Monero currently occupies the foremost position among privacy cryptocurrencies in terms of market capitalization. The following Learning and Insights explainer briefly delves into the origins and development of Monero (XMR), emphasizing its distinctive features, such as anonymous transactions and untraceable payments, that set it apart from its peers.

The Genesis of Monero: A Look at Monero’s Inception

Monero (XMR) has emerged as one of the most widely utilized and valuable privacy coins since its inception in 2014. Unlike the multitude of forks derived from Bitcoin’s codebase, Monero was constructed on the Cryptonote protocol, initially implemented by Bytecoin in 2012. While Bytecoin introduced innovative privacy features like ring signatures, it was reported that 80% of its coins were premined.

Consequently, in 2014, anonymous developers forked the Bytecoin blockchain to create Bitmonero, which was later renamed Monero. The new Monero blockchain produced a block every two minutes but without the premine associated with Bytecoin. Presently, Monero’s hashrate is coasting along at 2.30 gigahash per second (GH/s) or 2,296,248,004 hashes per second.

Privacy Features That Define Monero

Monero employs ring signatures, ring confidential transactions (Ring-CT), and stealth addresses to obscure senders, amounts, and recipients. Ring signatures blend the user’s output with that of others to mask origins, while Ring-CT conceals amounts. Stealth addresses are automatically generated, one-time public keys.

The Randomx consensus algorithm allows ordinary CPUs to mine XMR, reducing centralization and hardware requirements. Developers and members of the XMR community further believe that regular hard forks enhance security and efficiency.

Monero also utilizes Dandelion++, a privacy protocol that conceals IP addresses. Bulletproofs, a form of zero-knowledge proof, decrease transaction fees by reducing size. Together, these four technological advancements maximize the anonymity of XMR.

Monero’s Prominence and Challenges

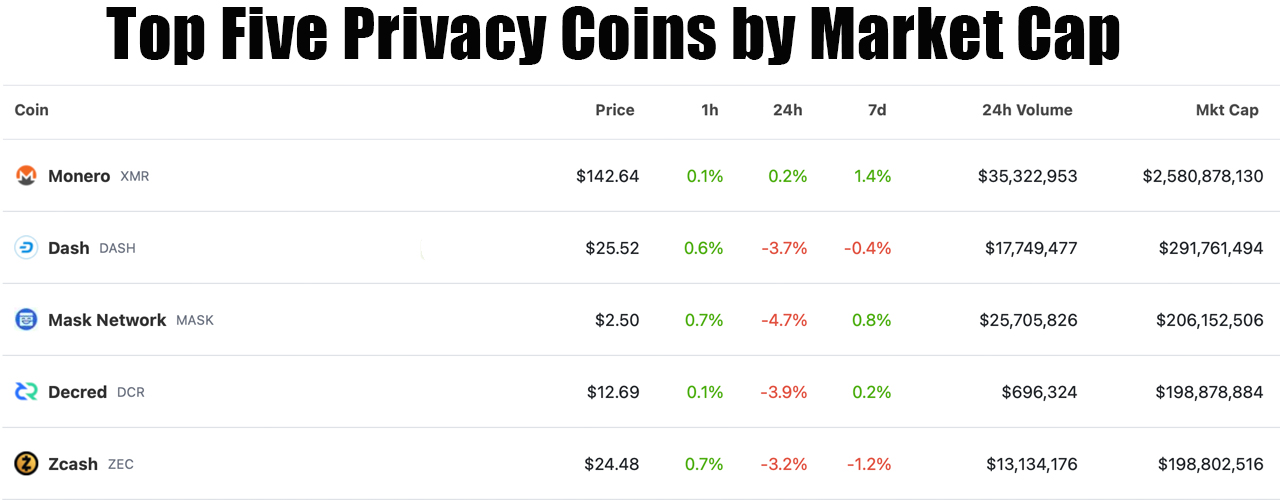

As the largest privacy coin by market capitalization, presently valued at $2.6 billion, Monero proponents assert that XMR fulfills a growing need for confidential transactions. Since its launch, XMR has appreciated over 65,000%, although it has declined 74% from its 2018 all-time price peak.

While fully anonymous transactions attract attention from regulators, Monero strives to provide users with complete control over their privacy, ensuring that intermediaries cannot monitor payments. XMR enthusiasts insist that this preserves financial autonomy. Nevertheless, recent regulatory actions and exchange delistings have cast uncertainty on the future of privacy coins.

A Competitive Privacy Coin Landscape and Alleged De-Anonymization Technology

While XMR is prominent on the dark web, Monero has endeavored to gain mainstream acceptance through engagement with merchants and advocates advocating for legitimate use cases. Regardless of debates surrounding anonymity, Monero remains committed to preserving it. Developers continue to program with the support of the community to keep XMR at the forefront of untraceable cryptocurrency.

In terms of competition, XMR faces challenges from coins like dash (DASH), mask network (MASK), decred (DCR), and zcash (ZEC). The diverse array of privacy coins available today seeks to offer distinct privacy techniques for anonymizing crypto transactions. As of September 10, 2023, the total market capitalization of privacy coins stands at $4.7 billion, with XMR commanding 55.31% of that value.

In conclusion, monero stands as the leading privacy coin, but it faces persistent challenges. Competing coins aspire to surpass it, regulatory pressures cast uncertainty, and blockchain surveillance teams claim to possess de-anonymization technology. Both Ciphertrace and Chainalysis are blockchain surveillance companies that claim to possess de-anonymization technology for cryptocurrencies, including Monero.

While XMR proponents continue to champion user privacy and financial autonomy, the landscape remains dynamic, with privacy-focused cryptocurrencies navigating a precarious path in the ever-evolving world of digital finance.

What do you think about monero and the privacy coin’s history? Share your thoughts and opinions about this subject in the comments section below.