Quick Take

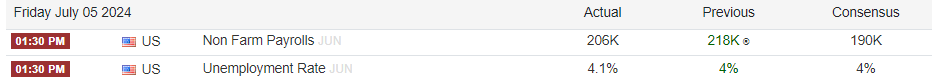

The US unemployment rate has edged up to 4.1%, slightly higher than the consensus of 4.0%. This marks the highest unemployment rate since November 2021, though the labor market remains tight by historical standards.

Nonfarm payrolls, however, showed a positive trend, increasing by 206,000, surpassing the expected 190,000. This mixed economic data has influenced financial markets. The DXY (US Dollar Index) has dipped below 105, reflecting a softer dollar. Meanwhile, the US 10-year Treasury note yield has decreased to 4.3%.

Bitcoin remains hovering around the $55,000 mark in the digital assets market.

The post US unemployment rate rises to 4.1%, highest since November 2021 appeared first on CryptoSlate.