The post Whale Buys $2.55 Million of Chainlink, What’s Next? appeared first on Coinpedia Fintech News

Amid ongoing bearish market sentiment, a whale seized the opportunity in Chainlink (LINK) and made a notable purchase. On October 23, 2024, the blockchain-based transaction tracker Lookonchain made a post on X (previously Twitter) that a crypto whale wallet address “0x9cE” had purchased a significant 222,677 LINK tokens worth $2.55 million.

Whale Adds $2.5 Million of LINK

Lookonchain further noted that the average purchase price of this significant LINK acquisition is $11.5. This notable purchase amid bearish market sentiment has attracted considerable attention from crypto enthusiasts and suggests a potential buying opportunity.

In addition to this significant purchase, the on-chain analytics firm IntoTheBlock recently posted on X that LINK has experienced consistent negative exchange netflow over the past 30 days. This negative netflow suggests accumulation, as investors move their assets from exchanges to cold or private wallets.

Chainlink (LINK) Technical Analysis and Upcoming Levels

According to expert technical analysis, LINK appears bearish as it is at a crucial support level of $11.30. If the asset breaches this level and closes a daily candle below it, there is a strong possibility it could drop to the $10.5 level in the coming days.

Currently, LINK is trading below the 200-day Exponential Moving Average (EMA) on the daily time frame, indicating a downtrend. Traders and investors commonly use the 200 EMA to determine whether an asset is in an uptrend or downtrend.

Bearish On-Chain Metrics

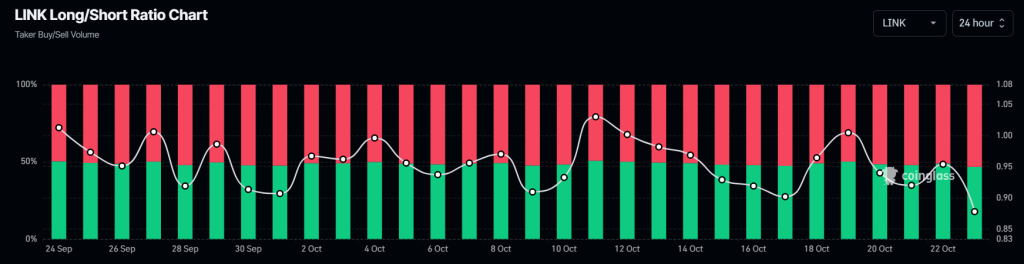

LINK’s negative outlook is further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, LINK’s Long/Short ratio currently stands at 0.87, indicating a strong bearish market sentiment among traders. Additionally, its open interest declined by 10% in the past 24 hours and 5.3% in the past four hours.

This declining open interest suggests that traders’ positions are potentially being liquidated due to the ongoing price decline.

Current Price Momentum

At press time, LINK is trading near $11.26 and has experienced a price decline of over 8.3% in the past 24 hours. During the same period, its trading volume dropped by 30%, indicating decreased participation from traders and investors compared to the previous days.

(@EyeOnChain)

(@EyeOnChain)