In a rapid turn of events, Tether’s stablecoin dominance has surged to its highest point in a year and a half, a feat crypto watchers attribute to difficulties surrounding rival stablecoins USDC and BUSD.

Tether USDT now stands at its highest dominance over the stablecoin sector in 18 months.

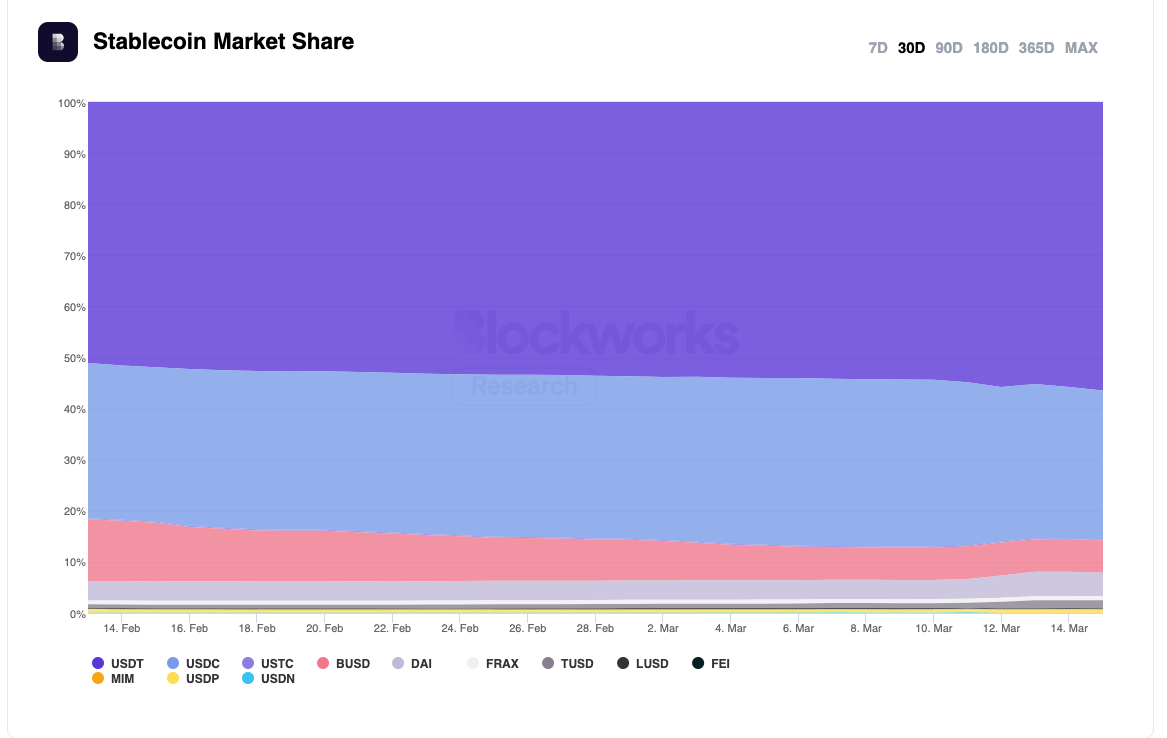

According to Blockworks’ data analysis of stablecoin supply composition, USDT’s assets total market share has risen to its highest point since at least July 12, 2021, currently sitting at 56.4%, after increasing by 5.4% in the past 30 days.

The surge in market share comes after a busy weekend in the world of stablecoins, with two of the industry’s other top five tokens — USDC and DAI — both losing considerable ground after briefly losing their $1.00 peg.

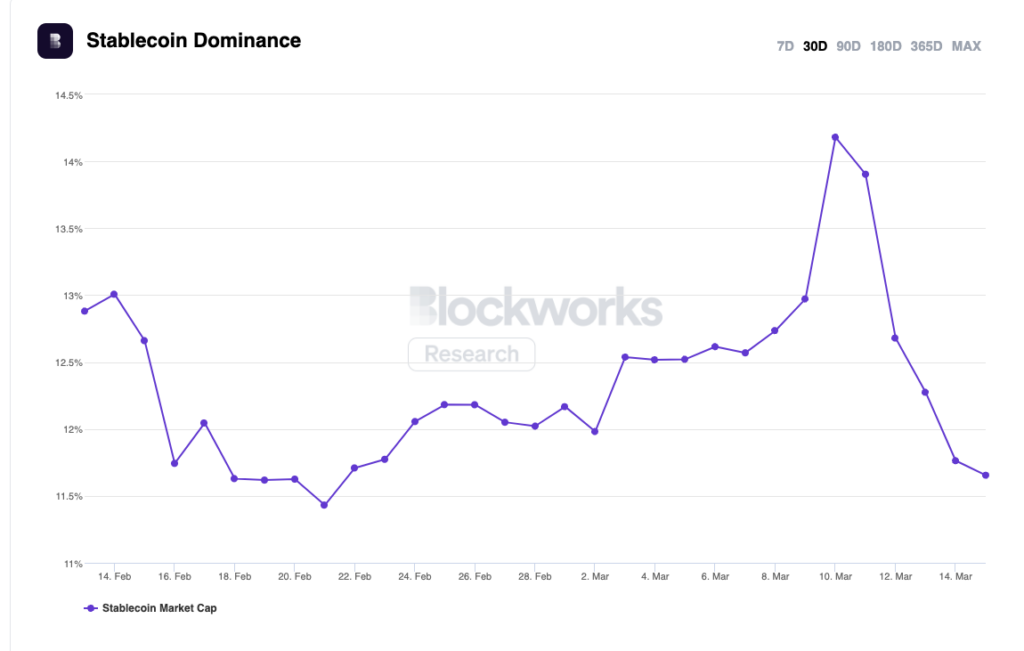

On-chain analysis of aftershocks from the SVB bank run that began on March 8 shows that stablecoin volume surged as investors moved in and out of USDC. A wallet belonging to long-time crypto entrepreneur Justin Sun was found to have made $3.3 million, flipping USDT into USDC.

Stablecoin marketshare

As the market leader, Tether seems to be weathering the storm of the broader economic downturn stemming from the collapse of three U.S. banks, which led to the brief depegging of another stablecoin, USDC, on March 1.

Read more: USDC depeg – Everything we know so far as contagion spreads from TradFi banking

Despite facing scrutiny over the validity, quality, and certainty of its reserves, USDT holds the position of the world’s third-largest digital asset, with a total market capitalization of approximately $73 billion, trailing only bitcoin (BTC) and ether (ETH). Tether, USDT’s issuer, maintains that its assets surpass its liabilities, as reported in the latest quarterly assurance report.

Meanwhile, USDT’s closest rivals, USDC and BUSD, have encountered significant challenges in recent weeks. Circle, USDC’s issuer, disclosed that roughly 8% of its stablecoin reserves, approximately $3.3 billion, were held by troubled Silicon Valley Bank, which caused instability in USDC over the weekend.

Stablecoin dominance

This news may have spooked a small portion of institutional investors, leading them to diversify their funds into other stablecoins or fiat USD, according to Danny Chong, co-founder of DeFi platform Tranchess. US officials quickly intervened to protect depositors of SVB and grant them access to their money, but the severe market reaction caused USDC’s value to drop to a low of $0.8726 on March 11 before recovering to $0.99 two days later.

In contrast, Binance’s stablecoin, BUSD, has faced regulatory actions in the US, causing market participants to seek out alternative fiat-backed options and boosting USDT’s demand. After the New York Department of Financial Services instructed Paxos to halt producing new BUSD last month and the SEC issued a Wells Notice, BUSD’s market cap has shown observable signs of decline.

The post USDT climbs to highest market share since July 2021 amid stablecoin chaos appeared first on CryptoSlate.