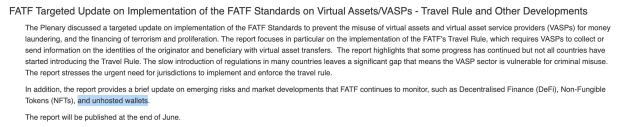

The FATF released meeting notes hinting at an upcoming report on recommendations for business compliance with the Travel Rule and “unhosted wallets.”

The below is a direct excerpt of Marty’s Bent Issue #1229: “A new FATF report drops at the end of the month.” Sign up for the newsletter here.

Our favorite unelected supranational organization is back with a warning shot. Four days ago, the Financial Action Task Force (FATF) released meeting notes from the most recent congregation of faceless demons who think they have the power to decide how billions of humans can conduct commerce among each other in the digital age. As you can see from the snippet above, it seems as though FATF will be releasing a fresh report to update the world about the state of compliance with their arbitrary rules. Making a point to highlight those who are not moving at an acceptable pace to implement draconian surveillance requirements on any business that touches bitcoin.

Even worse, the concept of “unhosted wallets” is still top of mind and the report will provide a brief update on “emerging risks and market developments that FATF continues to monitor.” Said another way, they are going besmirch the concept of individuals creating and controlling their own private keys. The unelected overlords really don’t like the idea of the common man controlling his money without the nanny state being able to see everything he is doing.

I imagine that this “brief update” will set the stage for a full on narrative assault on private key ownership by individuals. They will likely state that individuals holding their own keys presents an elevated risk of criminal activity that may prove too high to even allow the practice in the first place. Then they will likely recommend that regulation be crafted that prohibits individuals from interacting with bitcoin outside the purview of a regulated “Virtual Asset Service Provider” who is diligently keeping tabs of who owns what and sends what at any given point in time. If this narrative arises, it should be met with a high degree of ridicule and contempt.

This issue is a non-starter. Individuals have the right to protect their private property as they see fit and they should never be subjected to unfettered surveillance from the state, which has committed more atrocities and human rights violations than any group of individuals could even attempt to commit. The power over freedom money in the digital age should not be ceded to these people. It belongs to the individuals who use it.

Make no mistake, the narrative battle is about to increase significantly as governments and central banks completely lose control of their monetary systems and, by extension, their subjects. The arrows will be flung from all angles. In fact, they already are, as is evidenced by recent comments from the Jabba-the-Hutt-looking demon who heads the Bank of International Settlements.

Prepare yourselves, freaks. Things are about to get spicy.