The post Will Solana (SOL) Reclaim $180? Key Chart Signals Massive Move appeared first on Coinpedia Fintech News

After a notable price decline in recent days, Solana (SOL) is now poised for a massive upside rally due to its bullish price action on the daily time frame. SOL is one of the top cryptocurrencies, with its technology and adoption significantly rising, recently hitting a record high.

Despite this bullish development, the asset experienced a notable price decline due to bearish market sentiment. However, sentiment has begun to recover, and SOL is now gaining upside momentum.

Solana (SOL) Technical Analysis and Upcoming Levels

According to expert technical analysis, SOL appears bullish as it has formed a bullish divergence on its daily time frame, indicating that the asset is poised for a massive upside rally. A bullish divergence is rare and occurs when the asset’s price makes a lower low, while its Relative Strength Index (RSI) forms a higher high. This signals that bulls are gaining strength and supporting the asset for a price jump.

Based on recent price action and historical momentum, if the asset holds above the $120 level, it could soar by 42% to reach $180 in the coming days.

Current Price Momentum

SOL is currently trading near $126, having surged over 8% in the past 24 hours. During the same period, its trading volume increased by 25%, indicating heightened participation from traders and investors compared to the previous day.

Bullish On-Chain Metrics

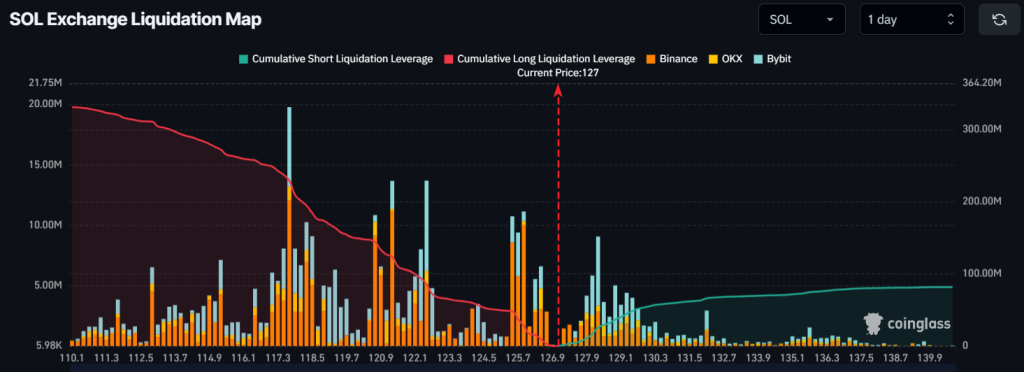

With this bullish price action and ongoing market recovery, traders and investors seem to be strongly participating and betting on the bullish side, as reported by the on-chain analytics firm Coinglass.

$60 Million Worth SOL Outflow

Data from spot inflow/outflow reveals that exchanges have witnessed a significant $60 million worth of SOL tokens in the past 24 hours, indicating potential accumulation and causing buying pressure and upside momentum.

Traders’ Over-Leveraged Positions

In addition, traders have increased their open positions in the past 24 hours. According to on-chain data, SOL’s open interest has surged by 11%. At press time, traders are over-leveraged between $125.8 and $128.5, having built $40 million worth of long positions and $23 million worth of short positions during the same period.

Combining these on-chain metrics with technical analysis, it appears that bulls are back, and the asset could soon recover and reclaim the $180 level in the coming days.