The seemingly unshakeable reign of Tether (USDT) as the king of stablecoins faces a new challenger. Circle’s USD Coin (USDC) has pulled off a surprise victory, recording a higher transaction volume than Tether in April 2024, according to on-chain analytics from payments giant Visa.

This development marks a significant shift in the stablecoin landscape. While Tether boasts a staggering market capitalization of over $110 billion, USDC, with its $33 billion valuation, has emerged as the more actively traded coin.

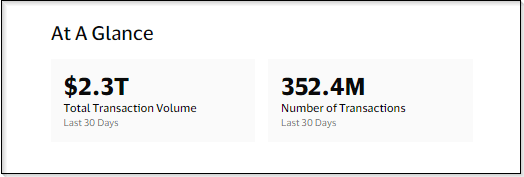

Visa’s data reveals USDC processed a whopping $456 billion – which is 400% more – in transaction volume last week, compared to Tether’s $89 billion.

USDC: A Slow And Steady Climb

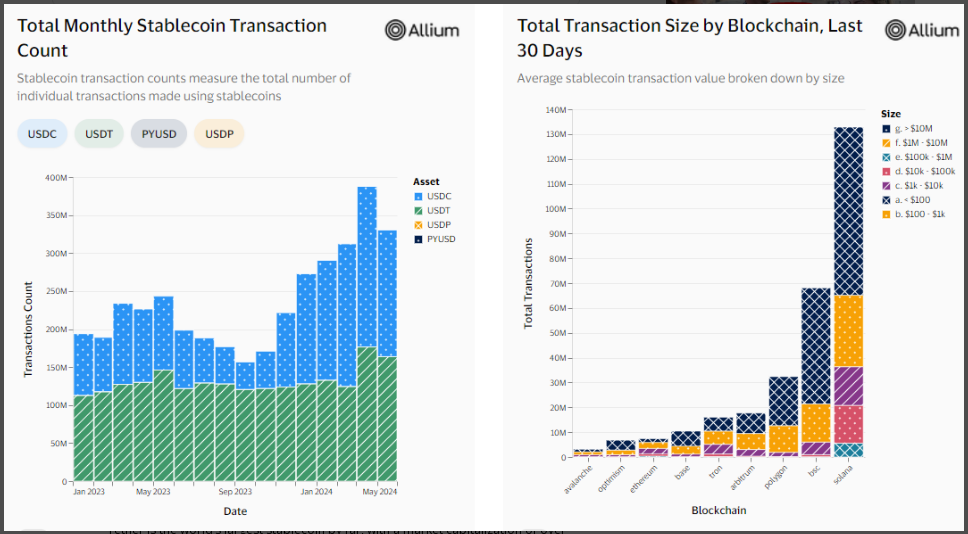

This victory wasn’t a sudden overnight success. USDC has been steadily chipping away at Tether’s dominance since late 2023. Visa’s data shows USDC’s monthly transactions surpassed Tether’s for the first time in December 2023, with 145 million transactions compared to Tether’s 127 million. The April figures solidify this trend, with USDC clocking in at over 166 million transactions against Tether’s nearly 164 million.

Experts point to several factors behind USDC’s rise. Increased regulatory scrutiny surrounding Tether’s reserves and ongoing concerns about its transparency may be driving users towards USDC, perceived as a more regulated and auditable stablecoin.

Additionally, USDC’s partnership with Visa itself could be playing a role. Visa launched a stablecoin analytics dashboard in April, prominently featuring USDC alongside other major stablecoins. This increased visibility might be attracting new users to the platform.

Tether Still Holds The Crown (For Now)

Despite USDC’s impressive transaction volume surge, Tether remains the undisputed king in terms of market capitalization. Its $110 billion dwarfs USDC’s $33 billion, indicating a much larger total value of outstanding coins. This suggests Tether is still the preferred store of value for many crypto investors, even if they aren’t actively trading it as frequently.

Furthermore, Tether boasts a significantly larger user base. While USDC processed more transactions in April, Tether saw activity from over 34 million unique wallets compared to USDC’s 9.57 million. This could imply Tether is used for larger transactions or by a wider range of individuals, while USDC caters to a more active trading community.

The Future Of Stablecoins: A Two-Horse Race?

The battle between USDC and Tether is far from over. USDC’s recent success in transaction volume demonstrates its growing influence within the crypto ecosystem. However, Tether’s established user base and market cap dominance suggest it won’t be easily dethroned.

The evolving regulatory landscape and user preferences for transparency and security will likely be key factors shaping the future of stablecoins. Whether USDC can maintain its momentum and challenge Tether’s market cap advantage, or if Tether can regain its transaction volume lead, remains to be seen.

Featured image from Tap Global, chart from TradingView