As the crypto market struggles to shake off the weakness of last week, the latest sentiment data from Santiment shows that token holders and traders are bearish on some of the top altcoins. According to their recent analysis, token holders are bearish the most on Chainlink–a middleware solution that powers DeFi and NFTs, Ethereum, Solana, and Bitcoin.

Out of their assessment, it is interesting to note that these coins on focus are those in the top 10, except for Chainlink that is still perched outside the top 20. While Chainlink tops the list, others, mainly Ethereum, Solana, and Bitcoin, are in the top 5.

Chainlink Struggling Despite CCIP Success, Ethereum Disappoints

Although Santiment didn’t provide a reason to explain why the community is bearish on these tokens, there are fundamental factors that prop up this outlook. Despite being a leader in DeFi through their Oracle solution and Cross-Chain Interoperability Protocol (CCIP), Chainlink still struggles for momentum.

LINK, the native token, rose to as high as $22, which is below the 2021 highs and is currently down 53% from the 2024 highs. Considering its role in DeFi and NFTs, holders expected the token to float higher, outperforming the market. This was especially so after the launch of the CCIP solution, which has found adoption among some of the top DeFi and TradFi platforms.

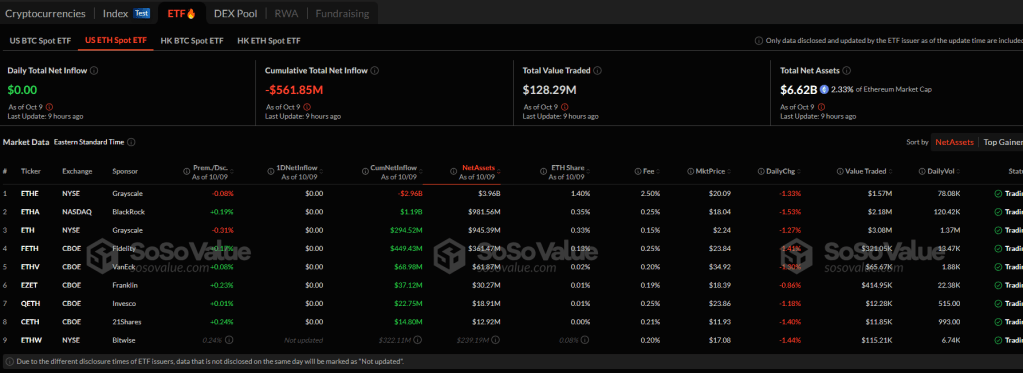

Pessimism about Ethereum’s outlook could also stem from disappointment following the approval of the first batch of spot Ethereum ETFs. Unlike Bitcoin, whose prices ripped higher, breaking above $70,000 to as high as $74,000, spot Ethereum ETFs have not been as successful.

As of October 10, Soso Value shows that all issuers in the United States managed just over $6.6 billion. Even so, there are massive outflows from Grayscale’s ETHE, heaping massive pressure on ETH prices. The second most valuable coin is still trading below $2,800 and is moving sideways in a possible distribution.

Solana Suffers As Meme Coin Momentum Fades, Impact Of FTX Asset Distribution

Solana, on the other hand, is also under pressure. The success of Pump.fun, which saw hundreds of thousands of meme coins deployed, supported prices. However, as Tron gains market share, the momentum is fading, negatively impacting prices.

Moreover, in the coming few months, FTX trustees will distribute nearly $16 billion of assets to victims. Even though some might continue to HODL, others will choose to liquidate–a negative for the coin.