Here’s what on-chain data says regarding which segment of the Bitcoin market has been participating in selling at the latest high prices.

90-Day+ Bitcoin Investors Have Been Showing Activity Recently

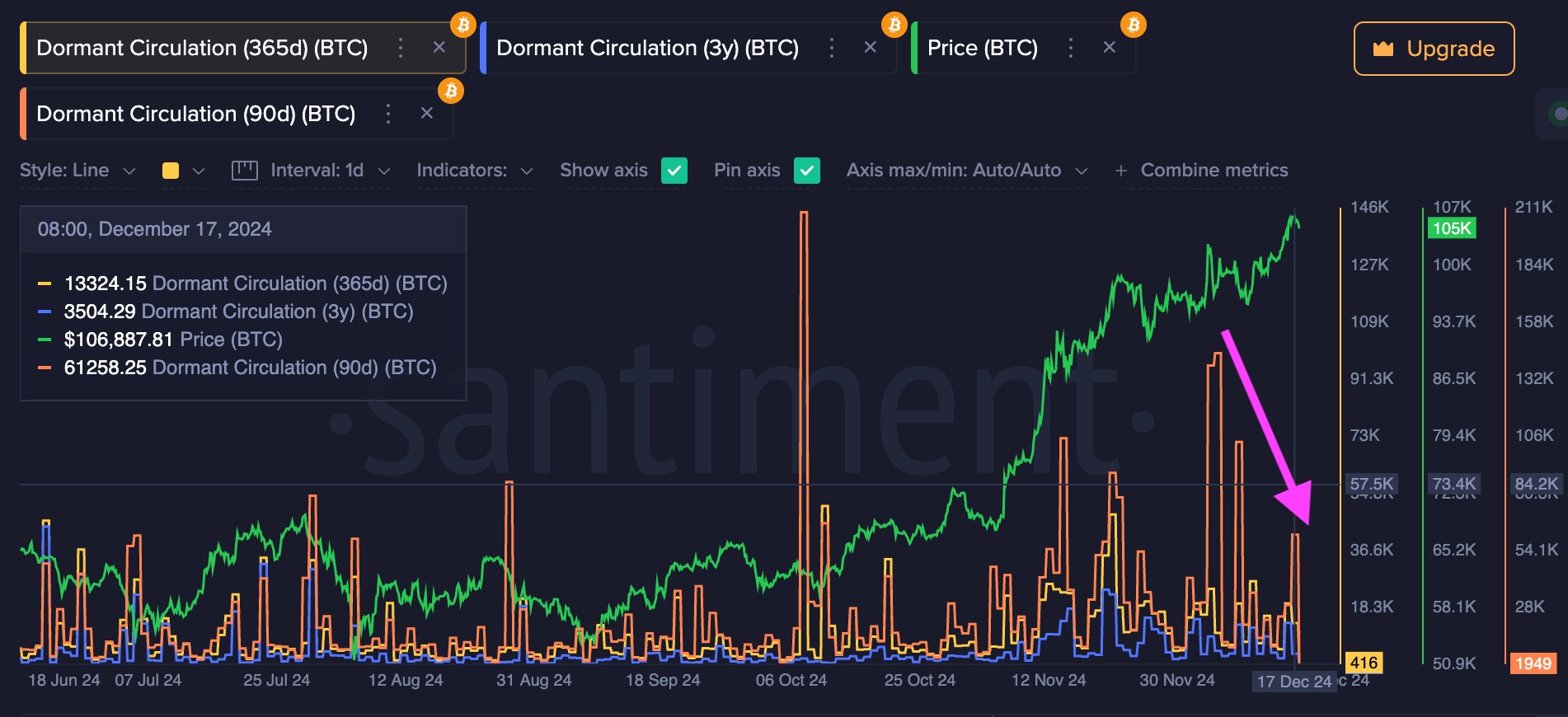

As pointed out by YouTuber denome in an X post, only one segment of the Bitcoin market is still participating in profit-taking. The data shared by the user is from the on-chain analytics firm Santiment. More specifically, the chart is for the Dormant Circulation indicator.

The Dormant Circulation keeps track of the total number of tokens being moved on the blockchain after having been dormant for at least a given length of time.

Below is the chart for the metric, which shows the trend in its value for three different timeframes over the last few months:

In the graph, the three versions of Dormant Circulation listed are: 90 days, 365 days, 3 years. Note that these are the starting points of the periods for which the metric tracks; the 90-day, for instance, measures the transactions of coins that were held for more than 90 days prior to the move.

From the chart, it’s apparent that the Dormant Circulation surged to notable levels for the 90+ days and 365+ days coins as the cryptocurrency’s rally occurred last month.

At one point, the difference between the spikes of the two wasn’t even that much, so a bulk of the transactions that were being counted by the 90+ days version were in fact of coins older than 365 days. Thus, it seems the veteran cohort of the Bitcoin market, called the long-term holders (LTHs), were busy with selling.

The 90-day Dormant Circulation has remained at notable levels this month as the bullish momentum of the asset has continued with its price exploring above the $100,000 level.

Unlike last month, however, the 365-day version of the indicator hasn’t registered any spikes, implying coins aged between 90-days and 365-days are the ones being sold. This range is half made up by the older of the short-term holders (STHs) and half by the younger of the LTHs.

Considering that the wider LTH cohort hasn’t been participating in any selling, though, it’s likely that a majority of the transactions are in fact of coins belonging to the STHs.

Based on the trend witnessed in the past month, it seems some of the HODLers were hasty in taking their profits earlier, but now the cohort believes Bitcoin still has the potential to run beyond the recent highs, so its members are holding off on selling.

The STHs are known to represent the fickle-minded side of the market that easily sells, so it’s no surprise that they are still taking profits amid the $100,000+ hype run.

BTC Price

At the time of writing, Bitcoin is trading around $104,200, up more than 6% over the past week.