At press time, Bitcoin is within a bullish formation and firm, rejecting attempts for lower lows despite slumping by roughly 20% in June.

Though there is hope that prices will trend higher in June, one analyst thinks BTC is walking on a tightrope. For buyers to take over, it means BTC will defy its historical trends observed in the last five years by printing green by September.

Will Bitcoin Beat The Odds?

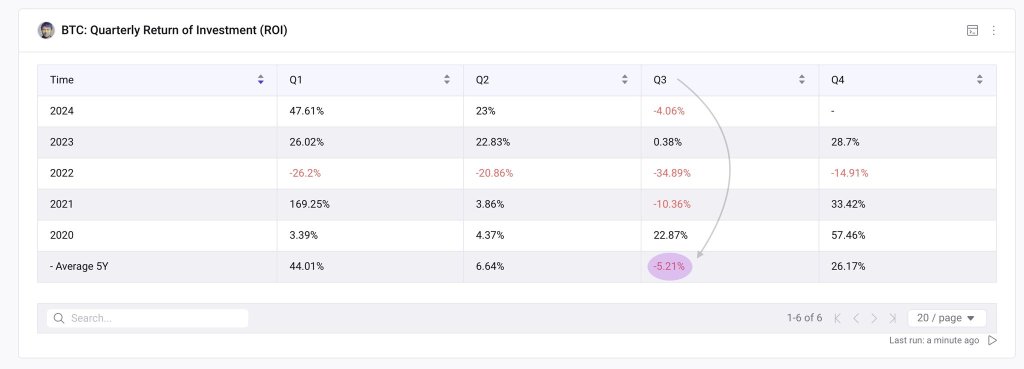

Price data aggregated over the past five years paints a concerning picture for Q3 2023. In a post shared by one analyst, historical data shows that Bitcoin often dips in Q3, posting an average return on investment (ROI) of -5.21%.

If this sets precedence, then it means that though BTC is firm when writing, the coin will most likely end up in losses below current rates.

Looking at price charts, it is evident that buyers are in control, primarily because of Q1 2024 gains. Then, prices soared to all-time highs before correcting, dropping to $56,800.

Even though this line has not been broken, bulls have been struggling for momentum as bears have been unrelenting, forcing prices lower on numerous occasions.

BTC To $300,000? On-chain Activity And Institutional Adoption Rising

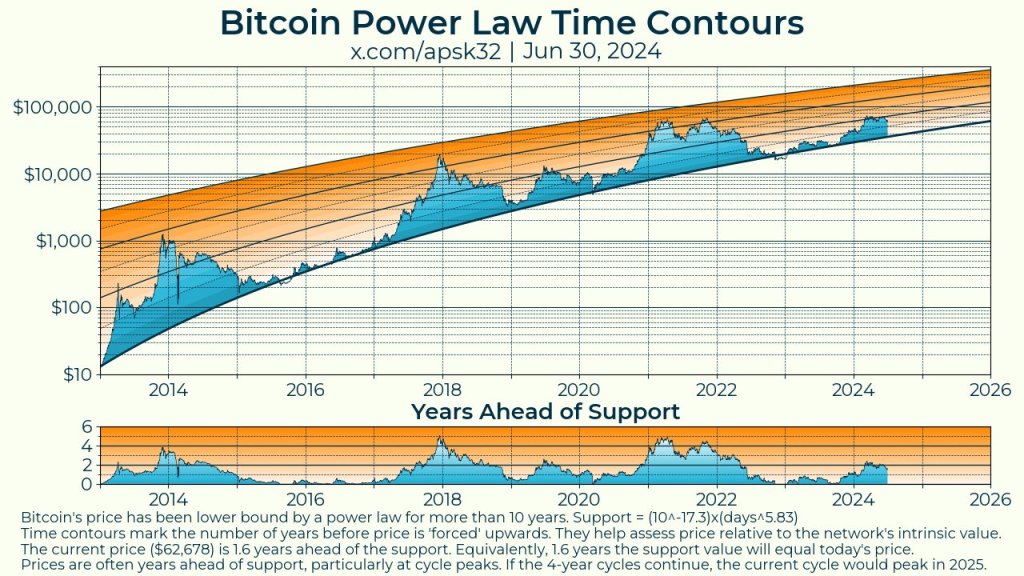

Despite the historical bearish trend in Q3, some analysts remain optimistic. Considering X, one analyst thinks BTC will fly to as high as $300,000 by 2025 based on the “power law” theory. This prediction is almost 5X from spot rates, an overly optimistic prediction.

Under the “power law” theory, the analyst said fundamentals play a crucial role. When a predictable growth pattern for Bitcoin based on its network activity is factored in, then the only way forward, the analyst said, is up.

To further support this outlook, the analyst said Bitcoin prices have followed the power law for over a decade. It means the coin’s intrinsic value is independent of market hype.

Beyond this, several other metrics support the potential for continued growth. For instance, IntoTheBlock data reveals that the number of active Bitcoin addresses continues to rise, reaching levels not seen since mid-April.

An ETF analyst, Eric Balchunas, said inflows to spot Bitcoin exchange-traded funds (ETFs) remain strong despite recent price dips. This means that investors expect prices to trend higher despite short-term price fluctuations.

As institutions pour in on spot Bitcoin ETFs, other data also show that the top 25 hedge funds in the United States now hold BTC in their portfolios.