The United States Trustee in the Celsius bankruptcy case has raised objections against claims made by several parties asserting their “substantial contributions” to the bankruptcy proceedings of Celsius Network and its affiliates.

Celsius Network’s bankruptcy journey began in July 2022, when it filed for Chapter 11 protection, a move later followed by its affiliates. A key development was the substantive consolidation of the estates of Celsius Network Limited and Celsius Network LLC. This consolidation simplifies the proceedings by treating the separate legal entities as one for the bankruptcy case.

According to the Trustee, the claims made by eleven applicants for administrative expense status, based on their alleged substantial contributions to the case, lack merit. These claims, primarily related to professional fees and expenses, are considered self-serving and not in the broader interest of the creditor body.

These applicants, comprised of five ad hoc groups and six individual parties, collectively claim that their actions have substantially contributed to the bankruptcy proceedings, justifying their claim to approximately $5 million in expenses, including professional fees.

The United States Trustee, however, has taken a firm stand against these claims. The Trustee argues that the actions of these applicants were primarily in self-interest and did not result in any significant benefit to the broader creditor group. This objection is grounded in the assertion that many, if not all, services claimed by these applicants as substantial contributions were either duplicative of efforts made by the Official Committee of Unsecured Creditors or were actions that the Debtors were already undertaking.

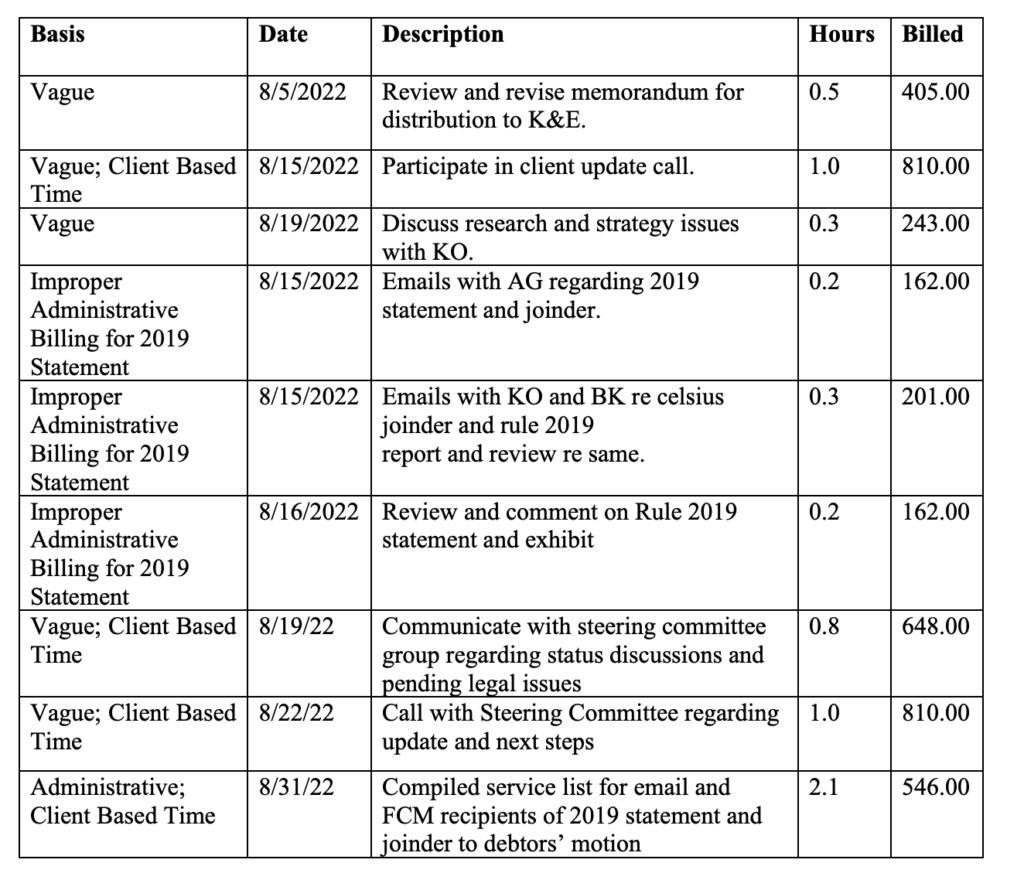

Breakdown of applicants’ claims contested by US Trustee.

Applicants’ claims included expenses for Amtrak rides, Ubers, meals, and hotels, one of which totaled $2,108.49, which the Trustee argues lacked clear justification for reimbursement under the substantial contribution clause. The Trustee pointed out that the Earn Ad Hoc Application, to which the claimant contributed, did not establish the necessity or the nature of the contributions to the mediation or the bankruptcy case.

Another claimant’s requests included up to $1,000 for future expenses, totaling $2,000 in estate resources for “unknown” and unsubstantiated future expenses without further court review or order. The objection noted that Section 503(b) does not permit prospective relief, and charges like expenses for pharmacy items (deodorant, breath mints) and Uber rides to court were considered non-compensable.

Further applications sought an award of expenses totaling approximately $437,065.38 for dates beginning prepetition through filing the applications. They also sought separate reimbursement through the Earn Ad Hoc Application. The objection stated they were also not entitled to Section 503(b) expenses.

Furthermore, the Ad Hoc Applications alone seek fees of approximately $2.35 million and costs of about $18,581. The Trustee emphasized that the actions and positions taken by these Ad Hoc Groups were not only duplicative and unnecessary but also failed to bring any demonstrable benefit to the Debtors’ estate and creditors.

BNK To The Future sought reimbursement for reasonable and documented out-of-pocket fees and expenses as part of their agreement with the Debtors and the Committee. The request was to pay legal costs and expenses related to the negotiation and execution of an agreement, with any payment subject to Bankruptcy Court approval.

A member of the group allegedly also sought an additional $50,000 in fees and expenses through the effective date without further court order or review of fee details. The objection noted a lack of supporting case law or basis for this request, asserting that Section 503(b)(4) does not permit prospective relief.

The filing lists additional requests from applicants to bring the total to the $5 million stated. Examples of some of the claims under question are shown in the image below:

These objections by the United States Trustee bring to the fore the intricate balancing act in bankruptcy proceedings between acknowledging individual efforts and ensuring that such recognitions are in the collective interest of all creditors.

CryptoSlate has contacted some applicants for comment but has not received a response as of press time.

The post US Trustee challenges $5 million claims by parties in Celsius bankruptcy case appeared first on CryptoSlate.