A recent report by Electric Capital, which analyzed nearly 500 thousand code repositories and 160 million code commits across Web3, uncovered the top blockchain ecosystems based on one of the key “indicators of value creation”–developer engagement.

To create its 2021 Developer Report, the early-stage venture firm focused on open-source repositories only, inferred non-original commits and credited only original authors and ecosystems that produce code–not counting no-libraries and eliminating machine-generated code.

65% of active developers in Web3 joined in 2021

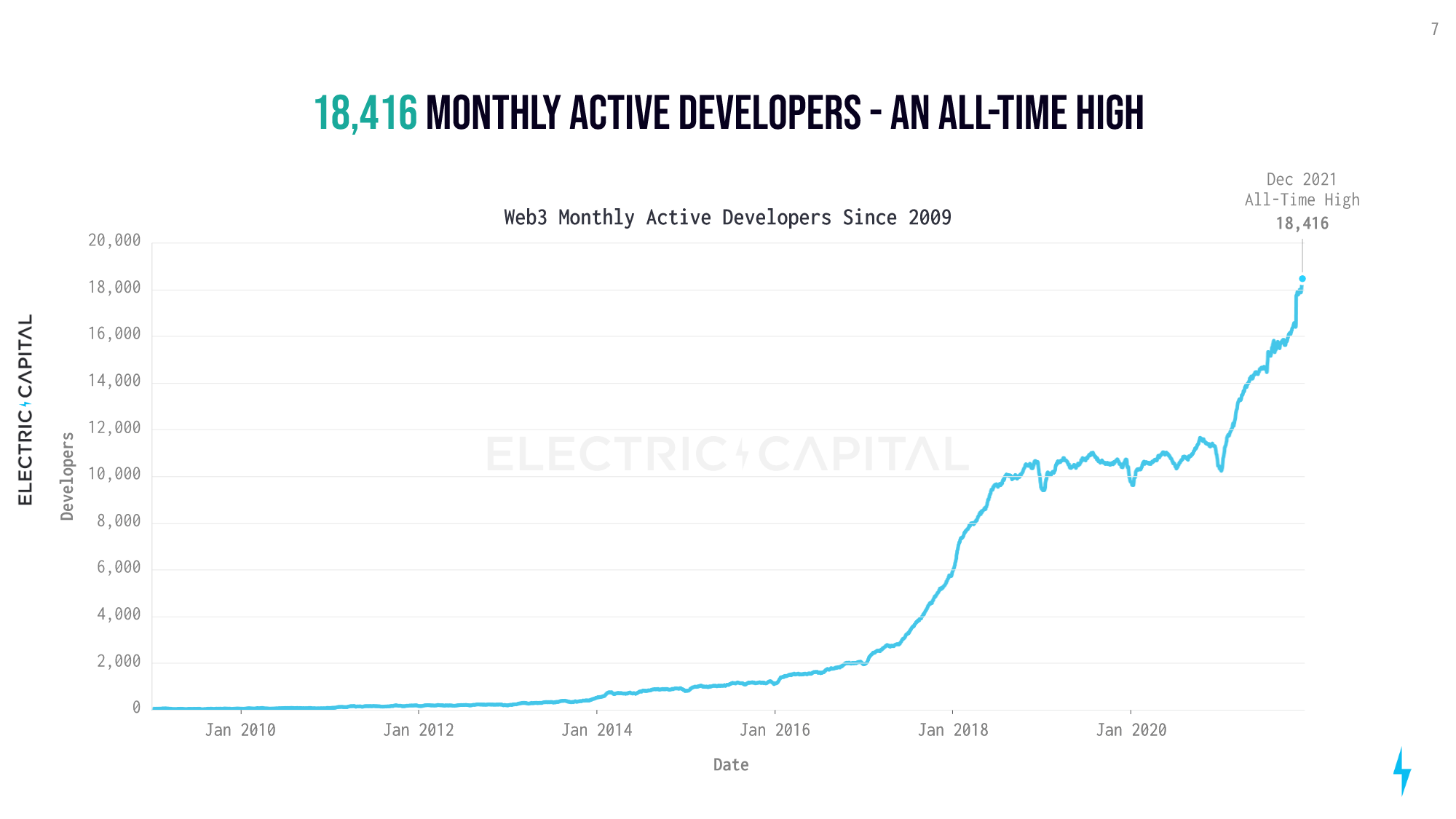

Web3 development is at an all-time high, as 65% of active developers hopped on board during the past year alone. The number of new developers who committed code in 2021 topped 34.000–the highest in history–a 14% bump compared to 2018, which thus far counted as the year of the highest engagement.

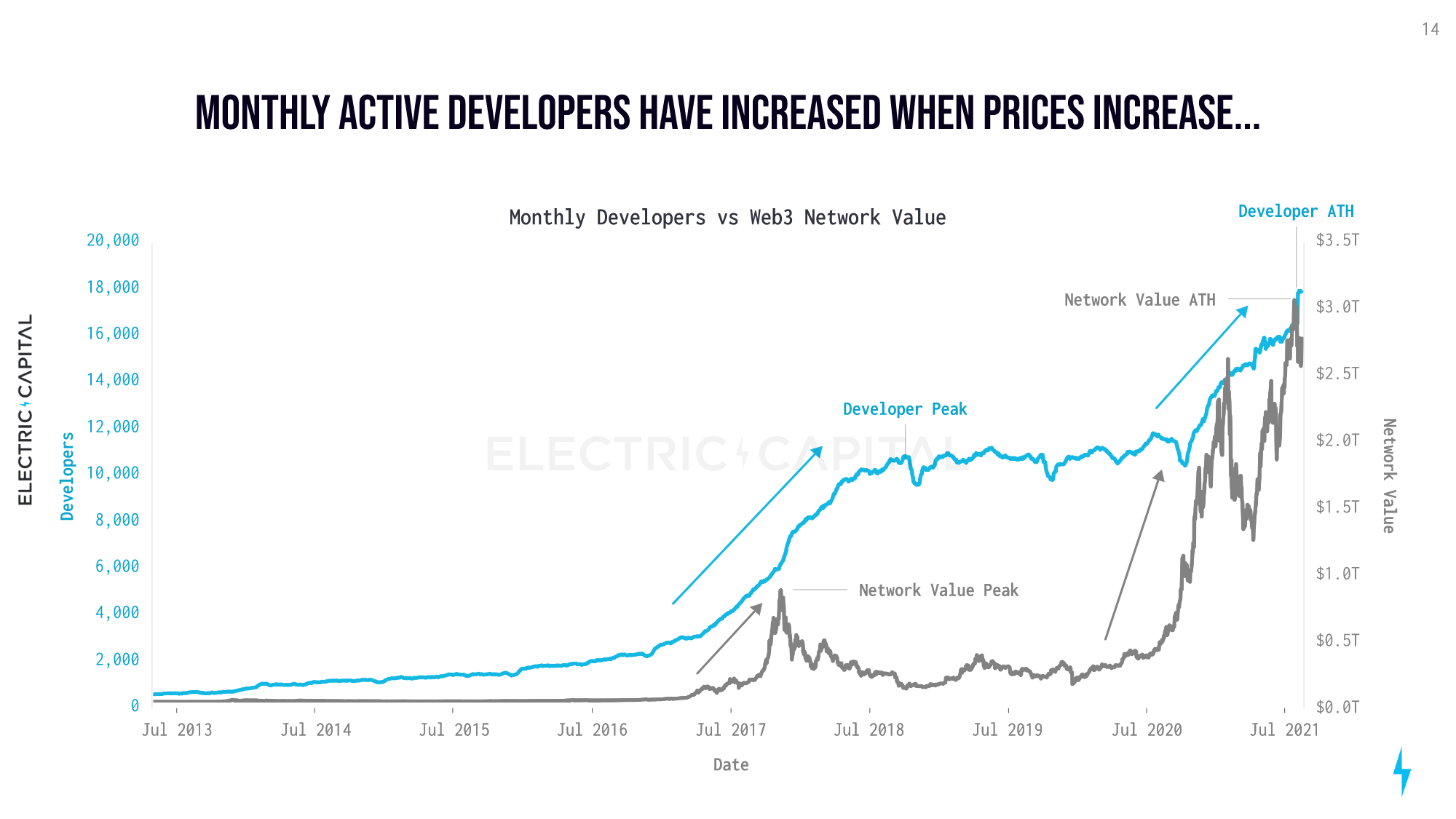

Since January 2021, 7.895 monthly active developers flooded to Web3–a 75% increase in a year. According to the report, the number of monthly active devs increased in periods when prices were up, however, remained steady during bearish times.

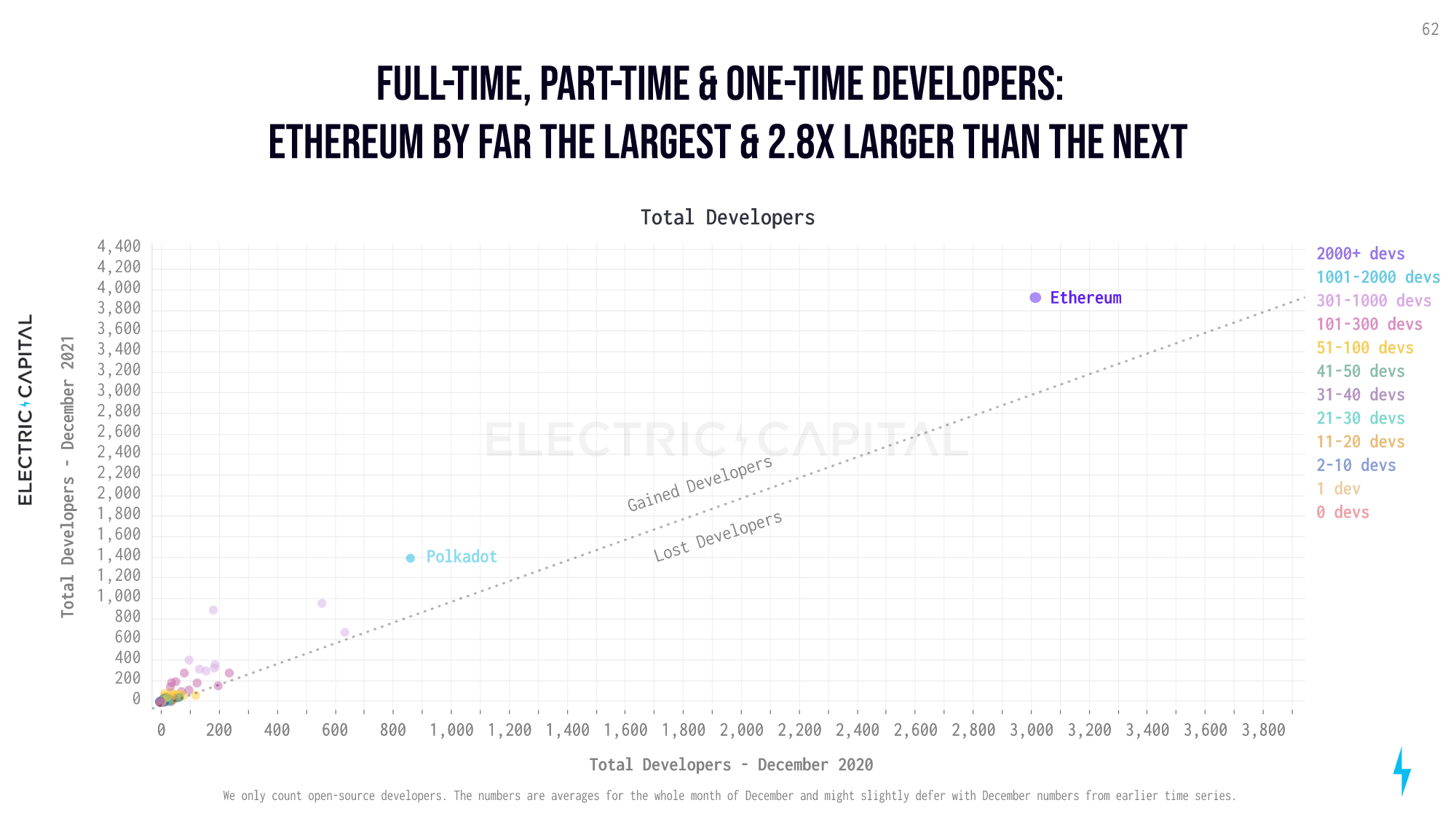

More than 18.400 monthly active developers commit code in open source crypto and Web3 projects, revealed the report, noting that more than 4.000 of them work on Ethereum, while the number of those working on Bitcoin topped 680.

Polkadot surfaced as “a class of its own with clearly the strongest developer growth since the launch of any Web3 protocol and by far the biggest dev community outside of Ethereum,” Polkadot founder Gavin Wood commented the report.

New ecosystem developer analysis by @ElectricCapital shows @Polkadot literally in a class of its own with clearly the stongest developer growth since launch of any Web3 protocol and by far the biggest dev community outside of Ethereum. https://t.co/Tu6OQ7MMeX pic.twitter.com/3X0qWzleYd

— Gavin Wood (@gavofyork) January 6, 2022

Meanwhile, 30% of all developers are writing code on Ethereum Virtual Machine (EVM) compatible Layer-1s.

Looking past Ethereum and Bitcoin–Polkadot, Cosmos, Solana, BSC, NEAR, Avalanche, Tezos, Polygon, and Cardano surfaced as ecosystems that have more than 250 monthly active developers.

While over 20% of new Web3 devs joined the Ethereum ecosystem, several other blockchains attracted impressive numbers in 2021.

In fact, Polkadot, Solana, NEAR, BSC, Avalanche, and Terra are building their teams faster than Ethereum–when indexed to the date from 1st commit.

According to the report, more than 2.500 devs are working on DeFi projects, and less than 1.000 of those committed full-time are responsible for over $100 billion in TVL in smart contracts.

Most vibrant ecosystems

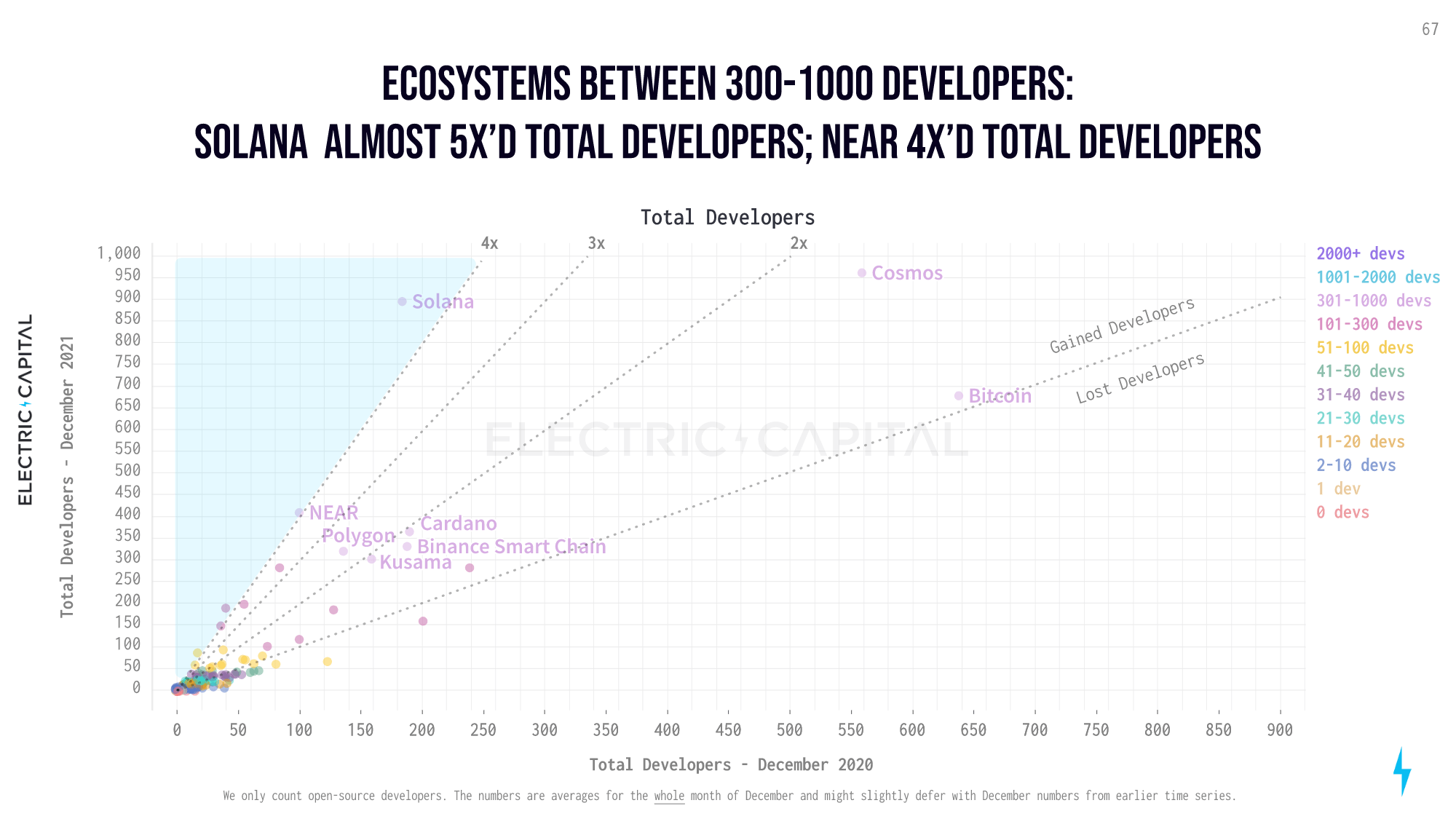

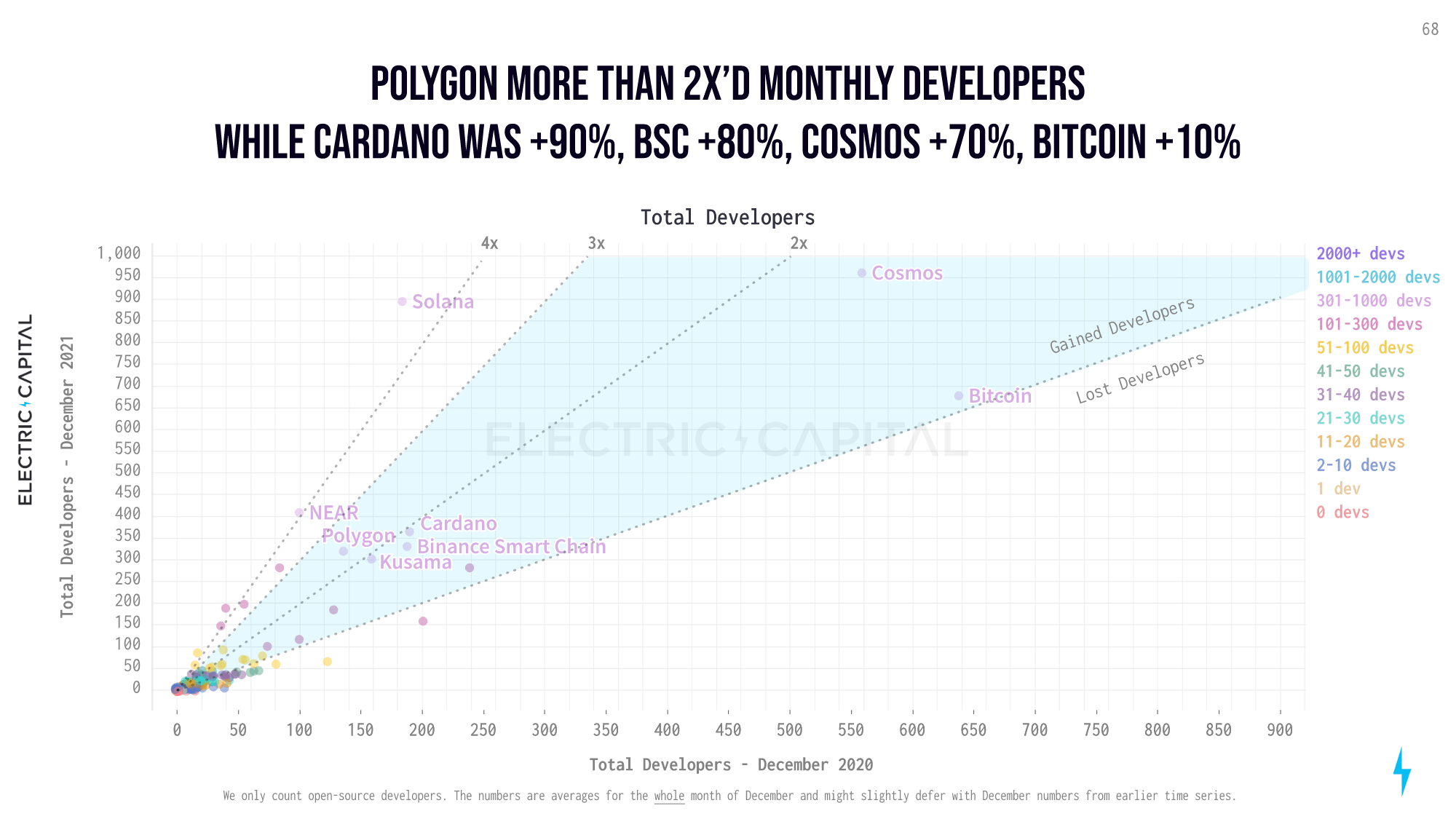

The report further compared average monthly active developers between December 2020 and December 2021.

As far as large ecosystems with more than 300 devs go, Solana surfaced as having the fastest growth rate–growing almost five times in 2021.

NEAR followed by growing four times during the year period–becoming the 6th largest ecosystem in 2021, nearing the largest five–Ethereum, Polkadot, Cosmos, Solana, and Bitcoin.

In the meantime, Polygon’s monthly developers grew by more than 2 times, while Cardano followed with a 90% growth.

BSC, Cosmos, and Bitcoin followed–growing their monthly dev numbers by 80%, 70%, and 10%, respectively.

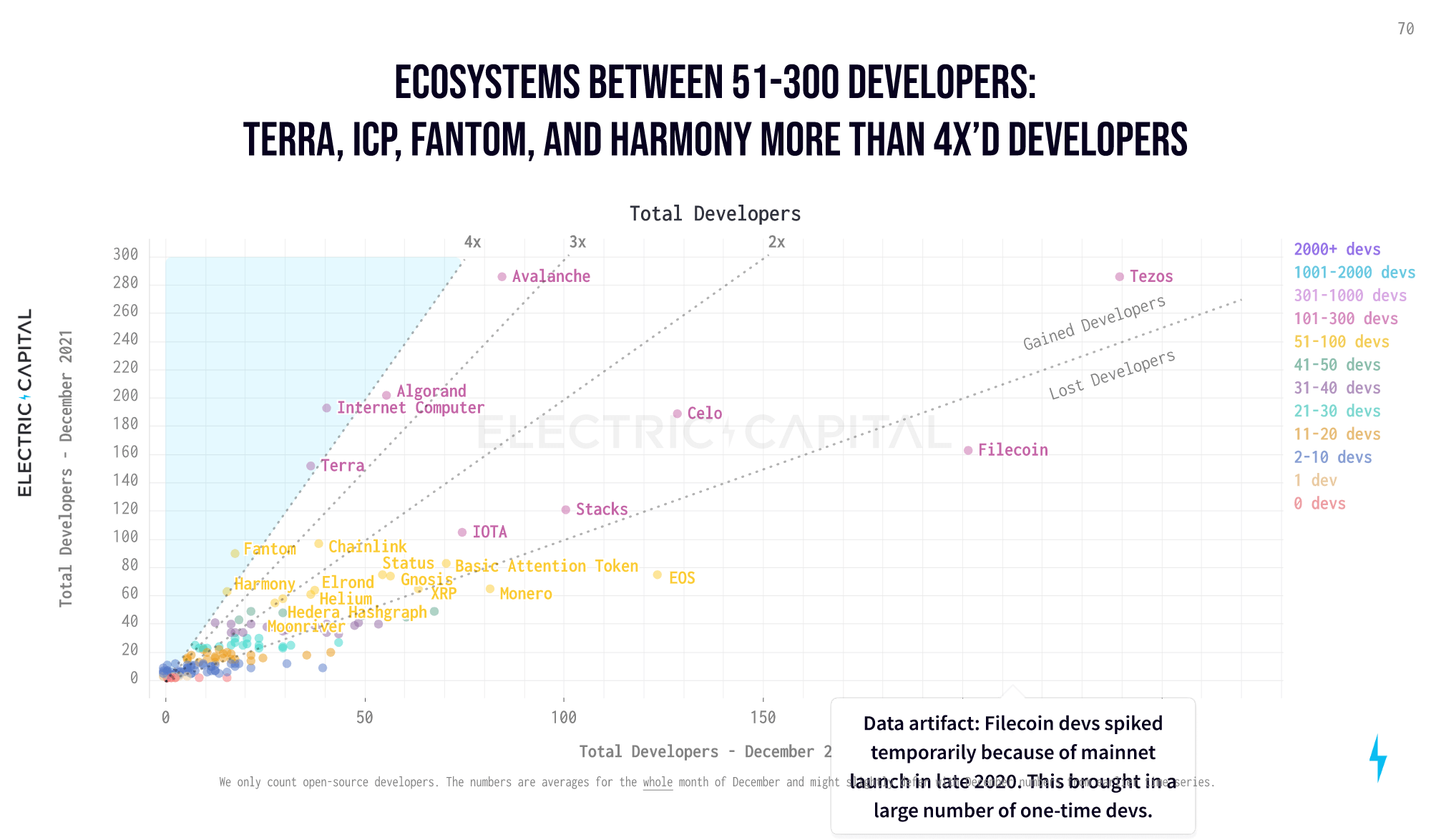

Finally, the report dove into mid-sized and smaller ecosystems with less than 300 developers.

Comparing average monthly active devs between December 2020 and December 2021–Terra, ICP, Fantom, and Harmony all quadrupled their teams, while Avalanche and Algorand followed, tripling theirs.

Zooming in to full-time devs only, Terra (312%), Solana (307%), NEAR (291%), Fantom (271%), Avalanche (179%), Polygon (175%), Kusama (161%), Dfinity (146%), Moonriver (125), and Algorand (116%) surfaced as the ecosystems that are growing at the fastest rate.

While noting that the report left out devs involved with backporting, testing and release engineering, Electric Capital also underscored the observed growth rates are potentially higher, since a great deal of projects initially build closed-source.

The post Which are the most vibrant blockchain ecosystems currently? appeared first on CryptoSlate.