The bullish momentum of the Bitcoin price has dwindled over the past few weeks, putting the progression of the crypto bull cycle into question. On Friday, April 12, the crypto market witnessed a flash crash, causing the premier cryptocurrency’s value to drop from $70,000 to below $67,000.

This latest downturn underscores the struggle of the Bitcoin price to return to its recent all-time high of $73,737, which was forged in mid-March. On-chain analytics platform Santiment has identified a particular Bitcoin metric that may signal the resumption of the bull run.

Bitcoin Bull Run May Resume If This Metric Falls

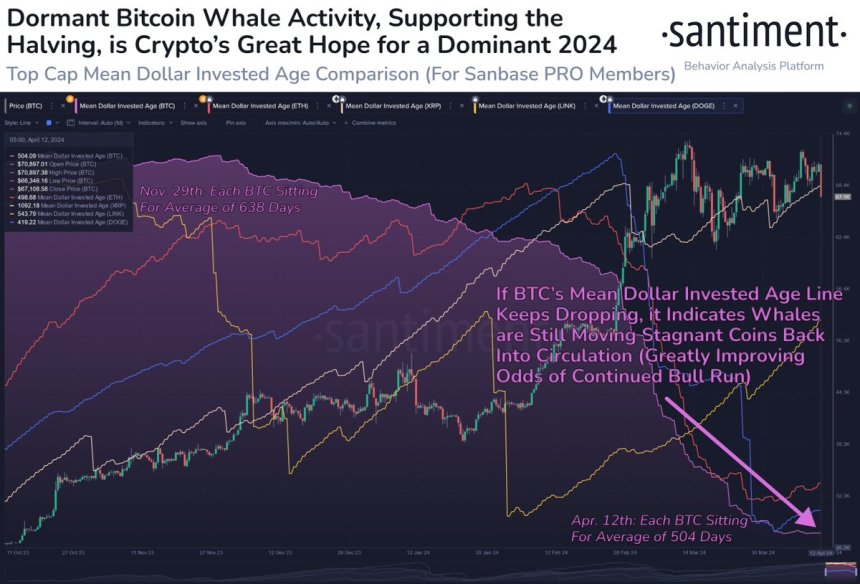

In a recent post on X, blockchain intelligence firm Santiment provided an exciting insight into the current cycle and the price performance of Bitcoin. The firm pinpointed the Mean Dollar Invested Age metric as one of the indicators to watch as the market leader moves sideways.

According to Santiment, the Mean Dollar Invested Age metric tracks the average age of investment in an asset that has sat in the same wallet. When this indicator is rising, it means that investments are getting more stagnant and old coins are being held in the same wallets.

Conversely, a decreasing Mean Dollar Invested Age metric implies that investments are flowing back into regular circulation. This “falling line” also suggests an increase in network activity.

From a historical perspective, Bitcoin exhibited a falling Mean Dollar Invested Age line during the previous bull cycles. According to Santiment, this has been the case for the premier cryptocurrency in the current bull run, which kicked off in late October 2023.

The on-chain analytics platform, however, noted that Bitcoin’s Mean Dollar Invested Age line has been moving sideways over the past couple of weeks. This phenomenon is even more shocking, considering that the highly-anticipated halving event is about a week away.

The Bitcoin halving will see the miners’ reward slashed in half (from 6.25 BTC to 3.125 BTC). It is a bullish event that has contributed to the optimistic outlook – borne by most investors – for the premier cryptocurrency in 2024.

From Santiment’s latest report, investors might want to keep their eyes peeled for the Bitcoin Mean Dollar Invested Age metric. And the bull run is likely to continue if the BTC’s Mean Dollar Invested Age line resumes its fall, which would imply that major stakeholders (like whales) are back to moving coins into regular circulation.

BTC Price At A Glance

As of this writing, Bitcoin is trading around $66,548, reflecting a notable 6% price decline in the past 24 hours.