The post Whales Turn Active After Ethereum’s Strong Recovery: What’s Next for ETH Price? appeared first on Coinpedia Fintech News

Ethereum’s price has jumped after being stuck in a slump for several weeks, helping it in gaining some market dominance after hitting record lows. The crypto market started to bounce back after U.S. Treasury Secretary Scott Bessent reportedly said in a private meeting that the trade tensions between the U.S. and China can’t last much longer. As ETH began to recover strongly, whales started getting more active, which could lead to increased price swings ahead.

Ethereum’s Open Interest Jumps Over 12%

Ethereum has seen a strong upward rally in the past few hours, gaining over 10% in just 24 hours. This sudden spike has also caused a noticeable rise in several on-chain metrics.

According to data from Coinglass, around $127 million worth of Ethereum positions were liquidated in the last 24 hours. Of that, buyers lost about $34.2 million, while sellers were hit harder, closing out $92.8 million in short positions.

This price surge followed comments from former President Trump, who said U.S. tariffs on Chinese goods “will come down substantially,” and Treasury Secretary Scott Bessent, who described the ongoing U.S.-China trade dispute as “unsustainable”, both hinting that a resolution might be coming soon.

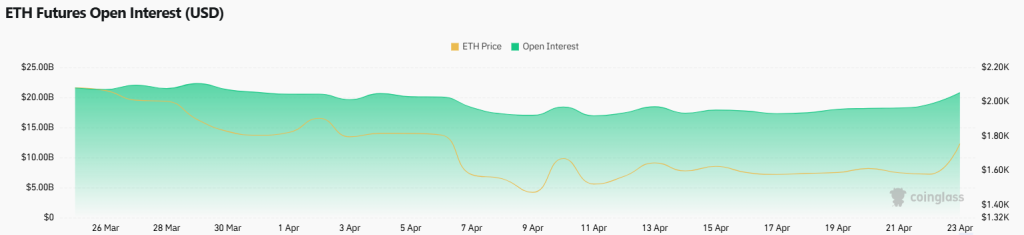

The bullish momentum has also influenced Ethereum’s derivatives market. Open interest (the total value of outstanding derivative contracts) jumped by 12%, reaching over $21.5 billion. It signals rising investor interest and adds hope to the recovery rally.

Also read: ETH Breaks $1,800: Why Ethereum Price is Up Today?

In addition, funding rates for ETH perpetual futures have turned positive, rising from 0.0018% on April 21 to 0.0087%, which suggests that traders are more willing to bet on price increases.

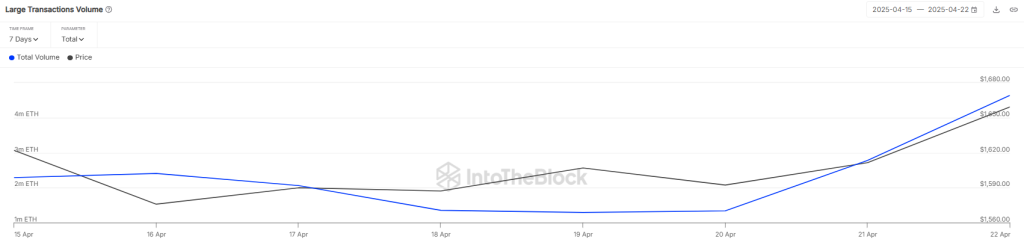

Ethereum’s market dominance has also gone up. On April 22, it dropped to just 7%, the lowest level since September 2019, according to TradingView. But after the recent price jump, its market share bounced back and climbed above 7.5% by April 23. Additionally, the large transaction volume jumped by almost 400%, touching 4.64 million ETH.

Altogether, the rising open interest and positive funding rates show that more money is flowing into the market, increasing buying pressure and possibly holding prices even higher.

What’s Next for ETH Price?

Ether (ETH) has recovered after dropping to around $1,500, and sellers are having a hard time pushing it any lower. Buyers have stepped in and pushed the price past some important short-term resistance levels. Now, ETH is aiming to stay above the $1,850 mark. Currently, it’s trading at about $1,816, which is over an 11% gain in the last 24 hours.

The technical indicators are also looking good for buyers: the moving averages are trending upward, and the RSI (Relative Strength Index) shows positive momentum. If ETH can stay above $1,850, there’s a good chance it could make a move toward $2,000 soon. If that happens, it might even break past a bigger resistance zone around $2,500.

However, if sellers want to take back control, they’ll need to push the price below the 20-day moving average (EMA20). If that level is broken, the price could fall to around $1,385, which is a key support zone. Dropping below that might signal a short-term shift in favor of the bears.