Quick Take

At the end of 2023, VanEck made 15 ambitious predictions for the digital assets market in 2024. Here’s a look at how some of these predictions have fared so far.

1. The US Recession and the First Spot Bitcoin ETPs

Prediction: The US would enter a recession in the first half of 2024, and the first spot Bitcoin ETPs would launch with significant inflows, keeping Bitcoin above $30,000.

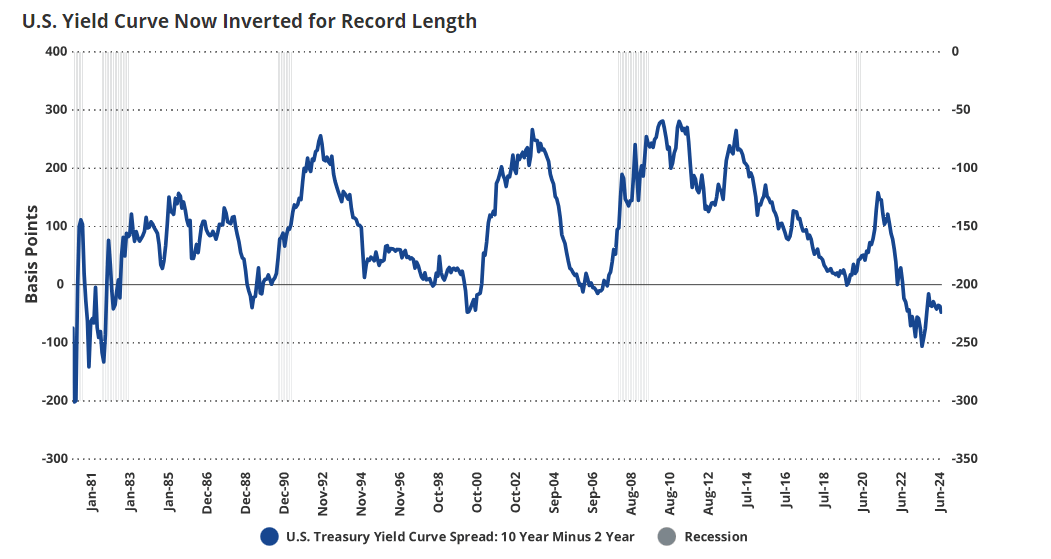

While the US recession has yet to materialize, the inverted yield curve, the longest bond market inversion in history, remains a strong recessionary signal, according to VanEck.

Meanwhile, Bitcoin ETFs have shattered records, with $14.5 billion in inflows keeping Bitcoin’s price above $30,000. Bitcoin has mostly traded above $60,000 since March, with few exceptions.

2. Bitcoin Halving

Prediction: The Bitcoin halving in April 2024 would proceed without major issues, with Bitcoin trading above $48,000 after the event.

Another accurate prediction was the smooth Bitcoin halving in April 2024. Post-halving, Bitcoin has not fallen below $55,000. The event also marked the launch of Runes, which set new records for BTC fees and initiated the current miner capitulation phase.

3. Bitcoin’s All-Time High in Q4

Prediction: Bitcoin will reach an all-time high in Q4 2024, driven by political changes and regulatory optimism.

VanEck also foresaw Bitcoin reaching an all-time high in Q4 2024, driven by political changes and regulatory optimism. Although BTC hit its peak earlier, in March, the forecast was directionally accurate.

4. Ethereum Won’t Flip Bitcoin in 2024

Prediction: Ethereum would not surpass Bitcoin in market cap but outperform mega-cap tech stocks.

Additionally, VanEck correctly predicted that Ethereum would not surpass Bitcoin in market cap but would outperform major tech stocks, which has been the case. One of the tech companies not included was NVIDIA, which is up 155% year-to-date (YTD) and 190% over the past 12 months. At one point, NVIDIA even became the largest company in the world.

Overall, VanEck’s predictions scored an impressive 95 out of 150 possible points, demonstrating the firm’s deep insight into the rapidly changing crypto market.

The post VanEck’s 2024 Bitcoin outlook impresses with accurate forecasts appeared first on CryptoSlate.