Large investors are buying Bitcoin at record levels, which may be the precursor to a price explosion. Recent statistics indicate that these large holders, or “whales,” are acquiring around three times the amount of daily Bitcoin produced by miners as the cryptocurrency sits at key price levels.

Whales Purchase At Record Levels While Exchanges Witness Outflows

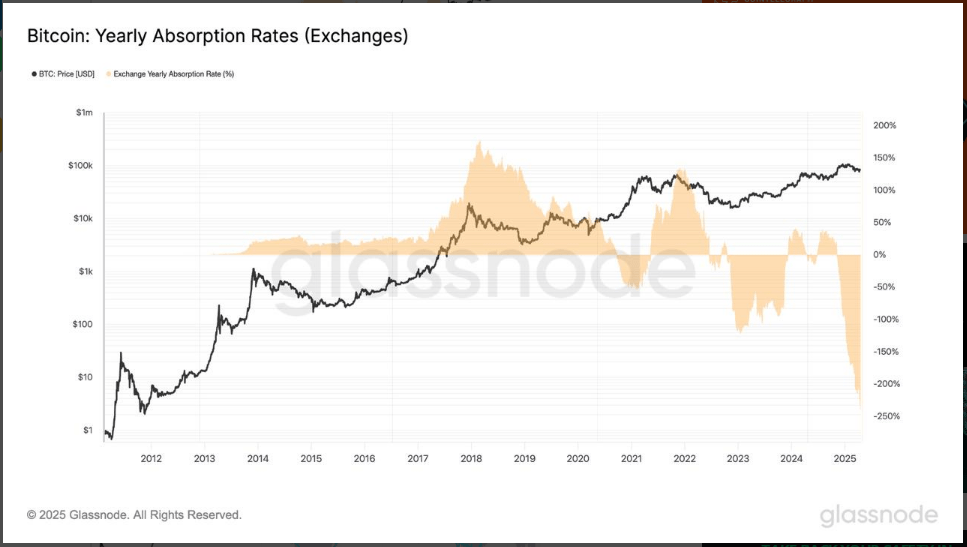

According to Glassnode information, investors possessing between 100 and 1,000 Bitcoins are buying up the cryptocurrency aggressively. These giant holders are at present taking on over 300% of the annual supply emission of Bitcoin.

Meanwhile, large crypto exchanges are seeing steady outflows of Bitcoin. This indicates that increasing numbers of whales and large holders are taking their assets to long-term storage instead of leaving them on hand for trading. Market observers view this exodus from exchanges as a sign of improving confidence in the long-term worth of Bitcoin.

Most of these large investors have persisted in buying when prices drop, viewing downturns as opportunities to increase their positions rather than sell. Onchain analysts have reported that this activity is reminiscent of trends during Bitcoin’s 2020 bull cycle.

Technical Indicators Reflect Key Resistance Points

Bitcoin is now testing its 50-day and 200-day exponential moving averages as points of resistance. Based on previous examination by analysts, these levels are approximately $85,500.

A pullback could occur if Bitcoin does not manage to breach the technical barriers. The next important support lies at about $80,000 on the upper trendline of the current wedge formation.

A narrow price range has existed for some time, between about $75,000 and $85,000. This period of lackluster volatility, combined with substantial buying pressure, may well suggest that accumulation is occurring behind the scenes in anticipation of a large price move.

Three-Month Correction Follows Typical Bull Market Trend

The price of Bitcoin is now back to correction after almost three months since reaching highs near $100,000 earlier in the year. The price has seen a drop of nearly 30% since then.

According to analysts, this drop follows the typical trend of previous bull markets. A decrease of 25-35% occurring midway through the cycle would usually denote a situation from which the prices would then continue up once again.

Featured image from Pexels, chart from TradingView