The post Will Gary Gensler Resign by December? Here’s When We Could See a New SEC Chair appeared first on Coinpedia Fintech News

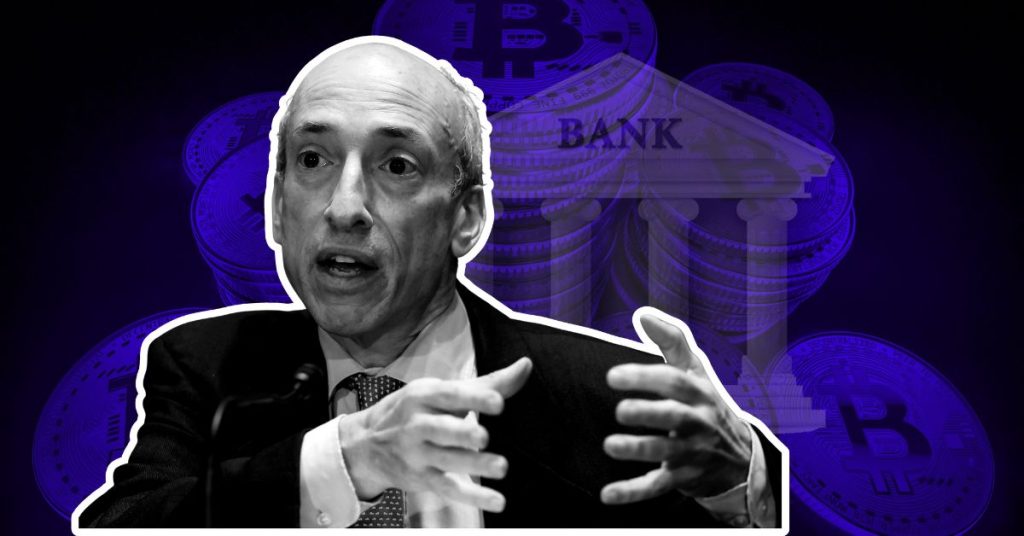

Following Donald Trump’s 2024 election win, speculation is mounting that U.S. SEC Chair Gary Gensler may soon exit his role. A recent report from 10X Research hints that Gensler could step down by December or January, aligning with the usual timing of SEC chairs stepping down as new presidents take office.

For example, Jay Clayton, appointed by Trump, stepped down in December 2020 before Biden’s term, and his successor, Gary Gensler, was confirmed in April 2021. Similarly, Mary Jo White resigned the day Trump was inaugurated, though Clayton’s confirmation took until May. Following this pattern, Gary Gensler may resign by December or January, with a new SEC Chair potentially confirmed by spring.

This expected timeline could enable Trump to appoint a new SEC Chair by spring 2025, aligning with his campaign promise to replace Gensler and introduce a regulator with a more crypto-friendly approach.

Who Will Replace Gary Gensler as New SEC Chair?

If Gary Gensler steps down, potential replacements are already sparking discussion. Crypto advocates hope Hester Peirce, known as “Crypto Mom,” will succeed him, as she’s widely seen as pro-crypto. Another strong contender is Chris Giancarlo, “Crypto Dad,” who also supports a more open approach to blockchain regulation. However, if Democratic contender Kamala Harris influences the choice, a more moderate option like Chris Brummer—who advocates for clear yet balanced crypto regulations—might be favored.

Bitcoin Rally Reflects Market Sentiment

With growing anticipation for a pro-crypto regulatory shift, Bitcoin recently surged past $75,000, sparking a wave of optimism among market experts who now see a path toward $100,000. This bullish sentiment is largely attributed to Trump’s favorable stance on crypto, which investors view as a potential catalyst for increased activity in the sector. His campaign promises for clearer and more supportive crypto policies have already lifted market sentiment, offering hope for relief from previous regulatory pressures that have held back investor enthusiasm.

A New Era for U.S. Crypto Regulation?

Should a new SEC chair bring a fresh approach, the crypto industry could see more constructive regulatory policies that encourage growth rather than hinder it. Under Trump’s influence, the SEC might ease its enforcement-driven approach, shifting toward clear guidelines that help legitimize and stabilize the industry. This potential chain could not only benefit existing crypto businesses but also attract more innovators and investors, putting the U.S. in a stronger position in the global digital asset class.

The entire crypto industry is rooting for a pro-crypto candidate as SEC chair; it will be interesting to see who takes the position as it will greatly impact the crypto space.