The post Will LTC Hit $90? Insights on the Spot Litecoin ETF Filing appeared first on Coinpedia Fintech News

Following the filing of the spot Litecoin Exchange Traded Fund (ETF) in the United States, social engagement around Litecoin (LTC) has skyrocketed. Amid this attention from the crypto community, the LTC price has experienced an impressive price surge and is now poised for another significant rally in the coming days.

Growing Social Engagement

According to data from an on-chain analytic firm, the number of followers on the X (Previously Twitter) has experienced a notable decline. However, following the filing of the LTC ETF, the asset has registered significant growth, indicating increasing interest from community members.

Litecoin (LTC) Technical Analysis and Upcoming Levels

According to expert technical analysis, Litecoin (LTC) appears bullish and is currently facing strong resistance at the $76.8 level. However, LTC has already gained a price surge of over 20% in the past week. This notable price surge in such a short period suggests growing investor interest in LTC.

Based on the recent performance, there is a strong possibility that LTC could soar by 18% to reach the $90 level in the coming days. On the other hand, October is historically a bullish month for the overall cryptocurrency market, which further supports the likelihood of this target being achieved in the near future.

LTC’s Bullish On-Chain Metrics

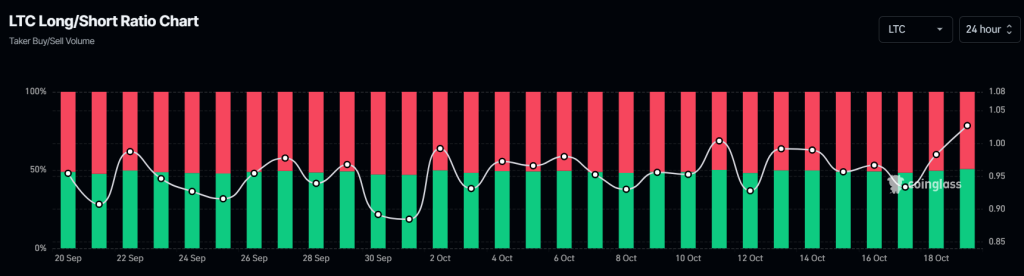

LTC’s positive outlook is further supported by on-chain metrics. According to on-chain analytics firm Coinglass, LTC’s Long/Short ratio currently stands at 1.035, the highest since September 2024. A long/short value above 1 indicates a strong bullish sentiment among traders.

Additionally, LTC’s open interest has jumped by 7.36% over the past 24 hours and 3.15% over the past four hours. This growing open interest suggests investors’ interest and participation in LTC, likely due to the ETF filing.

At press time, LTC is currently trading near $75.15 and has experienced a price surge of over 3.75% over the past 24 hours. During the same period, its trading volume dropped by 27%, suggesting a decline in participation from traders compared to the previous day.