The post Whales Invest $20M in Chainlink (LINK) Following Trump’s Inauguration appeared first on Coinpedia Fintech News

LINK, the native token of Chainlink, is gaining significant attention from crypto enthusiasts following Donald Trump’s recent $4.7 million investment. This substantial investment has attracted large-scale investors who have also invested in LINK tokens.

Crypto Whales Buy 770K LINK

Today, January 21, 2024, a prominent crypto expert shared a post on X (formerly Twitter) stating that investors have accumulated a significant 770,000 LINK, worth $19.48 million, in the past 24 hours. However, this substantial accumulation did not have any impact on the LINK price.

At press time, LINK is trading near $25.70 and has experienced a price decline of 2.50% in the past 24 hours. During the same period, its intraday trading volume dropped by 44%, indicating lower participation from traders, potentially due to profit booking as the market reacted ahead of Trump’s inauguration.

Chainlink (LINK) Technical Analysis and Upcoming Levels

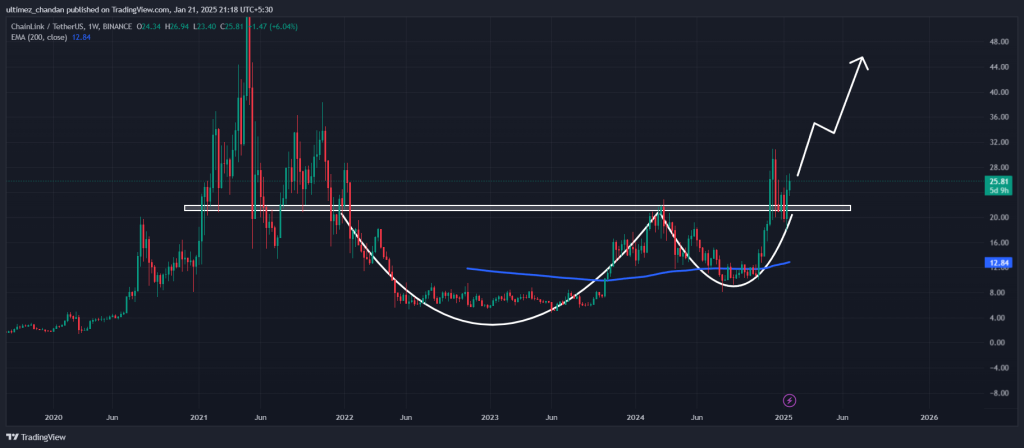

According to expert technical analysis, LINK appears bullish as it has successfully retested the bullish Cup and Handle price action pattern on the weekly timeframe and is poised for a significant upside rally. Meanwhile, the altcoin currently seems to be consolidating within a tight range due to prevailing market sentiment.

Based on historical price momentum, if LINK breaches the upper boundary of the consolidation and closes a daily candle above the $26.40 level, there is a strong possibility it could rally by 50% to reach the $38.50 level in the coming days.

Additionally, LINK’s Relative Strength Index (RSI) is at 52, indicating a potential price reversal and suggesting that the asset has sufficient room to rise significantly in the coming days.

Traders’ Bearish Outlook

Due to the ongoing consolidation, traders trading LINK appear bearish, as revealed by Coinglass data. Currently, LINK’s Long/Short ratio stands at 0.92, indicating a bearish sentiment among traders. The data further reveals that, in the past 24 hours, approximately 48.65% of top traders placed bets on long positions, while 51.35% favored short positions.

Looking at the current market sentiment, it appears that investors are taking advantage of the current price and seem to be accumulating, while traders appear to be trading based on market sentiment.