XRP may see record prices in 2025 despite its recent slump, according to industry expert Edoardo Farina. The digital coin trades at $2.40 as of press time, marking a 3.5% drop in the last day, and leaving recent investors with heavy losses.

XRP Still Outperforms Major Cryptocurrencies In 2025

This year, Bitcoin has dropped 9% and Ethereum shed 35% of its value. However, XRP has done pretty well, rising 12% since January. This performance comes even as the broader crypto market faces significant pressure, with many investors questioning if the bull run has ended.

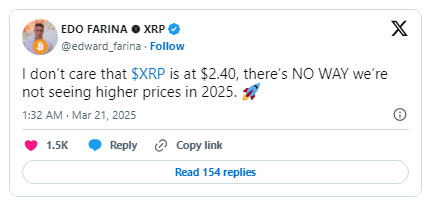

Farina, who serves as Head of Social Adoption at XRPHealthcare, remains confident about XRP’s future. “There is no way we’re not seeing higher prices in 2025,” he stated in a recent social media post. His optimism stands in stark contrast to the current market sentiment.

Multiple Factors Could Boost Altcoin’s Value

Based on Farina’s examination, a number of events could push the price of XRP higher in the months to come. Top among these is the pending evaluation of more than 15 XRP ETF proposals by the Securities and Exchange Commission. The investment products might unlock the gate for institutional funds to pour into the altcoin just like it has done with Bitcoin in 2024.

Facts.

Regulatory clarity, institutional adoption, and real-world utility are all aligning for XRP. $2.40 is just the beginning—2025 will be a game-changing year. Buckle up.

— Latest Crypto XRP (@LatestCryptoXRP) March 20, 2025

Future stablecoin regulation may also help the crypto asset indirectly. Although XRP itself is not a stablecoin, Ripple’s RLUSD stablecoin would receive credibility from more transparent rules. XRP researcher SMQKE opines this would boost demand for XRP because fees on transactions paid in altcoin get “burned”, lessening supply.

Trump Administration Support May Provide Additional Momentum

According to reports, the administration of US President Donald Trump intends to give preference to US-based cryptocurrency firms such as Ripple. This possible government support might result in increased acceptance and usage of XRP, driving its price upwards.

Farina believes this support, combined with what he calls “institutional FOMO,” will create a rush of large investors entering the XRP market. These big money moves would drive substantial buying activity.

Supply Reduction Could Lead To Price Surge

The last part of Farina’s forecast says there could be a “supply shock” for XRP. As more institutions start using it and transaction fees keep getting burned, the number of available XRP tokens will go down. Basic economics tells us that if supply keeps going down while demand stays the same or goes up, prices could reach new all-time highs.

For investors who bought XRP within the last two months, this prediction offers a good dose of optimism after suffering a 20% loss in value. However, market observers note that crypto predictions should always be viewed cautiously, especially when coming from those with potential conflicts of interest.

Featured image from Gemini Imagen, chart from TradingView