Ripple’s XRP has been the subject of recent media attention, and for good reason. The cryptocurrency has experienced a significant increase in 2024, with a gain of over 258% since the start of the year.

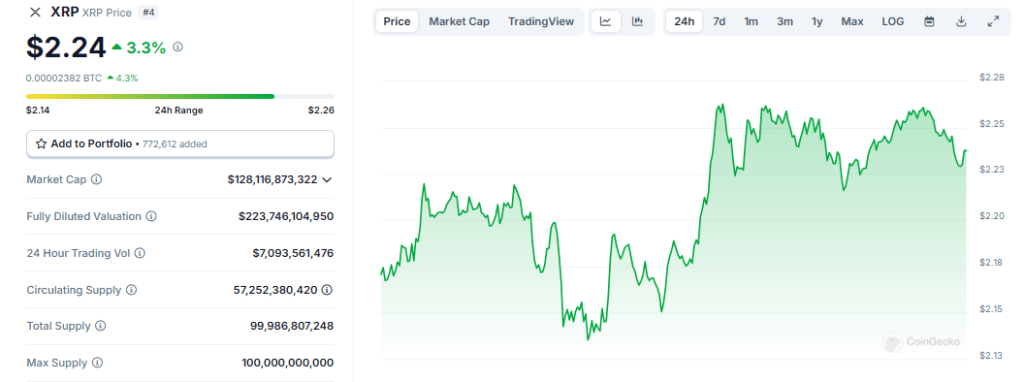

XRP’s price had risen significantly from its low of $0.22 in early 2021 to approximately $2.30 as of mid-December. XRP has now surpassed stablecoin Tether (USDT) to become the third-largest cryptocurrency by market capitalization, a testament to its extraordinary growth.

Linda Jones, a well-known wealth mentor, has just lately delivered her most current newsletter, which has generated a great deal of excitement among members of the international crypto community.

The Beginning Of A New Technology Cycle

Jones underscores that we are at the inception of a new technological cycle. She contends that digital assets are poised to revolutionize asset tokenization and money, much like the internet transformed communication.

An excerpt from my weekly newsletter today:

Digital assets should outperform tech stocks like the Magnificent 7 (Apple, Alphabet, Google, Tesla, Meta, Amazon and Nvidia) by possibly as much as 10x, in my opinion.

Why?

There are seven reasons I can think of:

1. We are early…

— Linda P. Jones (@LindaPJones) December 19, 2024

Investors who are prepared to adopt this emergent asset class may capitalize on substantial growth prospects as a result of this transformation. Jones emphasizes that digital assets have historically been the most successful asset class, with Bitcoin experiencing nearly 30,000% increase over the past decade and XRP following closely behind with a 35,000% increase during the same period.

Unexploited Market Potential

The current low adoption rate of digital assets is one of Jones’s most compelling arguments. She observes that only 5% of individuals worldwide have invested in cryptocurrencies, indicating a vast untapped market that is awaiting development.

Retail investors are currently better positioned than institutional players since they cannot fully enter the market because of regulatory barriers. However, Jones expects that institutional capital will soon flood the market in response to the expected regulations on crypto and stablecoins by early 2025.

The recent proposal by US President-elect Donald Trump to exempt capital gains on digital assets situated in the United States from taxation serves to bolster this optimism. This policy has the potential to substantially increase the potential of American projects such as XRP and Cardano (ADA) by redirecting investments toward them if it is implemented.

A Favorable Political Environment

Political change is also favoring digital assets. Jones notes David Sacks’ appointment as Crypto and AI czar, citing his pro-crypto stance as PayPal COO. This leadership change shows a commitment to promoting cryptocurrencies.

$XRP gonna make history next year

— Bitstamp (@Bitstamp) December 20, 2024

Moreover, Congress has lately grown much more pro-crypto, creating an environment fit for regulatory clarity and expansion.

As XRP and other digital assets gather pace in front of changing rules and more investor trust, Jones expects 2025 to be a decisive year for them. Other business leaders share her feelings; they believe that XRP may become historical in this year.

Featured image from DALL-E, chart from TradingView