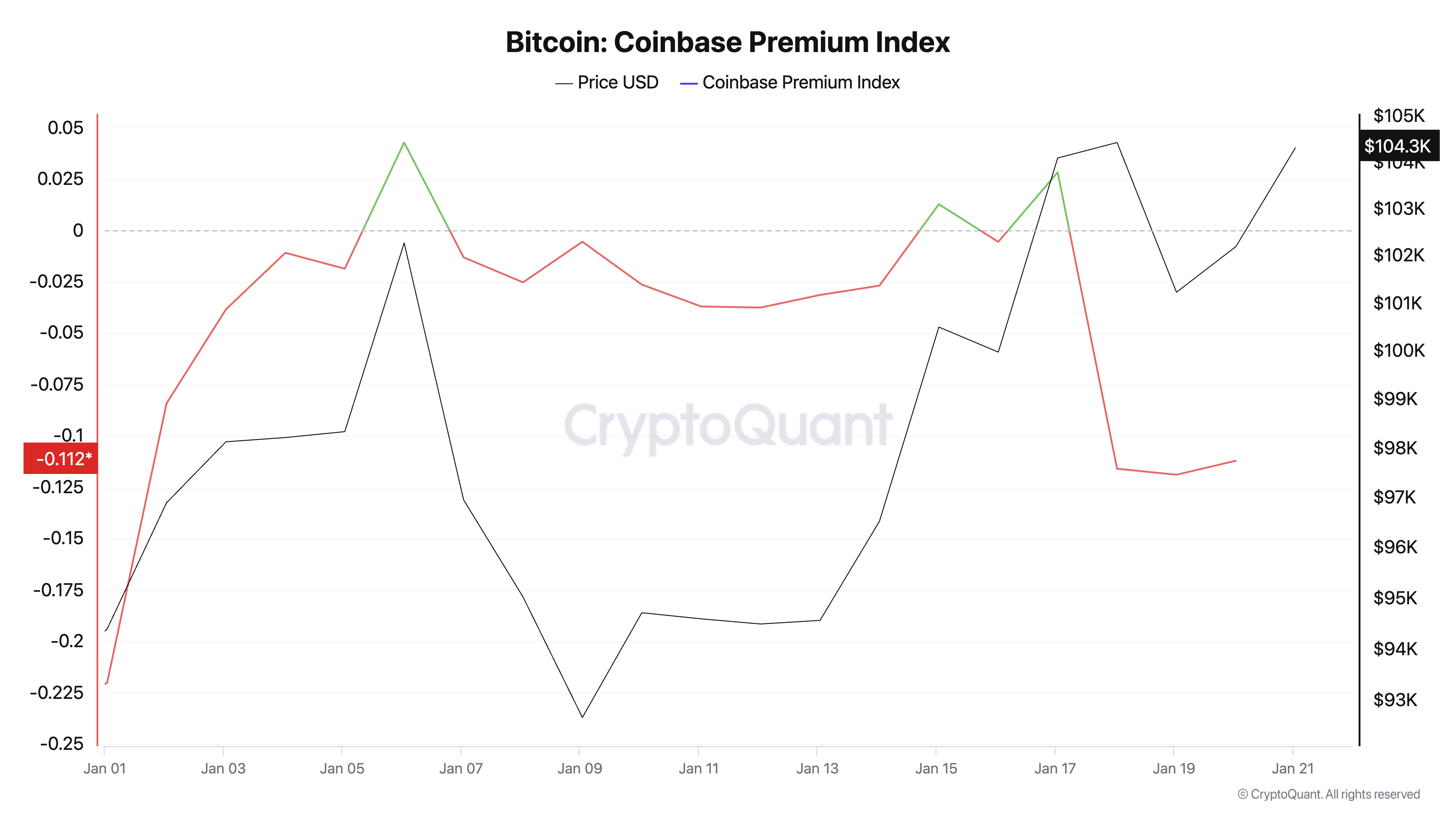

Its relative metric, the Coinbase premium index, also turned negative.

These declines indicate either a reduced demand or increased selling pressure from US investors. Historically, a positive Coinbase premium reflected strong institutional demand, making this dip a clear signal of uncertainty among US investors.

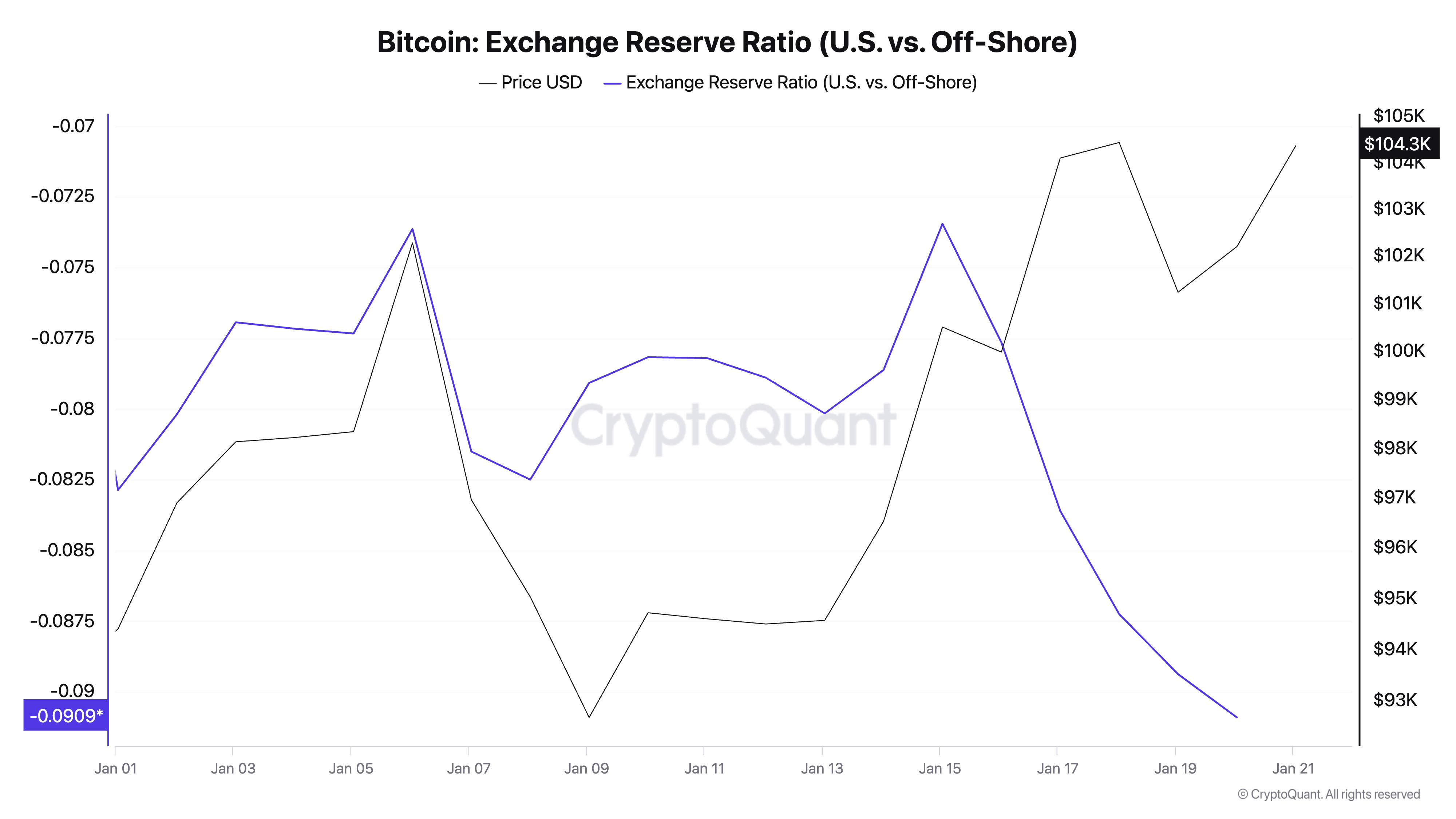

The increased selling from US investors can also be seen through the exchange reserve ratio, which tracks the relative reserves on US exchanges compared to offshore platforms. The exchange reserve ratio began trending downward on Jan. 15, showing that Bitcoin reserves on US-based exchanges declined faster than on offshore exchanges. Such movements typically indicate heightened withdrawals or reduced domestic liquidity, amplifying volatility from the US market.

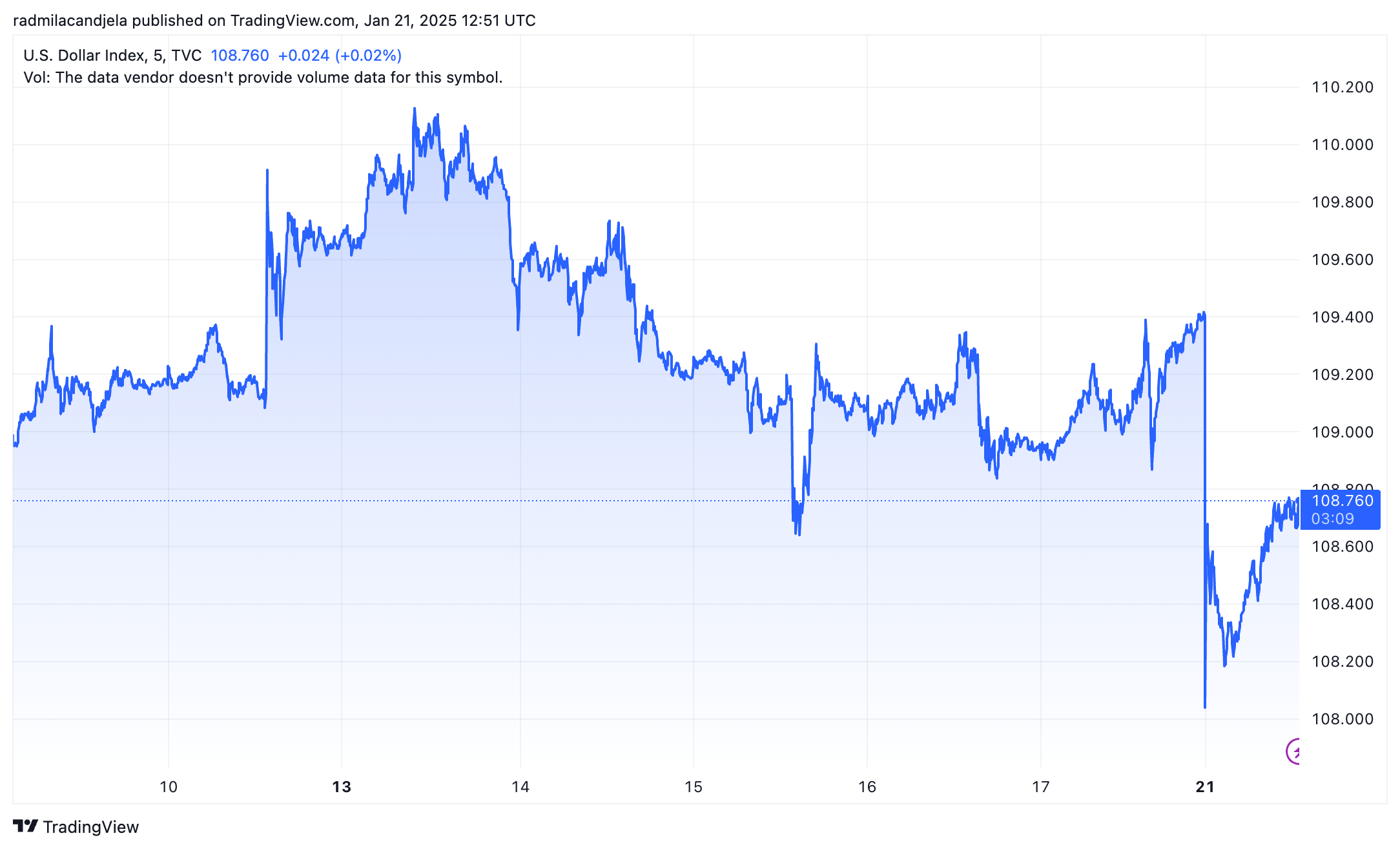

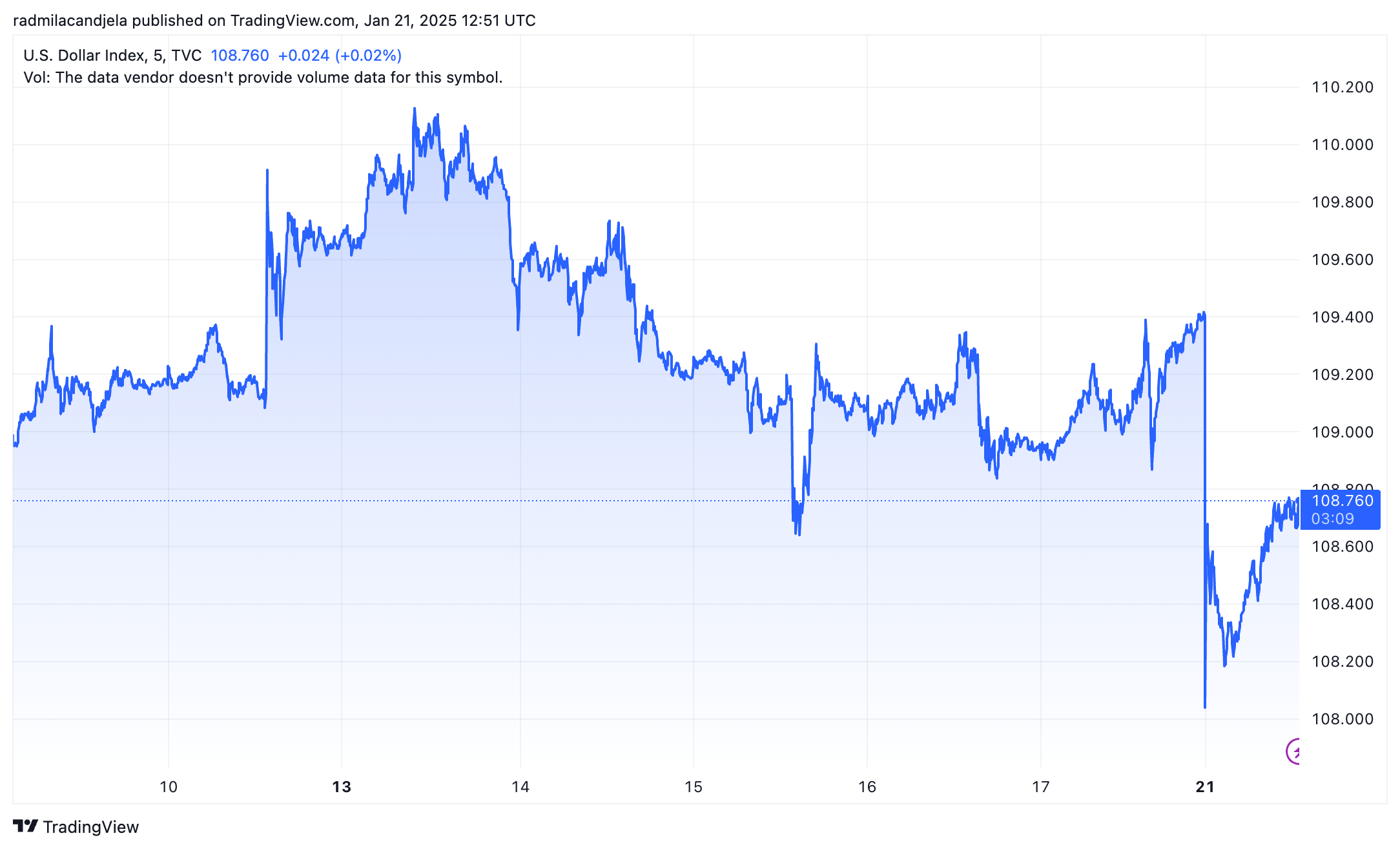

The US Dollar Index (DXY) also steeply declined over the same period, reflecting macroeconomic uncertainty tied to the political transition. Bitcoin’s inverse correlation with the dollar further supports the theory that US-based selling was driven by broader market risk aversion.

While the US market drove initial volatility, global markets stabilized Bitcoin’s price. Offshore exchanges showed relative strength, with reserves increasing as US reserves fell. This indicates that global participants, particularly outside the US, accumulated Bitcoin during the selloff. This absorption of selling pressure helped prevent a deeper price drop.

The slight recovery in the Coinbase premium after Jan. 19 shows that global demand persisted. As US selling subsided, offshore liquidity likely supported Bitcoin’s price, demonstrating the global market’s ability to counterbalance localized volatility. This also shows the US market’s outsized influence on Bitcoin’s price. Political and macroeconomic events in the US have always been one of the main drivers of sentiment, mainly as US exchanges like Coinbase cater to a significant number of institutional and high-profile investors.

The data confirms that US investors were the primary drivers of Bitcoin’s weekend volatility leading up to the inauguration, as evidenced by declining Coinbase Premiums, a sharp drop in the US to offshore reserve ratio, and DXY’s weakening. However, global markets—particularly offshore platforms—stabilized Bitcoin’s price. This reinforces Bitcoin’s position as a resilient, globally traded asset capable of weathering localized shocks while maintaining long-term stability.

The post US market drove Bitcoin’s volatility ahead of Trump’s inauguration appeared first on CryptoSlate.