The post Why Is Bitcoin Mirroring the Stock Market Crash? Michael Saylor Explains appeared first on Coinpedia Fintech News

Since February, when Donald Trump

Donald Trump

Donald Trump is an American former president politician, businessman, and media personality, who served as the 45th president of the U.S. between 2017 to 2021. Trump earned a Bachelor of science in economics from the University of Pennsylvania in 1968. Trump won the 2016 presidential election as the Republican Party nominee against Democratic Party nominee Hillary Clinton while losing the popular vote. As president, Trump ordered a travel ban on citizens from several Muslim-majority countries, diverted military funding toward building a wall on the U.S.–Mexico border, and implemented a family separation policy. Trump has remained a prominent figure in the Republican Party and is considered a likely candidate for the 2024 presidential election

President

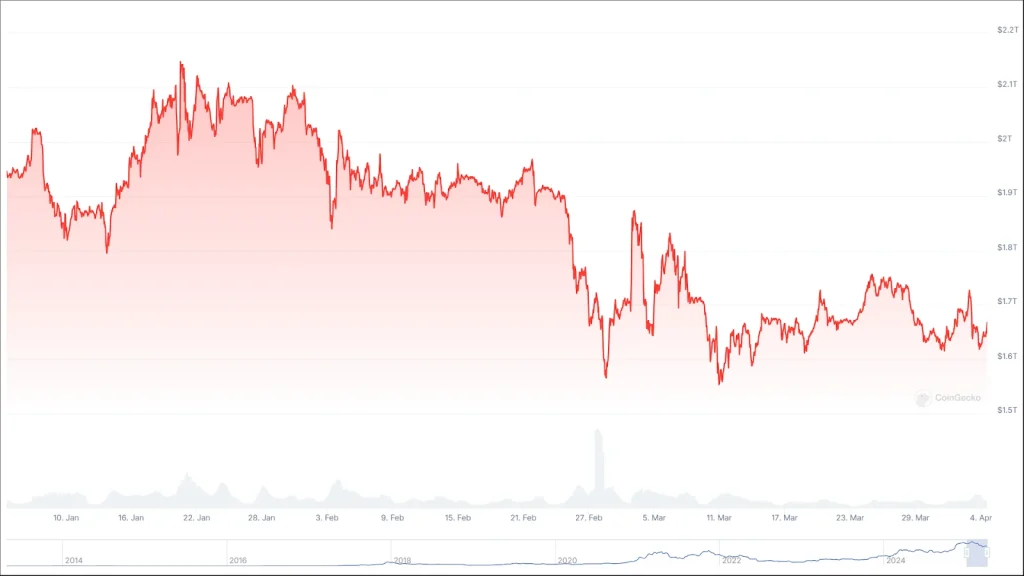

announced his aggressive tariff plan, the U.S. economy has been on shaky ground. Stocks have tumbled, with the S&P 500 down 9.5% and the Nasdaq 100 dropping over 12%. But the real shock? Bitcoin—often seen as a hedge against financial uncertainty—has followed the same downward path, losing nearly 18.5%. Meanwhile, gold, the traditional safe haven, has surged by 10.47%.

This unusual market movement has sparked a big question: Is Bitcoin truly an independent asset, or is it more connected to traditional markets than we thought? michael saylor

michael saylor

Michael Saylor is a Co-founder of Strategy formerly MicroStrategy. Before founding Microstrategy, he was a rocket scientist and studied aeronautics and astronautics at MIT on an Air Force scholarship. He dubs Bitcoin 'Digital Gold'. He made some early investment in Bitcoin as soon as he realized it was going to be the next big thing in shaping decentralized finance from traditional finance. His firm Strategy has made Bitcoin their primary treasure reserve. He is a vocal advocate and Top Bitcoin Speaker who participates in various Bitcoin and Crypto events. Michael Saylor is highly skilled in and has a rich knowledge of numerous fields, including analytics, data warehouses, SaaS, management, cloud computing, enterprise architecture, mobile devices, and many more.

Personal Details:

Born: Feb 4, 1965Location: United StatesGraduation: He graduated from MIT in 1987 with a double major in aeronautics, science, technology, and society.

Michael Saylor – Career Timeline

1983–1987: Studied Aeronautics & Astronautics and Science, Technology & Society at Massachusetts Institute of Technology (MIT).

1989: Co-founded MicroStrategy (Strategy).

1998: MicroStrategy IPO – Took MicroStrategy public on the NASDAQ at $12 per share.

2000: Accounting Scandal & Crash – MicroStrategy's stock plunged 62% in a day due to an accounting misstatement, wiping out billions in valuation.

2004–2019: MicroStrategy Rebuilds – Worked towards cloud-based analytics and AI-driven business intelligence, regaining stability.

2020: Bitcoin Strategy & Investment – Led MicroStrategy’s $425M Bitcoin investment. He made it the first publicly traded company to adopt Bitcoin.

2021: Bitcoin Evangelism – Became one of Bitcoin’s most vocal advocates, encouraging corporations and institutions to adopt BTC and blockchain.

2022: Stepped Down as CEO – Transitioned to Executive Chairman to focus entirely on Bitcoin strategy.

msaylor@microstrategy.com

EntrepreneurCrypto and Blockchain ExpertAuthor

, a longtime Bitcoin advocate, has a strong opinion on this – and his reasoning might just change how you see the crypto market.

Let’s break it down.

Is Bitcoin Really Independent?

Bitcoin saw major gains after political shifts in the U.S. On November 5, 2024, it was trading at $67,772.62. Over the next two weeks, from November 5 to 22, it surged by over 45.8%. By December 17, it hit a yearly high of $108,389.70.

In early 2025, Bitcoin fluctuated between $89,310 and $106,395.41. Then, on January 20, it reached an all-time high of $109,000.

However, after Donald Trump took office and introduced his tariff policy, Bitcoin lost momentum. Since February, it has dropped more than 18.49%, following the decline of the U.S. stock market. This has raised concerns about its ability to act as a hedge against financial instability.

Michael Saylor: Bitcoin’s Stock Market Link Won’t Last

Michael Saylor dismisses claims that Bitcoin is losing its status as an independent asset. He argues that the recent connection between Bitcoin and stocks is only a short-term reaction.

He points out that Bitcoin’s high liquidity and 24/7 availability make it an easy asset to sell when markets crash. In times of panic, investors sell what they can, and Bitcoin is always available for trading.

However, he insists that this temporary trend does not mean Bitcoin will always follow stock market movements. Long term, he believes Bitcoin will remain a non-correlated asset, independent of traditional markets.

Bitcoin vs. Stocks and Gold: The Bigger Picture

Looking at the broader picture, Bitcoin’s long-term performance tells a different story. In 2024, Bitcoin’s value skyrocketed by 121.1%, far outpacing traditional assets. The S&P 500 gained only 24.05%, while the Nasdaq 100 rose by 27.1%. Even gold, often considered the safest investment, increased by just 27.54%.

As discussions continue about Bitcoin’s market behavior, one thing is certain: short-term volatility does not define its long-term potential. While it may currently move in sync with U.S. stocks, history suggests Bitcoin has the ability to break free and prove itself as a truly independent financial asset.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Bitcoin dropped 18.49% since the tariff announcement, reflecting market-wide risk aversion, but experts see this as a temporary trend.

If market uncertainty eases, Bitcoin could rebound, with analysts eyeing $2,400 as the next key resistance level.

(@saylor)

(@saylor)