Quick Take

Bitcoin transaction fees have significantly dropped from their previous highs since the halving, based on Dune Analytics data.

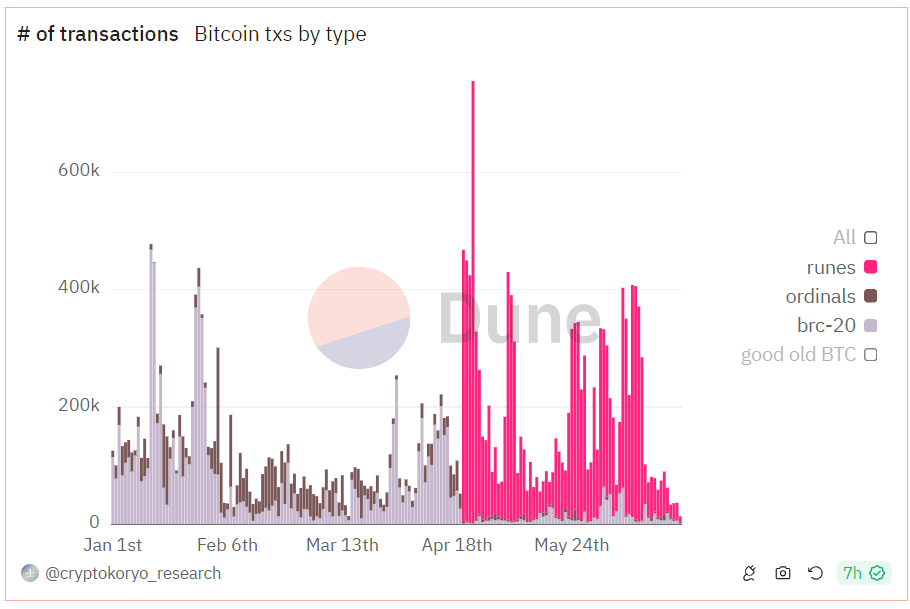

Currently, fees are considerably lower, driven partly by the activity around Runes. Shortly after the halving, Runes number of transactions surged to over 750,000, but they have now settled to around 30,000. In early June, there was a notable spike in Runes transactions, but recent trends show a decline.

According to Dune Analytics contributor CryptoKoryo:

“Trading activity on Runes has decreased a lot, accounting for only 5% of Bitcoin transactions in the last days, compared to 60% two weeks ago!”

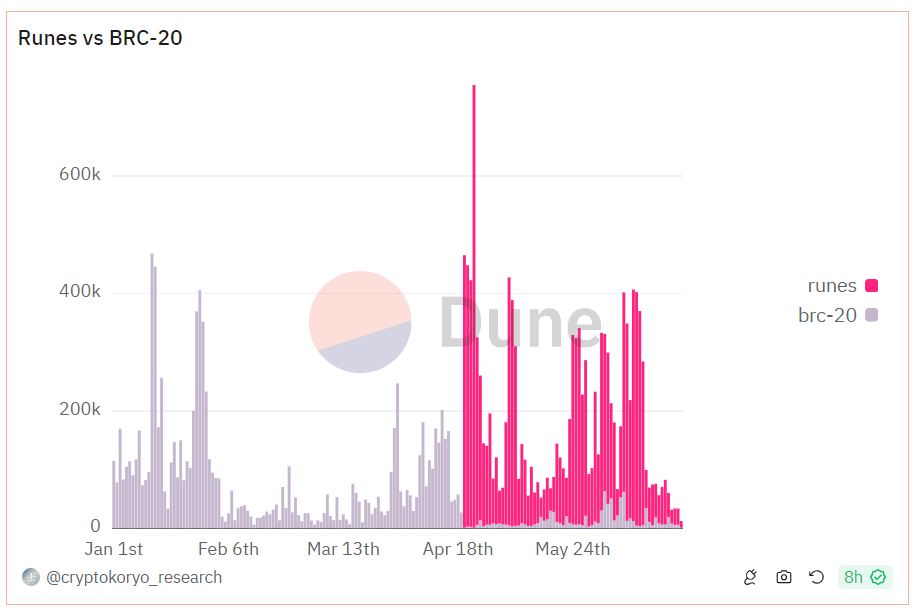

Despite this drop, Runes remains a key force in transactions for the Bitcoin ecosystem, especially against BRC-20 tokens. CryptoKoryo highlights that BRC-20 tokens lost market share quickly.

“Despite that, Runes are still dominating BRC-20. The latter surprisingly lost almost its entire market share over-night after the launch of Runes, despite months of developments and tooling.”

CryptoKoryo expresses curiosity about the future performance of Runes and BRC-20 tokens as market conditions improve.

“Curious to see how both BRC-20 and runes bounce when markert conditions improve and the Bitcoin ecosystem matures.”

The post Who reigns supreme? – Runes vs. BRC-20 tokens appeared first on CryptoSlate.