On-chain data suggests the whale entities have bought up around 5% of the supply of the major stablecoins over the past three weeks.

Whales Have Been Gobbling Up Stablecoin Supply Recently

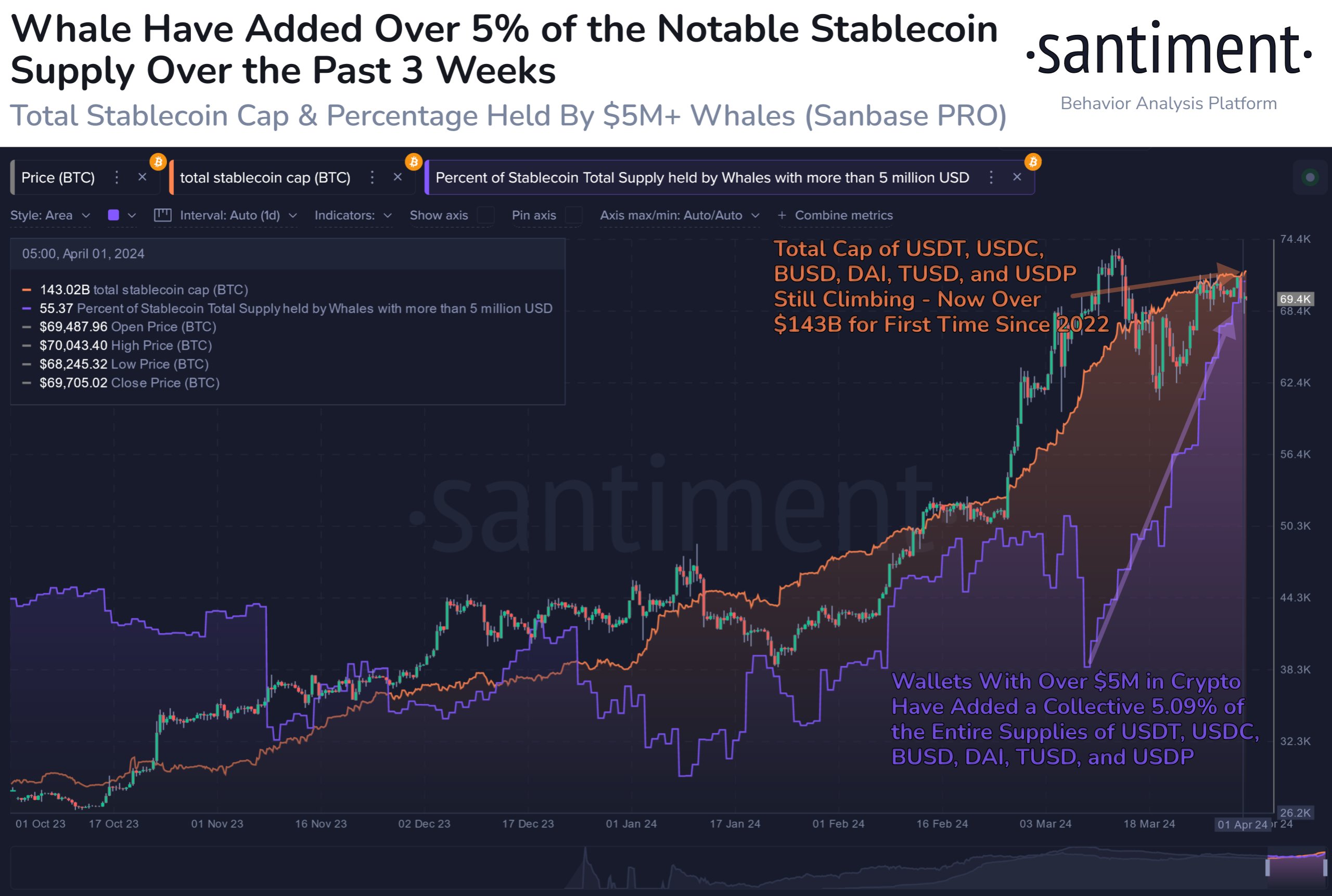

According to data from the on-chain analytics firm Santiment, whales have been rapidly accumulating the stablecoin supply recently. Whales here refer to investors holding at least $5 million in cryptocurrencies.

The chart below shows the trend in the supply of the major stablecoins held by these large holders over the past few months.

The “major” stablecoins here include Tether (USDT), USD Coin (USDC), BUSD (BUSD), Dai (DAI), TrueUSD (TUSD), and Pax Dollar (USDP). The chart shows that the percentage of the supply of these stables held by the whale entities has shot up recently.

This would suggest that these large holders have accumulated more of these fiat-tied tokens. In the same chart, Santiment has also attached the data for the total stablecoin market cap, and it appears that this metric has also been rising in the same period.

However, the growth in the whale holdings has been notably sharper, implying that the newly minted tokens of these assets wouldn’t be the only source behind the accumulation.

In total, the whales have added more than 5% of the combined supply of these major stablecoins to their wallets over the past three weeks, which is impressive.

What does this accumulation from the whales mean for the wider cryptocurrency sector? There are generally two reasons why the whales’ holdings might grow.

First, there could be some fresh big money coming into the market that is choosing to enter through stablecoins. Second, whales are selling coins from the volatile side of the sector (like Bitcoin) to seek safety in these dollar-pegged coins.

The former is always bullish for the sector, suggesting the inflow of new capital. The latter, though, can be bearish initially. Usually, however, investors who choose to invest in stablecoins do so because they eventually plan to enter (or re-enter) the volatile side.

Thus, the supply of stablecoins, especially that held by the whales, may be seen as capital sitting on the sidelines, waiting to be deployed. As such, the sharp increase in whale holdings recently would imply that there could be a large amount of potential dry powder amassed for Bitcoin and others currently.

In reply to a user under this X post, Santiment has also noted that the Bitcoin accumulation from the whales has been quite strong recently. This implies that a bullish combination has been developing since the stablecoin rise wasn’t simply due to the whales reshuffling capital from BTC to stables but from actual capital inflows.

BTC Price

Bitcoin has registered a sharp plunge over the past day, taking its price to the $65,200 level.