The post Why Crypto And Stocks Are Crashing: Key Factors Behind the $5.5T Market Wipeout appeared first on Coinpedia Fintech News

In the last one month, the S&P 500 market has experienced a drop of 7.13%, and the cryptocurrency market a decline of 17.09%. The general belief is that US President Donald Trump

Donald Trump

Donald Trump is an American former president politician, businessman, and media personality, who served as the 45th president of the U.S. between 2017 to 2021. Trump earned a Bachelor of science in economics from the University of Pennsylvania in 1968. Trump won the 2016 presidential election as the Republican Party nominee against Democratic Party nominee Hillary Clinton while losing the popular vote. As president, Trump ordered a travel ban on citizens from several Muslim-majority countries, diverted military funding toward building a wall on the U.S.–Mexico border, and implemented a family separation policy. Trump has remained a prominent figure in the Republican Party and is considered a likely candidate for the 2024 presidential election

President

decision to impose tariffs against China, Canada and Mexico has played a prominent role in the sudden collapse of these markets. A series of posts published by The Kobeissi Letter suggests that there exists another strong reason for the collapse of these markets. Read on for more details!

Markets Have Lost $5.5 Trillion in Two Months

On January 10, the total market cap of the crypto market was around $3.23T. On the same day, the S&P 500 index was at $5,828.54. Since then, the crypto market has slipped by at least 20.12%, and the S&P 500 by around 3.67%.

As per The Kobeissi Letter, over the last 2 months, the S&P 500 and crypto have lost a combined $5.5 trillion of market cap. Since February 20 alone, the S&P 500 has lost $4.5 trillion in market cap.

On February 20, the S&P market was at $6,133.58. Since then, the market has plummeted by approximately 8.46%. During the same period, the crypto market has slipped by no fewer than 18.86%.

Trade War Is Just a Scapegoat

According to The Kobeissi Letter, the markets were already aware about the possibility for the occurrence of a trade war. The recent shift in market sentiment has played a crucial role in the collapse of the markets.

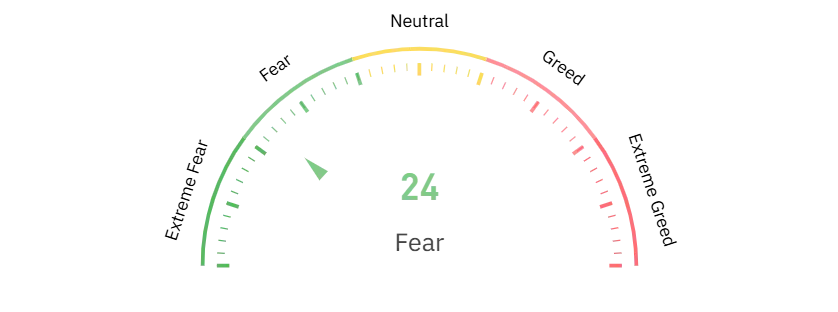

As of now, the Crypto Fear $ Greed Index stands at 24. On the same day, a year before, the index was at 82. On November 22, 2024, it touched a peak of 94. On the first day of 2025, the index was at 66. On February 27, it dropped as low as 10.

This sudden shift from extreme greed to extreme fear triggered the sell-offs in the markets, suggest experts.

Institutions Sold Before the Crash

The Kobeissi Letter notes that hedge fund exposure to tech stocks hit a 22-month low before the decline. The YTD return of AAPL stands at -4.85, MSFT at -9.81%, NVDA at -20.34%, AVGO at -20.44% and ORCL at -10.71%.Reports suggest that institutional investors shorted Ethereum on February 9, just before crypto’s crash.

On February 9, the ETH price was at $2,624.48. Since then, the Ethereum market has declined by at least 28%.In the last 24 hours alone, the ETH market has declined by approximately 8.1%. Importantly, reports highlight that the VIX index has surged by 70% in the last one month.

In conclusion, the market crash is more about fear than fundamentals. Understanding shifts in sentiment can help traders stay ahead of market swings. With volatility at extreme levels, expect big price movements ahead.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Crypto prices are falling due to market fear, institutional sell-offs, and a shift in sentiment, triggering widespread liquidations.

Hedge funds reduced tech stock exposure, and reports indicate institutions shorted Ethereum before the crypto market’s major decline.