The post Whales Dump 330 Million Cardano (ADA), What’s Next? appeared first on Coinpedia Fintech News

During the recent sharp market decline, where whales focused on accumulating assets, Cardano (ADA) remained untouched. Today, February 4, 2024, a prominent crypto expert posted on X (formerly Twitter) that whales have not purchased ADA during the dip. Instead, they have dumped millions of ADA tokens onto exchanges.

330 Million ADA Dumps on Exchanges

However, the post stated that whales dumped 330 million ADA tokens during the recent price dip. This substantial sell-off could have triggered significant selling pressure and further price decline, but ADA remained unaffected.

CoinMarketCap data shows that despite these substantial sell-offs, ADA has experienced a massive price reversal of over 62% in the past two days, surpassing the crucial support level of $0.71.

ADA is currently trading near $0.77, having surged over 7.10% in the past 24 hours. Meanwhile, its trading volume has dropped by 55%, indicating lower participation from traders and investors compared to the previous day.

Cardano (ADA) Technical Analysis and Upcoming Levels

However, the current level serves as strong support, which could determine whether ADA will rally or face another price drop. According to expert technical analysis, in addition to the strong horizontal support, ADA is also gaining support from the 200 Exponential Moving Average (EMA) on the daily timeframe, indicating an uptrend.

Based on recent price action and historical momentum, if ADA holds this support, there is a strong possibility it could soar by 50% to reach the $1.12 level in the future. However, it may face mild resistance near the $0.83 level.

Traders’ Strong Long Bets

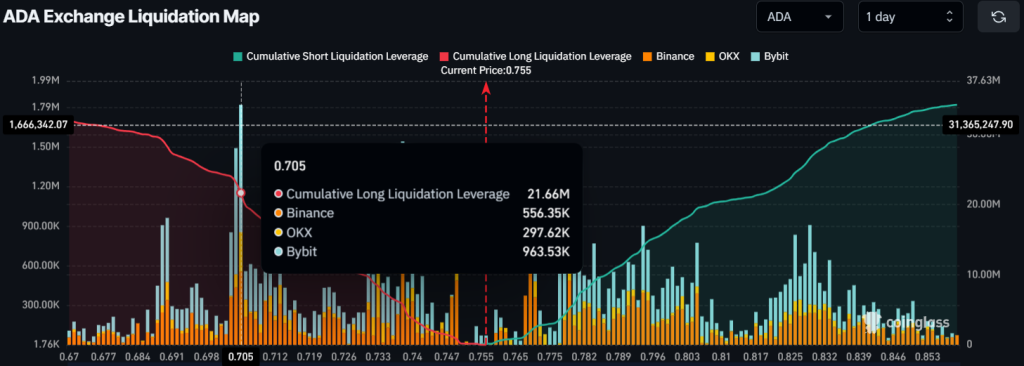

Despite ADA’s positive outlook, intraday traders remain optimistic, with many strongly betting on the long side. Currently, the major liquidation areas are $0.738 and $0.703, where bulls are over-leveraged, holding $21.66 million worth of long positions. Conversely, $0.781 is a key level where short sellers are over-leveraged, holding $7.25 million worth of short positions.

When combining experts’ posts, recent price action, and on-chain metrics, it appears that bulls are present in the market and could support the asset’s future gains.