The post What Happened in Crypto This Week? A Crypto Crash Breakdown appeared first on Coinpedia Fintech News

This is a very short and simple update on what we have witnessed this week in the cryptocurrency market. Staying up-to-date with the latest developments in the market is essential for making better decisions. Let’s analyse the market. Ready? Dive in!

US Market Weekly Update

The US S&P 500 index has slipped from $6,050.84 to $5,930.84, marking a decline of 2.02%. Notably, all the major markets, including Europe, China, Japan, India, South Africa and Australia, have witnessed drops this week. Europe has dropped by 2.04%, and China by 0.65%.

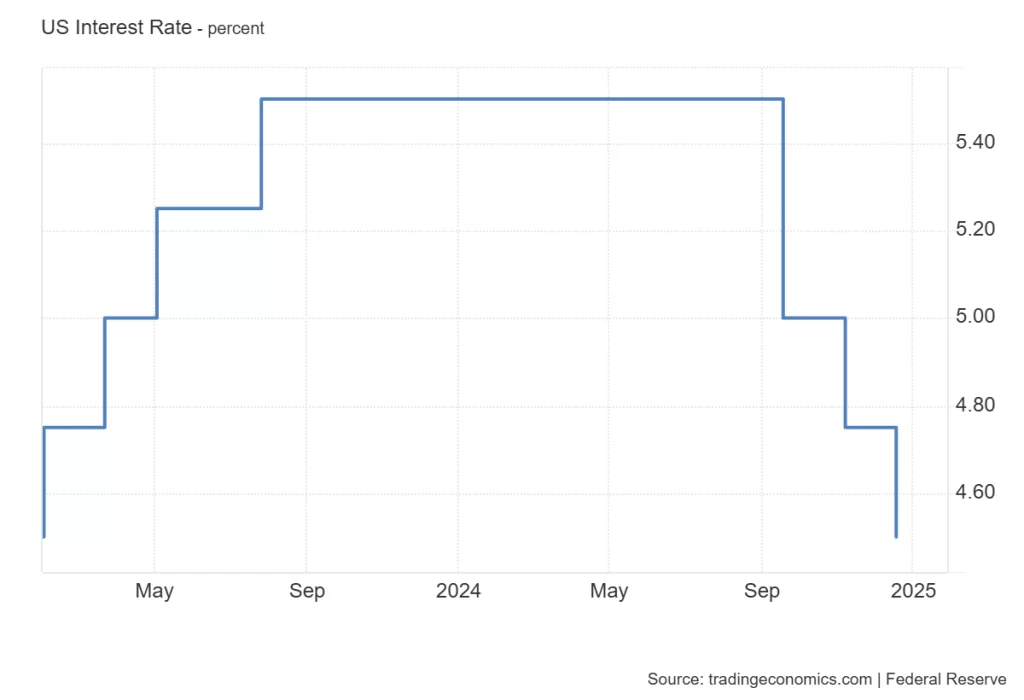

This week, the US Federal Reserve reduced its interest rate by 25 basis points, bringing borrowing costs to the range of 4.25% to 4.5%. The US GDP Growth Rate QoQ Final index slightly increased from 3% in Q2 to 3.1% in Q3. The US Initial Jobless Claims index sharply fell to 220K in the second week of December from 224K in the first week. The US Core PCE Price MoM index dropped to 0.1% in November from 0.3% in October.

Apart from these, several key indices have been released this week. The NY Empire State Manufacturing Index dropped from 31.2 points to 0.2 points in December. The US S&P Global Composite PMI Flash index sharply climbed from 54.9 to 56.6 in December. The S&P Global Manufacturing PMI Flash index declined from 49.7 to 48.3 in December. Meanwhile, the US S&P Services PMI Flash index surged to 58.5 from 56.1. The US Retail Sales MoM index fell from 0.5 in October to 0.7% in November. The US Industrial Production MoM slightly bettered from -0.4% to -0.1%. The US Business Investors MoM index grew to around 0.1% in October. The US NAHB Housing Market Index remained at 46 points in December, showing no change. The US API Crude Oil Stock Change declined to 4.7 million barrels in the first week of December from 1.232 million barrels in the last week of November. The US Housing Starts index slipped to 1.29 million units in November from 1.31 million in October. The US Existing Home Sales index jumped to 4.15 million in November from 3.96 million in October.

This week, the US dollar has shown strength against almost all the major currencies, including the Euro, Chinese Yuan, Japanese Yen and Indian Rupee. Against the US dollar, the Euro has surged by 0.70%, Yuan by 0.27%, Yen by 1.78%, and Rupee by 0.20%.

Crypto Market Scenario This Week

The total crypto market cap has declined by 8.2% this week. The altcoin market cap has dropped from $1.55T to $1.39T. The total crypto market cap excluding Bitcoin and Ethereum has slipped from $1.07T to $969.31B. The total market cap excluding the top ten cryptocurrencies has slipped to $348.32B from $406.93B.

Bitcoin Market Overview

On December 16, Monday, the Bitcoin price stood at $106,058.18. On Thursday, it plummeted to a low of $97,461.38. At a point on Friday, the price dropped as low as $92,198.03. However, by the time of closing, buyers pushed the price to around $97,812.27. Between December 16 and 20, the market declined by at least 7.77%.

Ethereum Market Scenario Analysis

On December 16, the Ethereum price was at $3,988.87. By December 19, it fell to a low of $3,415.69, registering a severe correction of 14.36%. At a point on December 20, the price declined to as low as $3,108.75. By the time of closing, buyers pushed the price to $3,471.16. Between December 16 and 20, the market slipped by over 12.97%.

Top Ten Cryptos: Weekly Performance Review

In the last seven days, almost all the top ten cryptos have displayed drops. Dogecoin shows the highest 7-day drop of 19.1%. Cardano and Solana follow with 13.4% and 12.5% declines, respectively. Ethereum has slipped by 10.8%. Bitcoin, XRP and BNB have declined by 3.9%, 6.0% and 5.6%, respectively.

Trending This Week

Binance HODLer Airdrops, Circle Ventures Portfolio, Binance Launchpool, Binance Labs Portfolio, and Coinbase Ventures Portfolio are the top five trending categories at the time of writing. Among these categories, Binance HODLer Airdrops displays the highest seven-day change of +181.3%.

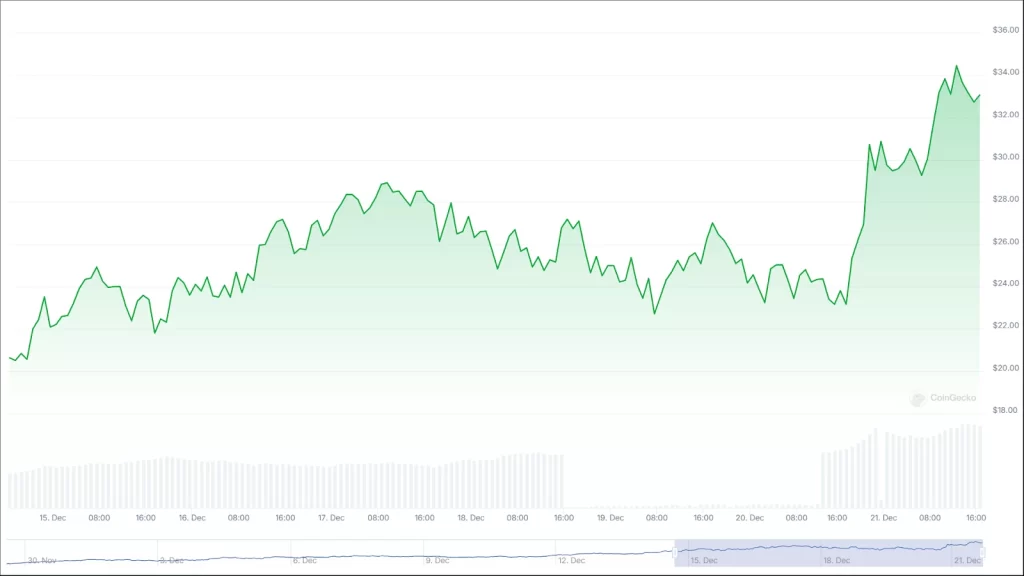

Hyperliquid, LUKSO, Pudgy Penguins, Ethena, and Sui are the top five trending cryptos. Among the top five, Hyperliquid showcases the highest seven-day change of 54.6%.

Crypto Category Overview

In the last seven days, the Smart Contract Platform category has declined by around 6.7%, Layer 1 by 6.0%, Proof of Work by 4.4%, Proof of Stake by 11.6%, Centralised Exchange Token by 4.1%, Decentralised Finance by 9.9%, Meme by 16.9%, Liquid Staking by 11.7%, Crypto-Backed Tokens by 8.7%, Wrapped-Tokens by 8.6%, Decentralised Exchange by 3.8%, Artificial Intelligence by 14.5%, DePIN by 17.6%, NFT by 21.4%, Layer 2 by 13.1%, GameFi by 20.7%, Yield Farming by 17.4%, Real World Assets by 8.9%, Layer 0 by 19%, Metaverse by 20.7%, Internet of Things by 20.1%, Gaming Utility Tokens by 19.5%, Gaming Governance Tokens by 19.9%, Liquid Staking Governance Tokens by 22.2%, and Bridge Governance Tokens by 18.6%.

Meanwhile, Stablecoins has grown by 0.8%, Perpetuals by 35.9%, Binance HODLer Airdrops by 181.3%, AI Agent Launchpad by 2.2%, and Virtuals Protocol Ecosystem by 13.9%.

In conclusion, this week, global markets, including the US, Europe, China, Japan and India, have faced declines, alongside an 8.2% drop in the cryptocurrency market. Bitcoin, Ethereum and other major cryptocurrencies have seen losses. The US Federal Reserve cut interest rates by 25 basis points. The US dollar has strengthened against major currencies. Overall, it has been a challenging week for both traditional and digital asset markets.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Stay tuned to Coinpedia’s Crypto Market Weekly Report – where we bring you