Bitcoin might be weak at spot rates, sliding roughly 13% from $74,800 amid intense liquidation pressure.

Even as prices retract from all-time highs and $66,000 proves to be a mirage, analysts are upbeat about what lies ahead. Most expect the coin to surge towards the all-important psychological line, $100,000, in the coming days or weeks.

A Banking Crisis In The United States?

The spike would be accelerated by Bitcoin riding on the “digital gold” narrative that’s quickly gaining traction amid growing concerns about the financial health of banks in the United States.

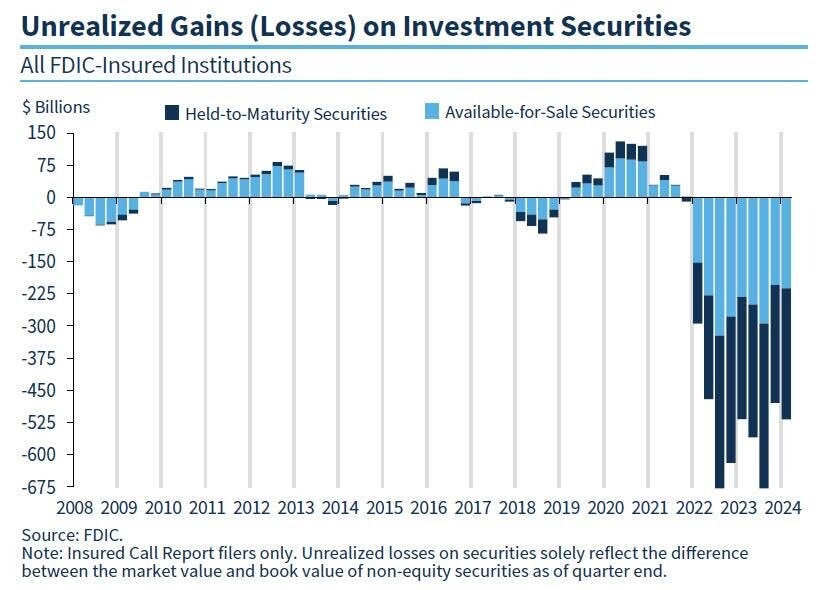

Taking to X, one observer notes a Federal Deposit Insurance Corporation (FDIC) report shows that 68 banks in the United States are sitting on over $500 billion in unrealized losses. Most of these losses in their diverse portfolios are from investment securities and are made worse by rising mortgage rates.

In their report, the FDIC notes that this is the ninth consecutive quarter where banks continue to hold “unusually high unrealized losses.” If this persists, there is a real risk of these banks destabilizing the financial markets in the United States.

The current state of banks in the United States has drawn parallels with the 2008 GFC. However, any banking instability could favor Bitcoin and safe-haven assets like gold. As history has shown, following the collapse of the Silicon Valley Bank (SVB), Silvergate Bank, and Signature Bank, BTC and ETH prices rallied.

Managers might be forced to reassess their positions if the trend of rising unrealized losses in the United States FDIC continues in the coming quarters.

Eyes On The BTFP Program And CRE: Time To Consider Bitcoin?

In this scenario, the United States Federal Reserve’s emergency Bank Term Funding Program (BTFP), launched in response to the bank failures of early 2023, could play a significant role.

This program, which offers shaky bank loans in exchange for collateral, could strongly support the banking system, influencing BTC prices.

Beyond this, the commercial real estate (CRE) market appears to be more troubled. While Neel Kashkari, the President of the Federal Reserve Bank of Minneapolis, recently downplayed the risk of a widespread crisis, it is widespread knowledge that some big banks, including those struggling with more unrealized losses, have significant exposure.

Though implementing stricter regulations after the 2007-08 GFC helps, it remains to be seen how the system will absorb shocks should there be cracks. If it happens, BTC will likely benefit from the current consolidation.