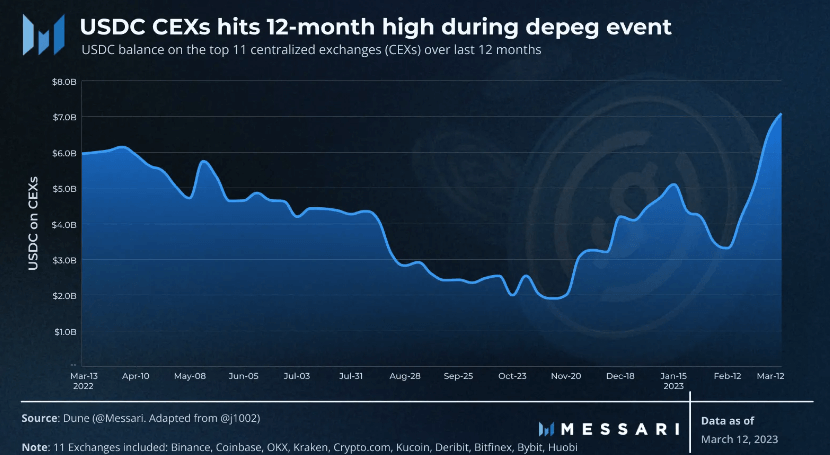

USDC available on centralized exchanges has hit a 12-month high despite the recent calamity surrounding the depeg event.

Coinbase was forced to temporarily halt USDC to USD conversions due to the deviation of USDC’s value from its pegged price of $1.00.

As USDC demand plummeted, its value dropped by a significant 13% on March 11, hitting a low of $0.87 before rebounding to $0.95-0.97 after Circle provided assurances that redemption operations would normalize by March 13.

However, it was not until the U.S. government made a public statement confirming that all SVB depositors would be reimbursed that the price of USDC finally experienced a full recovery, climbing up to $0.99. This development has alleviated concerns among investors who were previously apprehensive about the stability of USDC’s peg and provided renewed confidence in the digital asset’s prospects.

Volatility in the Curve 3pool

DeFi exacerbated the volatility caused by the depeg event, which was triggered by concerns about the backing of USDC. The Curve 3pool, one of the largest USDC DEX pools, assumes that all three stablecoins within it should be worth $1.00 when one deviates from this peg. The concentrated liquidity mechanism and incentives lead to further price declines.

DAI also depegs

Elsewhere in DeFi, USDC was so trusted that protocols hardcoded $1.00 assumptions, such as Maker’s peg stability module (PSM), which supports the DAI peg. However, this led to Maker and DAI absorbing significant risk and volatility as arbitrageurs took advantage of price discrepancies, resulting in over $2 billion of USDC being offloaded to the PSM and more than doubling the USDC held by Maker.

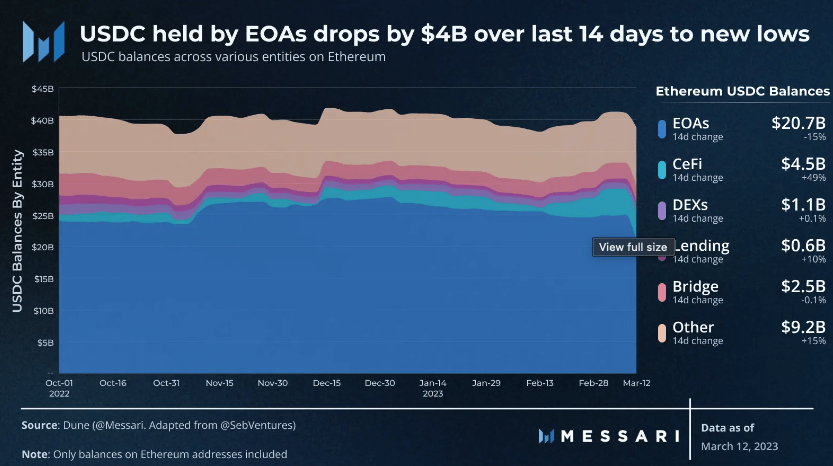

Stablecoin supply

Ethereum, the leading ecosystem for USDC, has a commanding hold on the stablecoin with a $38 billion share of its $40 billion supply. However, following the recent USDC depeg event, Ethereum’s externally owned addresses (EOAs) have been divesting in droves, shedding over $4 billion of USDC and causing a new 12-month low balance held by EOAs.

The post USDC CEXs hits 12 month high following USDC depeg event: Messari appeared first on CryptoSlate.