The Bitcoin and crypto markets suffered severe price downturns at the beginning of the week, with the premier cryptocurrency falling to a low of $76,500. Interestingly, the digital assets market was not alone in the misery, as the United States equities market also lost a significant portion of its value to kick off the week.

Several experts have weighed in on this widespread market downturn triggered by the economic uncertainty, as United States President Donald Trump continues to roll out trade tariffs at will. Prominent crypto pundit Burak Kesmeci is one of the latest to comment on this scenario, predicting which market will recover first.

BTC And ETH Exhibit High Correlation With US Stock Market

In a March 15 post on the X platform, Kesmeci explained why it is almost impossible for Bitcoin and other cryptocurrencies to recover before the US traditional markets. The reasoning behind the expert’s assertion is based on the high correlation between cryptocurrency and the US stock market.

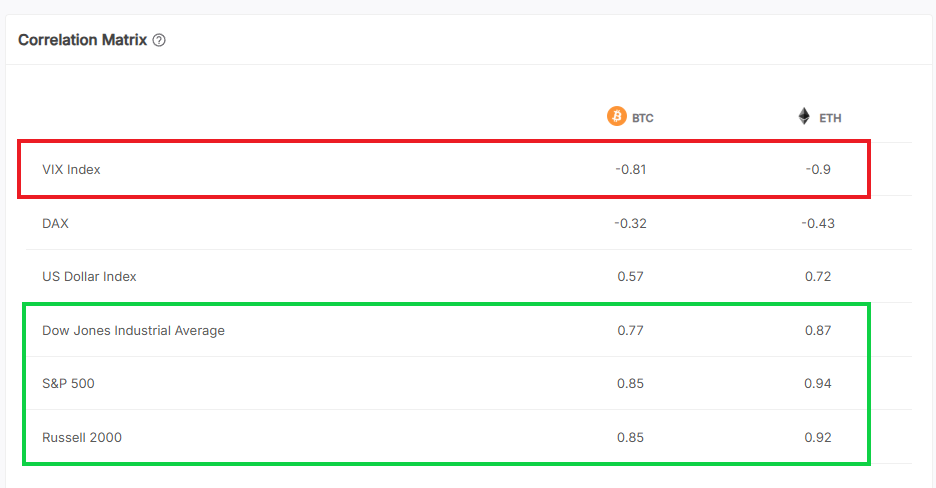

Proving this direct relationship, Kesmeci revealed Bitcoin’s and Ethereum’s correlation with the S&P 500 index (regarded as the best gauge of US equities market performance) stands at 0.85 and 0.95, respectively. As highlighted in the chart below, the two largest cryptocurrencies also exhibit a high correlation with other US stock market indices, including the Dow Jones Industrial (DJI) Average and Russell 2000.

According to Kesmeci, this trend suggests that investors view digital assets, especially Bitcoin and Ethereum, in a similar light as stocks in the United States. This explains why the crypto market experiences profound selling pressure whenever Trump announces new trade tariffs.

Contrarily, an opposite trend can be seen with gold, which has reached a new high in recent days. Kesmeci noted that the VIX (fear) index is strongly negatively correlated with Bitcoin, which explains why the flagship cryptocurrency is falling as the former is rising.

Finally, the analyst revealed that the DJI and S&P 500 indices are below the 200-day simple moving average (used for long-term trend tracking) for the first time since October 2023. According to Kesmeci, these US stock market indices would need to move above the SMA200 again before the crypto market would recover.

Bitcoin Price At A Glance

As of this writing, the price of Bitcoin stands at around $84,050, reflecting a 0.3% increase in the past 24 hours. According to data from CoinGecko, the market leader is down by more than 2% in the past week.